Primer On Funding Trends for Early-Stage Startups - Martin Zwilling - Startup Professionals Musings. (1) Startups: How to Hustle with AngelLis... by Brendan Baker. A Compilation of the Web's Best Advice for Entrepreneurs. Spinning Data into Marketing Gold - CitizenNet.com. Chris dixon's blog / What’s strategic for Google? Google seems to be releasing or acquiring new products almost daily.

It’s one thing for a couple of programmers to hack together a side project. It’s another thing for Google to put gobs of time and money behind it. The best way to predict how committed Google will be to a given project is to figure out whether it is “strategic” or not. Google makes 99% of their revenue selling text ads for things like airplane tickets, dvd players, and malpractice lawyers. A project is strategic for Google if it affects what sits between the person clicking on an ad and the company paying for the ad. PPC Text Ad Testing for Statistical Significance. (2) How did Mint acquire 1.5m+ users without a high viral coefficient, scalable SEO strategy, or paid customer acquisition channel. What does a convertible note bridge financing term sheet look like. Browse > Home / Convertible note / What does a convertible note bridge financing term sheet look like?

Company: [___________], a [_______] corporation (the “Company”) Amount of Financing: Up to $______________ may be issued. Type of Security: [Secured][Subordinated] convertible notes (the “Notes”). Purchase Price: Face value. Interest Rate: Annual interest rate of [___], [payable at maturity][quarterly in arrears]. If the Company does not consummate a Qualified Financing prior to ____, 200__, the Notes shall be convertible into common stock at a conversion price of $___ per share. Term; Prepayment: The day that is [one year] following the date of the Note (the “Maturity Date”).

Payment on Liquidity Event: If a Liquidity Event occurs before repayment or conversion of the Note into equity, the Company will pay the holder of the Note an amount equal to _____% of the outstanding principal amount of the Note plus any accrued interest due under the Note upon the closing of such Liquidity Event. Founder Space – connecting startups with advisors, angels & VCs. TC Teardown: 13 Ways To Get To $10 Million In Revenues (Part I) After last month’s TechCrunch Disrupt, and to provide a business companion to the popular “Lean Startup” customer development methodology, this TC Teardown focuses not on how one specific company makes money but rather seeks to provide a breakdown of the main general ways consumer Internet startups try to make money.

Consider it a guide to Internet business models. If you are currently thinking about or are in the process of developing your own consumer startup idea, these key business models will help give you a working knowledge of what it takes to get to $10 million in revenues (assuming you have a good product that the market wants). (Before you post in the comments about how unique your startup is, this list is not meant to capture every consumer business permutation. There are always going to be exceptions. And the breakaway companies like Zynga, Groupon, Facebook, Twitter, and Foursquare, to name just a few, inevitably introduce nuances to pre-existing models.) 1. 2. 3.

Why Business Plans Don't Get Funded. Contact Us Now for a Free Assessment By Akira Hirai Your business plan is very often the first impression potential investors get about your venture.

But even if you have a great product, team, and customers, it could also be the last impression the investor gets if you make any of these avoidable mistakes. Investors see thousands of business plans each year, even in this down market. High Tech Startup Valuation Estimator. Contact Us Now for a Free Assessment Wondering what your Pre-Money Value will be if a VC ever puts a term sheet on the table?

Valuing a startup is intrinsically different from valuing established companies. Because of the high level of risk and often little or no revenues, traditional quantitative valuation methods like P/E comparables or discounting free cash flows are of little use. Startup valuations are largely determined based on qualitative attributes.

We've been told by several investors that our valuation model produces reasonably good valuations. Business Basics - Equity: Dividing the Pie. Email: mike@risktaker.com I'd rather have a small piece of a big pie than a large piece of nothing!

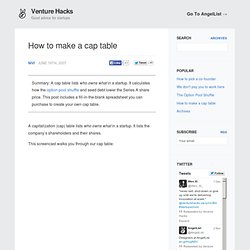

(M. How to make a cap table. Summary: A cap table lists who owns what in a startup.

It calculates how the option pool shuffle and seed debt lower the Series A share price. This post includes a fill-in-the-blank spreadsheet you can purchase to create your own cap table. A capitalization (cap) table lists who owns what in a startup. It lists the company’s shareholders and their shares. This screencast walks you through our cap table: The cap table is free. The Option Pool Shuffle. “Follow the money card!”

– The Inside Man, Three-Card Shuffle Summary: Don’t let your investors determine the size of the option pool for you. Use a hiring plan to justify a small option pool, increase your share price, and increase your effective valuation. If you don’t keep your eyes on the option pool while you’re negotiating valuation, your investors will have you playing (and losing) a game that we like to call: Venture Capital Deal Algebra. Fred Wilson wrote a useful post on valuation today.

It reminded me of a document I had Dave Jilk write when he was doing some work for me. I decided to write this “bladon” (Blog Add-on) post – inspired by Fred. Please read Fred’s post first – it lays the groundwork for why VCs do things this way. I’ve found that even sophisticated entrepreneurs didn’t necessary grasp how valuation math (or “deal algebra”) worked. VCs talk about pre-money, post-money, and share price as though these were universally defined terms that the average American voter would understand. In a venture capital investment, the terminology and mathematics can seem confusing at first, particularly given that the investors are able to calculate the relevant numbers in their heads. The essence of a venture capital transaction is that the investor puts cash in the company in return for newly-issued shares in the company.