Using Excel CUBE Functions with PowerPivot - PowerPivotPro. Arriving Here from a Search Engine or via Excel Help?

This article below by Dick Moffat, as well as the one by Dany Hoter, is an excellent, detailed example of how to use cube functions with *any* OLAP data source, and NOT just PowerPivot. Cube functions work the same with PowerPivot as they do with other OLAP sources like Analysis Services. I highly recommend reading both for examples and ideas. But if you want to use cube functions with just plain tables of regular data, you can do that with Excel 2010! Just download PowerPivot (free addin from MS), copy/paste or link your tables of Excel data into PowerPivot sheet tabs, and you are off and running. And now, on to Dick’s excellent article… Five Must Knows About Index Options. In the options trading world, there are many, many products that can be traded.

There are options on individual equities, equity indexes, currencies, commodities, bonds and more. Consistent income trading options: Comparing widths of SPX ICs. In our quest to understand trading options for income, we often consider further OTM (out of the money) ICs (iron condors) in the SPX.

Would moving the short strikes further OTM to improve POP (probability of profit), while increasing the width of the spreads, improve our P&L? This article attempts to answer that question. Consistent income trading options: Theta efficiency. In our quest to understand trading options for income, we often consider improving the efficient use of capital.

While ROC (return on capital) is a common metric, another metric being discussed is Theta Efficiency. Theta efficiency is defined as: Theta / Buying Power Reduction (or margin requirement). It is expressed as a percentage. Employing theta efficiency with the SPX, we can compare the results for Weekly short Puts vs. Weekly bull Put spreads, and Monthly short Puts vs. We performed two tests using the SPX. For the Monthly vs. The results: when comparing theta efficiency, we found the bull Put spread was more efficient by a factor of two (at 2 SD) to four (at 1 SD). Of interest is the premium accumulated by the Monthly in comparison to the Weekly trades (7 weeks). Articles on Options and Markets. In Part 1, we will cover the Option Contract, Assignment and Exercise, and American and European style options.

In Part 2 we will discuss the components that comprise an option's price and the Greeks. In Part 3 we will be discussing Intrinsic and Extrinsic value: two components that comprise and option's overall value. In Part 4 we will be discussing the important topic of Volatility; specifically the differences between Historical and Implied. Credit spread. James Bittman - Trading Options.

4 Must Know Options Expiration Day Traps To Avoid. It’s options expiration day and time to decide what to do with your current positions right?

If you sell options, it’s probably an anticipated event. When you buy options, it’s something usually something to dread. Either way, there are things you must know, and steps you should take, to avoid any unpleasant surprises on the third Friday of each month. pTheta Naked Options Trend Following System Overview and Trade Analysis - Theta Trend.

Overview: The video below is intended to help explain the pTheta system. the pTheta system is a longer term short options trend following system that sells naked options in the direction of the trend.

Trade Analysis: In the video I take a look at a potential trade in the Russell 2000 ($IWM). I currently have an open $IWM trade and I’m not planning to take the trade, but the risk/reward is favorable. Backtesting suggests the trades have a greater than 50% probability of success so the 1:1 risk/reward for the sample trade creates a positive expectancy. A Plan For Trading In The Bathroom With A Day Job - Theta Trend. Last week I mentioned that I recently started a full time job.

Let me assure that working full time is far from my favorite thing in the world, but, at least for now, it’s what I need to do. While I was out on one of my 4 a.m. caffeine loaded, cold, dark jogs, I realized that it also presented an opportunity. Specifically, working a demanding day job (like being a Tax Accountant during Tax Season) gives you the (dis)ability to not watch the market. It’s extremely frustrating when trades go against you and you want to make an adjustment but you can’t because you’re at work, traveling, or whatever. The ability to react is critical in trading. How can you trade without looking at the markets? Option Pricing Calculators by Peter Hoadley. Calculate Probability of Profit. Probability of Profit We use a Monte Carlo method to determine probability.

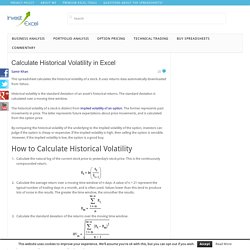

This involves modeling price using a lognormal distribution and then determining option price, at that modeled stock price, using a Black-Scholes option model. Here is the formula for modeling lognormal price distribution. Option Pricing - Invest Excel. Calculate Historical Volatility in Excel. This spreadsheet calculates the historical volatility of a stock.

It uses returns data automatically downloaded from Yahoo. Historical volatility is the standard deviation of an asset’s historical returns. The standard deviation is calculated over a moving time window. Black Scholes Option Calculator. Download the zipped version Option Trading Workbook (63 KB) Download the Excel file Option Trading Workbook.xls (314 KB) The above option pricing spreadsheet will allow you to price European call and put options.

You can also enter up to ten different option/stock leg combinations to view the expected payoff at expiration. If you have trouble with the formulas, check out the support page. Alternatively, you can visit the online version of these calculations at Option-Price.com. Monthly Cash Thru Options. Click here to go to the Members Only Learning Center Figure 1 below shows a risk/reward graph for a Bear Call Credit Spread on the Russell 2000 index (RUT). In order to create this Bear Call Credit Spread we would open the following two "legs" shown below: Buy to open, RUT 10 contracts, 750 strike, January 2006 Call Sell to open, RUT 10 contracts, 740 strike, January 2006 Call Or alternatively: Buy 10, RUT 750 Jan 06 Call Sell 10, RUT 740 Jan 06 Call.

Black Scholes Option Calculator. Historical Volatility Calculation. This page is a step-by-step guide how to calculate historical volatility. Examples and Excel formulas are available in the Historical Volatility Calculator and Guide. Although you hear about the concept of historical volatility often, there is confusion regarding how exactly historical volatility is calculated. If you are using several different charting programs, it is quite likely that you will get slightly different historical volatility values for the same security with the same settings with different software.

The following is the most common approach – calculating historical volatility as standard deviation of logarithmic returns, based on daily closing prices. Option Pricing Models (Black-Scholes & Binomial) Option Pricing Models and the "Greeks" The Black-Scholes model and the Cox, Ross and Rubinstein binomial model are the primary pricing models used by the software available from this site (Finance Add-in for Excel, the Options Strategy Evaluation Tool, and the on-line pricing calculators.) Both models are based on the same theoretical foundations and assumptions (such as the geometric Brownian motion theory of stock price behaviour and risk-neutral valuation).

However, there are also some some important differences between the two models and these are highlighted below. See also: The Black-Scholes model is used to calculate a theoretical call price (ignoring dividends paid during the life of the option) using the five key determinants of an option's price: stock price, strike price, volatility, time to expiration, and short-term (risk free) interest rate. Capital Discussions Members Web Site. Today's Most Active Options.

Welcome! Log In Register Symbol Lookup Home > Tools & Resources > Today's Most Active Options. Today's Most Active Options. The_most_liquid_index_options. No-Hype Options Trading - Given_ Kerry. Log in to Questrade. Log in to your practice account Take me to IQ Essential. Options Center - Most Active Options. Options trading software - an investment platform for beginners and experts.

Options Trading - Manage Iron Condors with the Condormax System - Sop… Options Trading - Manage Iron Condors with the Condormax System - Sop… POWERSHARES QQQ TRUST SERIE (QQQ) 25-Sep-15 105.50 C Price History. Tools. CBOE.com. TradingBlock options analytical tools and options strategy scanners are provided by TradingBlock, and are located on the TradingBlock website. All content, tools and calculations provided herein are for educational and informational purposes only.

TradingBlock uses industry-standard valuations to calculate all present and future values. Calculated future values are based on the stock price, time horizon, and implied volatility input parameters provided by the end-user. Best Options Trading Strategies. CBOE Margin Calculator. Capital Discussions Members Web Site. Options Strategy Builder & Analyzer Online — OptionCreator.

Best Trading Books. Creating trading success also has to come from many angles. When I am asked about what option trading books to read, it’s complicated. With that in mind, here is my list of recommended trading books. My Products OptionFu. Need an advanced options book. Comprehensive List of Free Historical Market Data Sources – Computer Aided Finance - Excel, Matlab, Theta Suite etc.

Often people ask me where they can find historical data of stock prices, commodities, interest-rates, bonds, fx rates … . In previous posts, we already looked at live data feeds for Matlab, and Excel. Then, we looked at how to load historical data. Now, we want to focus on where to get the data itself. Previous posts. Kenneth R. French - Data Library. Because of changes in the treatment of deferred taxes described in FASB 109, files produced after August 2016 no longer add Deferred Taxes and Investment Tax Credit to BE for fiscal years ending in 1993 or later. U.S. Historical Option Prices and Data in CSV and SQL Formats. Stock Options Analysis and Trading Tools on I Volatility.com. Reviews of Warrior Trading at Investimonials. Bullish on Warrior Trading: Going from Great to Best in Show I love researching companies and technologies. My profession and education is in Industrial/Product Design. I'm a small business owner (of 15 years). Last fall, I begin studying the market, how to read charts, etc.

Reviews of SteadyOptions at Investimonials. Excellent Service I have been a member of SteadyOptions for almost four months and told the founder and main contact, Kim Klaiman that I would not submit a review until I had a chance to use his service for a few months. In February of this year, I joined SteadyOptions as a trial member and even cancelled at the end of my trail membership. Options Trading, Options Trading System, Uncovered Options. LIMITED TIME ONLY- GoogleTrader 2015 v2.

ScamWatchdog.org: My Binary Options 101 Guide for Newbies - Learn how to make HUGE PROFITS with binary options. Implied Volatility Rank. Technical ta_p_channelup.