EconEdLink. EverFi – Financial Literacy™ Vault – Understanding Money™ Secret Millionaires Club with Warren Buffett. PLAY SPENT. Calculate the True Cost of Credit. Trading Around the World. International trade touches us all.

We drink soda from cans made of aluminum mined in Australia, wear shoes made in Europe, eat fruit from South America, build machinery from steel milled in Asia, wear clothes made from African cotton, and live in homes built from North American wood. We take it for granted, yet before we can enjoy these products and materials, traders must negotiate prices and deliver the goods through a network of relationships that literally spans the globe.

Play this game to experience the challenges and excitement of international trade. See if you can get the best price for the goods you sell and the biggest bargains for the goods you buy. Watch how the global economy is doing: the prices you'll be able to get and the deals you can make depend on how healthy the global economy is. Before you start, think about what you want to accomplish as a trader: Do you want to build up as much wealth as you can by selling as much of your commodities as you can? Lesson Plans. Give your students a deeper understanding of money management using a curriculum offered by Practical Money Skills.

Here you’ll find lesson plans for students of all ages – from preschoolers and elementary school students to teens and college students. We also offer course materials for students with special needs. Topics range from the basics for the very young, such as “What is Money?” And “Spending Plans” to more comprehensive courses for young adults who are about to venture off into financial independence.

These more advanced courses cover everything from budgeting and bill paying to the influence of advertising and issues of consumer privacy. Here, educators will find everything they need to teach a class on personal finance. Inspire Financial Learning. FastFind: Teachers Lesson plan: Inflate your knowledge Lesson Plan | Teachers In this lesson, students have an opportunity to experience the effects of inflation first-hand through an interactive classroom auction!

Grade(s): 11, 12 Subject(s): Business Studies, Canadian and World Studies Inflate your knowledge Urban planning and your finances In this lesson, students have an opportunity to experience the effects of urban growth on their personal finances. Grade(s): 9, 10 Subject(s): Business Studies, Social Studies. Activities - FITC. Banking Kids – Coin Students will love adding the totals of coins while playing this fun game.

Clickety Clack, Let's Keep Track In this online activity students will click on a train ticket to get a deposit or withdrawal scenario. Ed's Bank Help Ed collect enough money to shop for his favorite things. Grades 1-3 (Requires the free Flash player.) Financial%20Literacy%20Assessment%20Rubric.pdf. Pre%20-%20Post%20Assessment%20Questions.pdf. Make-it-Count-Instructor-Guide-French-MSC. Make-it-Count-Instructor-Guide-English-MSC. Money as You Learn - Tools for Educators to Integrate Personal Finance into Teaching the Common Core.

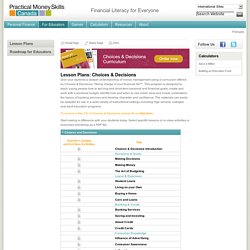

Secret Millionaires Club with Warren Buffett. My Classroom Economy. Lesson Plans. Give your students a deeper understanding of money management using a curriculum offered by Choices & Decisions: Taking charge of your financial life™.

This program is designed to teach young people how to set long and short-term personal and financial goals; create and work with a personal budget; identify how and when to use credit; save and invest, understand the basics of banking services and develop character and confidence. The materials can easily be adapted for use in a wide variety of instructional settings including high schools, colleges and adult education programs. To receive a free CD of Choices & Decisions, please fill out this form.

Start making a difference with your students today. Select specific lessons or in-class activities or download everything as a PDF file. Financial Literacy. Personal Finance. Teaching Financial Literacy To Kids: Goods And Services. Goods and services are one of the most basic ideas in economics.

Economics is the study of how resources are used to provide goods and services, and how they are made, distributed, consumed and exchanged. Tweens and teens will be able to apply their understanding of goods and services to more advanced economics concepts such as scarcity and supply and demand. Younger children, however, benefit from simply understanding that we use money to buy both goods and services, and it is helpful for children to be aware of the difference between the two. Goods Goods are things that are made or grown and something that you can use or consume. A good way to explain the concept to children is to tell them that goods are things that they can touch. Books Cheerios Computers Dishes Furniture Games Pictures Rugs Goods are things that people buy to use one time (such as a piece of candy) or over and over (for example, a toy). Is this a good or a service?