Venture Deals: Chapter 1: The Players. On day two of our romp through the table of contents of Venture Deals: Be Smarter Than Your Lawyer and Venture Capitalist, we cover the various players involved.

While it might seem like there are only two players in the financing dance—the entrepreneur and the venture capitalist—there are often others, including angel investors, lawyers, and mentors. Any entrepreneur who has created a company that has gone through multiple financings knows that the number of people involved can quickly spiral out of control, especially if you aren’t sure who actually is making the decisions at each step along the way. The experience, motivation, and relative power of each participant in a financing can be complex, and the implications are often mysterious. Let’s begin our journey to understanding venture capital financings by making sure we understand each player and the dynamics surrounding the participants. Venture Deals Is Officially Released. What Are Typical Employment Contract Terms and Severance Benefits for a Startup?

Q: I have read the your article on typical compensation for senior management of venture backed companies.

There was no mention of severance and length of contract terms. Can you opine? A: (Jason) Most everyone in the startup world is an at-will employee and does not have an employment contract. For those of you unfamiliar, “at-will” means “can be fired at any time for any reason.” Most employees have offer letters which outline basic terms of their employment, but are silent with regard to severance benefits. I’d estimate that less than 10% of folks working for startups have employment contracts. Remember, startups are normally resource constrained – they don’t have extra cash or equity to pass out to people, so don’t expect any types of severance benefits that you would see at a large company.

Venture Deals: Chapter 2: How To Raise Money. In Chapter 2 of Venture Deals: Be Smarter Than Your Lawyer and Venture Capitalist, we cover the basics of the VC fundraising drill.

Your goal when you are raising a round of financing should be to get several term sheets. While we have plenty of suggestions, there is no single way to do this, as financings come together in lots of different ways. VCs are not a homogeneous group; what might impress one VC might turn off another. Although we know what works for us and for our firm, each firm is different; so make sure you know who you are dealing with, what their approach is, and what kind of material they need during the fund-raising process. Following are some basic but by no means complete rules of the road, along with some things that you shouldn’t do. Hopefully we are whetting your appetite for the tasty morsels to come. Venture Deals: Chapter 3: Overview of the Term Sheet.

Chapter 3 of Venture Deals: Be Smarter Than Your Lawyer and Venture Capitalist is a transitional one that sets up the next few chapters on Term Sheets.

At the end of 2005, we participated in a financing that was much more difficult than it needed to be. All of the participants were to blame, and ignorance of what really mattered in the negotiation kept things going much longer than was necessary. We talked about what to do and, at the risk of giving away super-top-secret VC magic tricks, decided to write a blog series on Brad’s blog (Feld Thoughts) that deconstructed a venture capital term sheet and explained each section. That blog series was the inspiration for this book. The next few chapters cover the most frequently discussed terms in a VC term sheet.

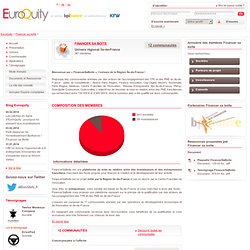

The specific language that we refer to is from actual term sheets. The various terms in a term sheet fall into three categories: (1) economics, (2) control, and (3) everything else. Two Kickstarter Projects You Should Know About. Financer sa boîte. FinancerSaBoite est une plateforme de mise en relation entre des investisseurs et des entrepreneurs franciliens cherchant des fonds propres pour financer la création et le développement de leur activité FinancerSaBoite est un projet initié par la Région Ile-de-France et mis en œuvre par le Centre Francilien de l’Innovation.

Vous êtes un entrepreneur, votre société est basée en Île-de-France et vous cherchez à lever des fonds : FinancerSaBoite vous propose une plateforme reposant sur le principe de la qualification par des acteurs de l’accompagnement des TPE et des PME en Ile-de-France : L’Univers est composé de 11 communautés animées par des opérateurs du développement économique et de l'innovation en Ile-de-France. En rejoignant une communauté reconnue dans l’éco-système, vous bénéficiez de sa qualification et vous accroissez ainsi très fortement vos chances de lever des fonds. Www.appuipme.fr. CDC Entreprises.

Jaïna Capital. Kima Ventures. VENTECH. ISAI, le fonds des entrepreneurs internet. Fédération des réseaux de Business Angels français, investisseur. Venture Capital / Funding.