The Procyclicalists: Fiscal austerity vs. stimulus. The world is seized by a debate between fiscal austerity and fiscal stimulus.

Opponents of austerity worry about contractionary effects on the economy. A Manifesto for Economic Sense. Austerity Doesn’t Pay as Debt Markets Ignore Rating Cuts. Britain is forcing Stephen Jobling and his stroke patients to defend the nation’s AAA credit rating.

Staffing at the National Health Service hospital ward where Jobling works was reduced by about half in the U.K.’s deepest drive since World War II to shrink its deficit. The goal was to avoid losing the top credit score, which might risk higher interest expenses, according to the government of Conservative Prime Minister David Cameron. “If they could see these people suffering while we have two members of nursing staff running round trying to wash, dress and feed 20 patients, they would think twice,” says Jobling, 27, a nurse at Lincoln County Hospital in eastern England. Mark Blyth on Austerity. There, but for austerity, go us? In his New Year message to his party, Nick Clegg said “We have had to make some very difficult decisions, but they've been the right ones for the long-term good of our country.

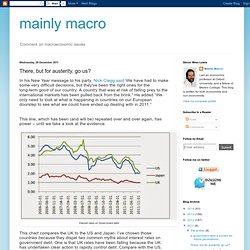

A country that was at risk of falling prey to the international markets has been pulled back from the brink.” He added “We only need to look at what is happening in countries on our European doorstep to see what we could have ended up dealing with in 2011.”This line, which has been (and will be) repeated over and over again, has power – until we take a look at the evidence. This chart compares the UK to the US and Japan. I’ve chosen those countries because they dispel two common myths about interest rates on government debt. One is that UK rates have been falling because the UK has undertaken clear action to rapidly control debt.

Policy errors like 2010 austerity – what can academics do? In this post I claimed that 2010 should be counted as one of the major errors of UK macroeconomic policy. In fact the claim is much more general, because 2010 was the year that the consensus among policymakers in the OECD area shifted from enacting stimulus to pursuing austerity, with damaging consequences in many countries. A number of comments and a couple of blogs added to my speculation on why this error might have occurred. Here I want to consider more generally what role academics and economists can play in preventing policy errors, and why this may depend on the reasons for those errors. Before coming to that, let me address one common objection to my view that 2010 was a major policy error at the time, and not just in hindsight. GMO_austerity-road-to-ruin. Austerity, democracy, and economics. Paul Krugman: Keynes Was Right.

"Good and Bad Deficits" by Robert Skidelsky. Exit from comment view mode.

Click to hide this space LONDON – “Deficits are always bad,” thunder fiscal hawks. Not so, replies strategic investment analyst H. Wood Brock in an interesting new book, The American Gridlock. A proper assessment, Brock argues, depends on the “composition and quality of total government spending.” Government deficits incurred on current spending for services or transfers are bad, because they produce no revenue and add to the national debt. From this distinction follows an important fiscal rule: governments’ current spending should normally be balanced by taxation.

Brock’s argument is that, given the state of its economy, the United States cannot return to full employment on the basis of current policy. Spending cuts to improve confidence? No, the arithmetic goes the wrong way. J.

Bradford DeLong, 6 April 2012 The Vox debate on austerity rages on. Here Brad DeLong draws on his recent research with Larry Summers to argue that unless long-term real borrowing costs in the Eurozone exceed 5%, the short-term contractionary effects of spending cuts are likely to erode rather than bolster the overall fiscal situation. In their recent ‘Lead Commentary’, Alesina and Giavazzi (2012) attack Corsetti (2012) for missing the point: “The European debate on fiscal austerity has gone astray – focusing exclusively on the size of deficit reductions.

De-Mythologizing Fiscal Consolidation. In Lost Decades, Jeffry Frieden and I argue that fiscal consolidation is a necessary prerequisite for long term recovery; however, fiscal consolidation too soon can derail the recovery, and plunge us further into debt. In contrast, some commentators have asserted that fiscal consolidation can be accomplished painlessly, or even with immediate benefits (e.g., JEC-Republicans, Rep. Paul Ryan/Heritage Foundation). Recent empirical work which carefully identifies the relevant episodes concludes that such instances of expansionary fiscal contraction are rare, and usually conducted near full employment. Ball, Leigh and Loungani review the effects of fiscal contraction in “Painful Medicine”. …fiscal consolidations typically have the short-run effect of reducing incomes and raising unemployment. Is austerity self-defeating? Of course it is.

Against the Financial Times's Editorial on Austerity. The Financial Times editorial on "austerity" yesterday felt like a punch to the stomach, especially coupled with the backup that Gideon Rachman provided for it.

The FT is thoroughly reality-based. Its people are smart. Partying Like It's 1934. A while back I read Lionel Robbins’s 1934 book The Great Depression; as I pointed out, it was a Very Serious Person’s book for its era.