VinegarHill-FinanceLabs. VH-Labs is a resource we plan to develop over time to assist academics and practitioners in the area of applied research on financial instruments and to promote technological solutions and app development that advance transparency and market efficiency.

VH-Labs will publish C++, C#, Python, Javascript, VBA, and R code that will have a blend of pedagogic and practitioner themes. We will try to follow the example somewhat of the late Fabrice Rouah who developed online repositories with extremely useful code for pricing. Unfortunately, Fabrice's Volopta website has now become defunct but his books are still very popular and highly practical. In addition, to providing practical help to price financial instruments, we also apply some operations research techniques to the field of option pricing.

Money Tutorials at thismatter.com: Fundamental Tutorials on Personal Finance, Investments, and Economics. FINVIZ.com - Stock Screener. Expectations Investing. Management Theories. Glossary of Finance Terms. Aswath Damodaran: Valuation, Books, Blog, Articles, Videos. “A brand name is one of those competitive advantages you can hang on to for a long time.” — Aswath Damodaran Get the entire 10-part series on Warren Buffett in PDF.

Investor Home - The Home Page for Investors on the Internet. Investor Home - Fundamental Anomalies. Gary Karz, CFA (email) Host of InvestorHome Principal, Proficient Investment Management, LLC Value Value investing is probably the most publicized anomaly and is frequently touted as the best strategy for equity investing.

There is a large body of evidence documenting the fact that historically, investors mistakenly overestimate the prospects of growth companies and underestimate value companies. Professors Josef Lakonishok, Robert W. Vishny, and Andrei Shleifer (of LSV Asset Management) concluded that "value strategies yield higher returns because these strategies exploit the mistakes of the typical investor and not because these strategies are fundamentally riskier. " 1 In Value and Growth Investing: Review and Update (or in the Financial Analysts Journal here January/February 2004) Louis K.C. Low Price to Book A classic study on the performance of low price to book value stocks was by Eugene Fama and Kenneth R. High Dividend Yield Low Price to Sales (P/S) Low Price to Earnings (P/E) 1. Market Making, Democratized – ERC dEX. Standing on the shoulders of giants As anyone familiar with the crypto markets knows, there is a lot of volitility here.

Q1 of 2018 saw a massive decline in prices from the highs of late 2017, which resulted in a lot of traders losing money. However, some institutions that focused on market-neutral strategies did quite well during Q1 2018 because they profited from trader activity in the market, regardless of the direction it was going. According to Bloomberg: “Funds specializing in virtual currency market making and arbitrage strategies delivered first-quarter gains even as their mostly bullish peers lost 40 percent on average.” In this post, we’ll share with you how you can take advantage of a market-neutral strategy called market making that promises the possibility of (realtively) steady returns, and we’ll give you the tools you need to do it yourself so you can profit from market volitility — and incentives — like the big institutions do. Overview of Financial Modeling - What is Financial Modeling. What is a financial model?

A financial model is simply a tool that’s built in Excel to forecast a business’ financial performance into the future. The forecast is typically based on the company’s historical performance and requires preparing an income statement, balance sheet, cash flow statement and supporting schedules (known as a 3 statement model). From there, more advanced types of models can be built such as discounted cash flow analysis (DCF model), leveraged-buyout, mergers and acquisitions, and sensitivity analysis. Below is an example of financial modeling in Excel: What is a financial model used for? Investment Banking Case Studies: 3-Statement Modeling Test. Spreadsheet programs. With time, the number of spreadsheets on this page has also increased.

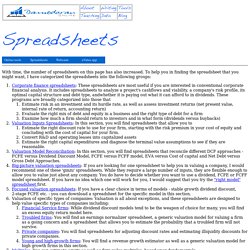

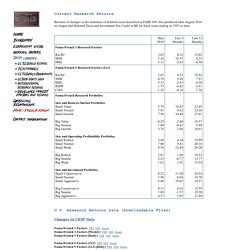

To help you in finding the spreadsheet that you might want, I have categorized the spreadsheets into the following groups: Corporate finance spreadsheets: These spreadsheets are most useful if you are interested in conventional corporate financial analysis. Aswath Damodaran: Valuation, Books, Blog, Articles, Videos. Musings on Markets. Kenneth R. French - Data Library. Because of changes in the treatment of deferred taxes described in FASB 109, files produced after August 2016 no longer add Deferred Taxes and Investment Tax Credit to BE for fiscal years ending in 1993 or later.

U.S. Research Returns Data (Downloadable Files) Univariate sorts on Size, B/M, OP, and Inv. Pronk Palisades. YALE - ECON 251 - Financial Theory. Corporate finance. Investment analysis (or capital budgeting) is concerned with the setting of criteria about which value-adding projects should receive investment funding, and whether to finance that investment with equity or debt capital.

Working capital management is the management of the company's monetary funds that deal with the short-term operating balance of current assets and current liabilities; the focus here is on managing cash, inventories, and short-term borrowing and lending (such as the terms on credit extended to customers). [citation needed] The terms corporate finance and corporate financier are also associated with investment banking. The typical role of an investment bank is to evaluate the company's financial needs and raise the appropriate type of capital that best fits those needs. Thus, the terms “corporate finance” and “corporate financier” may be associated with transactions in which capital is raised in order to create, develop, grow or acquire businesses. Marginal REVOLUTION - Small Steps Toward A Much Better World. Freakonomics - The hidden side of everything Freakonomics.

CEOExpress: Business portal for executives created by a busy executive. Calculator Soup - Online Calculator Resource. The Difference Between Profit & Profit Margin. One goal of any business is to increase its profit, but increased profit doesn’t always lead to increased profit margins.

Whether running a tattoo shop or a boutique, a business owner needs to understand the difference between profit and profit margin and realize which one serves as a better measurement for understanding costs. Profit One formula can help anyone better understand profit: total revenue minus total expenses equals profit. For example, let's say a furniture store sells $500,000 worth of furniture a year and its total expenses to operate the store (rent, utilities, labor, advertising, licenses, merchandise etc.) total $400,000. Take the $500,000 in revenue and subtract the $400,000 in expenses, and that furniture store has an annual profit, also called net income, of $100,000.

Investment Fundamentals: Table of Contents. The Calculating Investor. BlackLitterman.org. Portfolio Visualizer. Finance Articles - Self Study Guides to Learn Finance. Analysis of Financial Statements Guide to financial statement analysis The main task of an analyst is to perform an extensive analysis of financial statements.

In this free guide, we will break down the most important methods, types, and approaches to financial analysis. This guide is designed to be useful for beginners and advanced finance professionals, with the main topics... EBIT vs EBITDA What is the Difference between EBIT and EBITDA? IPO Process What is the IPO Process? StudyFinance: Fundamentals of Applied Finance.

StudyFinance: Fundamentals of Applied Finance. Enciclopedia Financiera. AnnualReports.com. 360-Degree Focus on Finance-IT-Risk Management Research Centers (tm), Financial Intelligence Research Reports on Everything You Need to Know from FinRM Global RISK Management Network, Financial Risk Management, Systemic Risk Management, Enterprise Risk Ma. CFO Retained Search. Mercado Forex. Rankia: Comunidad financiera. Le damos valor a las noticias. Investment Strategies, Education & News. Damodaran Online: Home Page for Aswath Damodaran.