Eurokrise: Aktuelle Nachrichten der FAZ zur Schuldenkrise in Europa. Schuldenkrise in Europa - Hält die Währungsunion der Belastung stand? France and the euro: The time-bomb at the heart of Europe. What not to worry about in the euro crisis - FT.com. EZB-Anleihenkäufe: Der Euro im Gleichgewicht des Schreckens - Europas Schul. Eine gute Nachricht aus der Eurozone jagt die nächste - das hat es schon lange nicht mehr gegeben: Frankreich, das noch vor einem Jahr mit in den Strudel Südeuropas gerissen zu werden drohte, konnte sich vergangene Woche wieder billiger Geld am Kapitalmarkt leihen.

Auch Sorgenstaat Italien musste deutlich weniger Zinsen für seine neuen Staatsanleihen berappen. Und die Schweiz, die als beliebtes Anleger-Fluchtland über viele Monate hinweg Euro kaufte, um den Kurs des Frankens nicht in den Himmel schnellen zu lassen, konnte zum ersten Mal berichten, der Euro stabilisiere sich jetzt selbst. Autor: Christian Siedenbiedel, Redakteur in der Wirtschaft der Frankfurter Allgemeinen Sonntagszeitung. Folgen: Anzeige Anzeige Die besten Apps für die Geschäftsreise Auf Geschäftsreisen wird das Smartphone zum nützlichen Helfer: Wir haben für Sie eine Auswahl der besten Apps, mit denen sich Geschäftsreisende den Reisealltag wesentlich erleichtern können. mehr...

Behold the Euroglut. (il testo del mio intervento al convegno "Morire per l'euro?

", organizzato dal gruppo EFD presso il Parlamento Europeo il 3 dicembre 2013. Qui il video originale). (English version here) Grazie Magdi per l'invito a questo incontro così importante. Vi parlerò in inglese, e in questo c’è un’amara ironia. È abbastanza paradossale che per poter essere capito dalla fetta più vasta possibile di cittadini europei io debba utilizzare proprio la lingua di questo paese. Primo: qui c'è una maggioranza di italiani e la soluzione più democratica sarebbe che io parlassi in italiano.

Seconda lezione: non sono contro l'Europa. Fatta questa premessa, andiamo avanti con il contenuto. Nel mio intervento cercherò di mettere i problemi che stiamo vivendo nella giusta prospettiva. Queste sono due condizioni necessarie, per i motivi che presto vi spiegherò e che in parte sono stati spiegati anche da Antonio e da Claudio. Germany and France rule out eurobonds. Options for Europe – Part 68. The title is my current working title for a book I am finalising over the next few months on the Eurozone.

If all goes well (and it should) it will be published in both Italian and English by very well-known publishers. The publication date for the Italian edition is tentatively late April to early May 2014. Wonkmonk sur Twitter : "Euroglut = lack of EU domestic demand ⇒ high unemployment rate &record current account surplus. So far apart and yet so close: Should the ECB care about inflation differentials?

Inflation rates can differ across regions of monetary unions.

We show that in the euro area, the US, Canada, Japan and Australia, inflation rates have been substantially and persistently different in different regions. Differences were particularly substantial in the euro area. Inflation differences can reflect normal adjustment processes such as price convergence or the Balassa-Samuelson effect, or can reflect the different cyclical position of regions. But they can also be the result of economic distortions resulting from segmented markets or unsustainable demand and credit developments fueled by low real interest rates. In normal times, the European Central Bank cannot influence such developments with its single interest rate instrument. Eurozone crisis resembles US turmoil in 2008. EconoMonitor : EconoMonitor » The Roots of the Euro Crisis Lie at the Doors.

This column argues that deficiencies in the Eurosystem[1] monetary policy contributed to the “euro crisis”, which is, in reality, an intra-Eurozone balance of payments and external debt crisis.

It claims that the Eurosystem’s monetary policy instruments and procedures allowed intra-Eurozone external imbalances to accumulate since the start of the third phase of the EMU[2] in January 1, 1999. As a result, though the Eurozone has low levels of net external debt relative to its GDP, it presently confronts, in its midst, what is likely the largest peacetime external debt crisis the World has ever seen (Das et al., 2012; Reinhart et al., 2003). Moreover, it points out that the Eurosystem’s monetary policy has always had large fiscal effects[3] and currently results in financial transfers from Eurozone creditor countries (the GNLF[4]) to Eurozone debtor countries (the GIIPS) that may amount to 1.3% of the GIIPS’ combined GDP per year.

The Debate on the Euro Crisis Conclusions. What not to worry about in the euro crisis - FT.com. How to Resolve the Euro Crisis. Coulda Been Worse - NYTimes.com. Josh Lehner does something I’ve been meaning to do: he compares US economic performance since the financial crisis with other episodes of major financial crisis.

And guess what? We actually look better than most (sorry about the small print): Photo This comparison actually tells us quite a lot. First of all, it makes immediate nonsense of the talking point that Obama must be doing terrible damage to our economy by threatening universal health care, or looking at businessmen funny, or something. That said, we should have done even better: if stimulus works, and the evidence says that it does, we should have done more, and made the slump even shorter and shallower. In this context, look at Japan. So thanks to Josh Lehner for this. Europäische Lohnkoordinierung oder nationale Währungen – entscheidet euch! Mit der Auflösung der nationalen Währungen und Einführung des Euro hat man bewusst Markt-mechanismen außer Kraft gesetzt.

Die Ausgleichsfunktion nationaler Währungen im Bezug auf sich unterschiedlich entwickelnde Volkswirtschaften wurde ausgeschalten. Weniger Markt erfordert mehr Staat, doch ist dieses “Mehr” an Staat zurzeit erkenntlich? Nomura Presents The Fair-Value Of European Currencies In A Euro Breakup Sce. As investors proceed happily through the forest that is this week's potentially epic fail, Nomura asks the question on every European is asking - What's in my wallet?

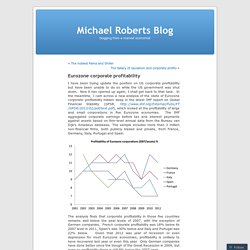

Investors holding EUR-denominated assets and obligations face potential redenomination of contracts into new currencies. Based on the current misalignment of the real exchange rate and future inflation risk estimates, the fixed income group sees very material depreciation risks in most of the periphery and one surprise but critically the research enables risk-reward trade-offs on intra-European trades. This potential 'fungibility' issue is exactly what we described last week as a potential driver of stress and Nomura's work provides a framework for quantifying that relative stress. Someday, the unraveling of these problems will be blamed on austerity — Mar. I have been trying update the position on US corporate profitability but have been unable to do so while the US government was shut down.

Now it has opened up again, I shall get back to that task. In the meantime, I cam across a new analysis of the state of Eurozone corporate profitability hidden deep in the latest IMF report on Global Financial Stability (GFSR, which looked at the profitability of large and small corporations in five Eurozone economies. The IMF aggregated corporate earnings before tax and interest payments against assets based on firm-level annual data from the Bureau van Dijk’s Amadeus database. The sample includes more than 3 million non-financial firms, both publicly traded and private, from France, Germany, Italy, Portugal and Spain. European Debt Crisis Explained - YouTube. Euro.pdf (application/pdf Object) China Pulls The Rug From Under Europe, Halts French Bank Transactions, Make.

A flurry of headlines out of China suggest global macro-economic volatility may be ready to take it to the next level.

We discussed last week how China's oh-so-generous offer of help to Europe was merely a veiled threat playing US against Europe in a game of who-gets-the-funding. Well, tonight, it seems, they are making good on some of those threats. Aggravated by EU's lack of market economy recognition, they pull trading lines with French banks, express concern at the EUR's safety (preferring US Treasuries), and indicate a clear preference for bonds over stocks - all the while warning of growing trade tensions - consider the sabre-rattled. Initial comments from Commerce Minister Shen via Bloomberg: How to break Europe’s economic taboos without shattering its union - FT.com.

Wen sets preconditions to help Europe - FT.com. The ECB’s Lethal Inhibition — Social Europe Journal. The EU's Camouflaged Bazooka. Euro bonds are not the answer. By Hugo DixonThe author is a Reuters Breakingviews columnist. Die Ersparnisse in Sicherheit bringen: Kundinnen vor einem Bankautomaten in Athen. Foto: Keystone Die Verhandlungen zwischen Griechenland und den anderen Euroländern sind am Montag ohne Ergebnis zu Ende gegangen. Am Freitag will man sich wieder treffen. Was wird als Nächstes passieren? Charlemagne: How much closer a union? This Time is Different, An Update « Oregon Office of Economic Analysis.

UPDATE: The information below was originally published September, 2011; an update was done in September, 2012 and the latest employment graph (data through November 2013) is here. The following provides an update on the great research that Carmen Reinhart and Kenneth Rogoff conducted regarding the build-up and subsequent bust of historical financial crises. While their work on crises was largely conducted in the time period leading up to and directly after the financial meltdown in late 2008, there does not appear to be any updates now that the U.S. economy has been in technical recovery for over two years at this point. Some of the facts and figures cited in This Time is Different and the authors’ academic papers were still a work in progress at publication date given that events were ongoing. With the benefit of hindsight, a longer time span and revised economic data (always a luxury), I have recreated and updated some of Ms Reinhart and Mr Rogoff’s work.

Explaining US Hypocrisy on Ukraine. U.S. government hypocrisy toward the Ukraine crisis has been breathtaking, as has the U.S. press corps’ stubborn refusal to see the hypocrisy (i.e. the Iraq War and many other U.S. interventions). William Blum looks at the reasons behind the double standards. By William Blum When it gets complicated and confusing, when you’re overwhelmed with too much information, changing daily; too many explanations, some contradictory … try putting it into some kind of context by stepping back and looking at the larger, long-term picture. The United States strives for world domination, hegemony wherever possible, their main occupation for over a century, it’s what they do for a living.

Unmittelbar betroffen: Die polnische Bank PKO hat Filialen auf der Krim geschlossen Was hat ein Schweinefuß mit der Krim zu tun? The "plan" outlined in a interview with Bloomberg is nothing more than a rehash of the plan that helped hurt the Soviet Union in the 1980's when a drop in currency revenue due to declining oil prices created substantial difficulties for the Soviet economy. Basically, Soros proposes that the US open up its strategic oil reserves and dump them all in the market. According to a Bloomberg report that he believes that "strongest sanction" against Russia "is in the hands of the United States" because US could sell crude from the Strategic Oil Reserve and depress prices . Today, during a panel discussion in Berlin, Soros stressed that the Russian government needs a price of over 100 US dollars per barrel in order to balance the budget.

EconoMonitor : EconoMonitor » International Debt and Financial Crises. The latest issue of the IMF’s World Economic Outlook has a chapter on global imbalances that discusses the evolution of net foreign assets (also known as the net international investment position) in debtor and creditor nations. The authors warn that increases in the foreign holdings of domestic liabilities can raise the probability of different types of financial crises, including banking, currency, sovereign debt and sudden stops. EmailShare 48EmailShare The widely believed proposition that this financial crisis was "a tsunami that no-one saw coming", and that could not have been predicted, has been given the lie to by an excellent survey of economic models by Dirk Bezemer, a Professor of Economics at the University of Groningen in the Netherlands. Bezemer did an extensive survey of research by economists or financial market commentators, looking for papers that met four criteria: “Only analysts were included who: provide some account on how they arrived at their conclusions.went beyond predicting a real estate crisis, also making the link to real-sector recessionary implications, including an analytical account of those links.the actual prediction must have been made by the analyst and available in the public domain, rather than being asserted by others.the prediction had to have some timing attached to it.”

On that basis, Bezemer found eleven researchers who qualified: Offshore deposits move from Cyprus to Latvia. Current Accounts Eurozone 2007. 'Europe was always plagued with debt, even before euro' Behold the Euroglut. Charting Europe’s Japanification.