Hoe Nederland opzettelijk belastingontwijking gemakkelijker maakte. De OESO, de club van rijke landen, denkt dat landen er miljarden aan belastingen door zijn misgelopen: mismatches met hybride leningen.

Als dat saaier klinkt dan een telefoonboek - dat is het ook. Mismatches met hybride leningen zijn echt stomvervelend. Maar ze zijn ook verdomd belangrijk. Want het zijn belastinglekken als deze die Nederland zo’n gewilde vestigingslocatie maken voor belastingschuwe bedrijven. En al beweerden opeenvolgende staatssecretarissen en ministers van Financiën dat Nederland geen belastingparadijs is, de geschiedenis van de hybride mismatch laat zien hoe Nederland belastingontwijking mogelijk maakte.

Dit is hoe de Nederlandse regering een gat in haar wet schreef, om vervolgens elke poging uit Europa om dit gat te dichten te frustreren. Het konijneendvormige gat in de Nederlandse wet. Hoe Nederland opzettelijk belastingontwijking gemakkelijker maakte. Rambam - Nederland Belastingparadijs. ICIJ Offshore Leaks Database. ICIJ - OFFSHORE LEAKS MAP. City of London wants to create a new African tax haven.

From Kenya’s Standard (hat tip Martin Kirk) Nairobi’s vision of following the footsteps of London, and becoming a global financial centre, has started taking shape with a financial firm appointed to deliver the work — TheCityUK — seeking partners to participate in the development of the project.

Treasure Islands: Tax Havens and the men who stole the world. Nicholas Shaxson @nickshaxson... $21tn: hoard hidden from taxman by global elite. A global super-rich elite has exploited gaps in cross-border tax rules to hide an extraordinary £13 trillion ($21tn) of wealth offshore – as much as the American and Japanese GDPs put together – according to research commissioned by the campaign group Tax Justice Network.

James Henry, former chief economist at consultancy McKinsey and an expert on tax havens, has compiled the most detailed estimates yet of the size of the offshore economy in a new report, The Price of Offshore Revisited, released exclusively to the Observer. Exhaustive Study Finds Global Elite Hiding Up to $32 Trillion in Offshore Accounts. Guests James Henry economist, lawyer, board member of the Tax Justice Network, and author of the report, "The Price of Offshore Revisited.

" Interview: our $21-32 trillion offshore estimates. Tax justice network: Estimating the Price of Offshore. A scheme designed to net trillions from global tax havens is being scuppered. British Virgin Islands, a tax haven.

The UK is said to be working with the Swiss to frustrate global transparency on taxation. Tax haven. There is no generally accepted definition of what a tax haven is, but activities that are commonly associated with such places range far beyond tax.

Some definitions do focus purely on tax: for example, a widely cited academic paper describes a tax haven as a jurisdiction where particular taxes, such as an inheritance tax or income tax, are levied at a low rate or not at all.[1] Other definitions refer to a state, country, or territory which maintains a system of financial secrecy, which enables foreign individuals to hide assets or income to avoid or reduce taxes in the home jurisdiction. Some refer to "secrecy jurisdictions" as an alternative to "tax havens," to emphasise the secrecy element, and a Financial Secrecy Index ranks jurisdictions according to their size and secrecy. [2] Earnings from income generated from real estate (i.e. by renting property owned in an offshore jurisdiction) can also be eliminated in this way.

Definitions[edit] There are several definitions of tax havens. Wealth doesn't trickle down – it just floods offshore, new research reveals. The world's super-rich have taken advantage of lax tax rules to siphon off at least $21 trillion, and possibly as much as $32tn, from their home countries and hide it abroad – a sum larger than the entire American economy.

James Henry, a former chief economist at consultancy McKinsey and an expert on tax havens, has conducted groundbreaking new research for the Tax Justice Network campaign group – sifting through data from the Bank for International Settlements (BIS), the International Monetary Fund (IMF) and private sector analysts to construct an alarming picture that shows capital flooding out of countries across the world and disappearing into the cracks in the financial system. The Wall Street Scandal of All Scandals.

Reich writes: "Yes, just when you thought the Street had hit bottom, an even deeper level of public-be-damned greed and corruption is revealed.

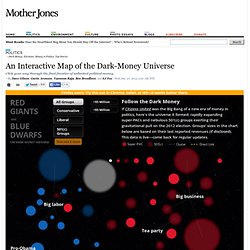

Sit down and hold on to your chair. " By Robert Reich, Robert Reich's Blog 08 July 12 Sit down and hold on to your chair. An Interactive Map of the Dark-Money Universe. Tracking the flow and impact of money in politics has long been one of Mother Jones' main beats.

Since the 2010 Citizens United decision paved the way for a new era of bottomless election spending, we've been focused on what we call "dark money"—the hundreds of millions of dollars being dropped by outside groups, much of it without full disclosure of where it's coming from. The key players in this new world are super-PACs, which may raise and spend unlimited sums of money for or against candidates; and 501(c) nonprofit groups, which may make political ads and give money to super-PACs without disclosing their donors. We wanted to visualize the major super-PACs and 501(c)s in a way that would provide both a good overview of outside spending in this election cycle as well as detailed information about each group.

The shocking truth about the crackdown on Occupy. US citizens of all political persuasions are still reeling from images of unparallelled police brutality in a coordinated crackdown against peaceful OWS protesters in cities across the nation this past week.

An elderly woman was pepper-sprayed in the face; the scene of unresisting, supine students at UC Davis being pepper-sprayed by phalanxes of riot police went viral online; images proliferated of young women – targeted seemingly for their gender – screaming, dragged by the hair by police in riot gear; and the pictures of a young man, stunned and bleeding profusely from the head, emerged in the record of the middle-of-the-night clearing of Zuccotti Park. But just when Americans thought we had the picture – was this crazy police and mayoral overkill, on a municipal level, in many different cities? – the picture darkened. To Europeans, the enormity of this breach may not be obvious at first. This global financial fraud and its gatekeepers. Last fall, I argued that the violent reaction to Occupy and other protests around the world had to do with the 1%ers' fear of the rank and file exposing massive fraud if they ever managed get their hands on the books.

At that time, I had no evidence of this motivation beyond the fact that financial system reform and increased transparency were at the top of many protesters' list of demands. But this week presents a sick-making trove of new data that abundantly fills in this hypothesis and confirms this picture. The notion that the entire global financial system is riddled with systemic fraud – and that key players in the gatekeeper roles, both in finance and in government, including regulatory bodies, know it and choose to quietly sustain this reality – is one that would have only recently seemed like the frenzied hypothesis of tinhat-wearers, but this week's headlines make such a conclusion, sadly, inevitable.

And what, in fact, happened? And then what happened? ICIJ: Secrecy for Sale: Inside the Global Offshore Money Maze. Offshore secrets. Sham directors: the woman running 1,200 companies from a Caribbean rock. At the age of 38, Bradford-born Sarah Petre-Mears is running one of the biggest business empires on earth. Or so it would appear. Official records show her controlling more than 1,200 companies across the Caribbean, the Republic of Ireland, New Zealand and the UK itself. Her business partner, Edward Petre-Mears, is listed as a director of at least a further 1,000 international firms. But the true headquarters of this major businesswoman remains mysterious. The UK companies register lists 12 addresses for her, several in London. Only one listed address, a cottage on Sark, seems genuinely residential.

Sark indeed was once the Petre-Mears' family home. John Parker, the owner of a British incorporation agency, explained in an email: "Sarah and Edward Petre-Mears have dual residence – Sark and Nevis … The reason for this is that the UK government is trying its hardest to stop the 'Sark Lark', as it is known, and they decided to do something about it before it was forced upon them. " The offshore trick: how BVI 'nominee director' system works. Nominee directors are not illegal and can sometimes be useful, for example in preparing "off-the-shelf" ready-made companies. But the legal conjuring trick behind the British Virgin Islands nominee system opens the way to abuses. OFFSHORE system 2611-001. How secret offshore firms feed London's property boom. The UK is increasingly turning into a property speculators' haven, thanks to tax loopholes and the offshore secrecy offered by the British Virgin Islands (BVI) that hides many property transactions.

We disclose the identities of some of the people secretly buying up Britain. The Guardian's investigation with the Washington-based International Consortium of Investigative Journalists (ICIJ), covering nearly 60 sample premises, shows how anonymous buyers are taking over more and more blocks of luxury housing. Some purchasers live abroad; other buyers live in the UK itself while they build up property empires using these artificial structures.

In 2011 alone, more than £7bn of offshore money flooded into potentially tax-exempt purchases of UK houses, flats and office blocks. Most buyers snapped up property in central London. Reckless bank loans to offshore entities have fuelled much of the historic property boom, handed over by lenders who subsequently had to be bailed out. . • No stamp duty. The Guardian's Offshore Secrets. Offshore secrets: BBC Panorama undercover reporting – video. Tackle Tax Havens. We're Not Broke, Just Twisted: Extreme Wealth Inequality in America. K2: how Jimmy Carr sheltered his millions. Q: Can I cancel? A: We have a range of contract lengths to suit from 1 month to 18 months. Within your contract you are not able to cancel. TheNewDeal : It's Funny That the Same C...

The missing billions. Goldman Sachs en de vernietiging van Griekenland. Goldman Sachs in Nederland. Baycitizen: "storefront business allows ING to avoid federal regulation" From the street, the new San Francisco location of the Internet banking giant ING Direct U.S.A. does not look like a place where financial transactions are made. The three-story glass-and-steel storefront near Union Square has no windows where tellers take deposits and dispense cash and no desks for loan officers. Instead, there are 13 flat-screen televisions; beanbag chairs; a deli counter that sells coffee, cookies and sandwiches; and plenty of tables and outlets for customers using the free wireless Internet access.

“It’s a big space with affordably priced coffee where people can relax, and at the same time if someone wants to talk with me about opening an account, that’s also something I can do,” said Zachary Beattie, the 28-year-old manager. European Gold Wars and Global Currency Wars. Nederlands goud vooral in buitenland. @jamesgrickards. Pentagon plays financial war games. Financial War Games: Jim Rickards/James Grant on Fed Policy and the Gold Standard - Ed Steer's Gold & Silver Daily. All The World's Gold. Kuitenbrouwer: Wie beoordeelt de kredietbeoordelaars? The Essence Of The Banking Industry - slaves to debt- THE SHOCKING TRUTH OF THE PENDING EU COLLAPSE! Docu: VPRO Import: Gewoon Doen! Reuters: Where’s the fraud, Mr. President? By David Cay Johnston The views expressed are his own.

A new report from London and President Barack Obama’s statements to “60 Minutes” show financial crimes spreading like wildfire and governments failing to stop them. Bain Capital en de 'Hollandse Route' Tax havens / tax evasion = money NOT invested in public domain. Tax haven. Nickshaxson : BBC Panorama on The Barclay... BBC iPlayer - Panorama: The Tax Haven Twins. Life’s good for bankers in the Socialist Republic of Jersey. Ewaldeng : Hier twee grafieken die misbruik... Foreign Direct Investments - Google Public Data Explorer. Foreign Direct Investments - Google Public Data Explorer. Bedrijven uit zuid-europa gebruiken NL brievenbusfirma's. Engelen 15 jaar dronken van geleende welvaart... Engelen 15 jaar dronken van geleende welvaart. 486736 565453186827675 1414503789 n. Cyprus: what the world’s media has missed. Nederland lijkt op Cyprus.

RTL Z NieuwsTrucjes: belastingontwijking kost heel veel geld. ‘Brievenbusfirma levert veel minder op’ Cash Abroad Rises $206 Billion as Apple to IBM Avoid Tax. Nederland belastingparadijs, met dank aan de PvdA. Terugblik. Smakeloos ewald engelen. Dutch Holding Companies: New Opportunities for Structuring of Ukrainian Business. FreezePage. De Kiev-Den Haag connectie. Fernandezamster : ter herinnering - Nederland... Dijsselbloem houdt kaken op elkaar over Kiev-Den Haag connectie. Diplomatie in Azië moedigt belastingontwijking via Nederland aan. Oekraïense tegoeden blijven in nevelen gehuld. Voor de VS is Nederland hét favoriete belastingparadijs. A-piketty-proteges-theory-on-tax-havens.

Inversion of the Money Snatchers - Terrific Jon Stewart segment last night on U.S. corporations filing to sort of move abr. The fall of Jersey: how a tax haven goes bust. EU lets Catholic Church off its billion-euro tax bill. Roomse Kerk pleegt miljardenfraude met EU-poet.

Even more (not yet)