Trading volume surges on decentralized exchanges. Atomic Cryptocurrency Wallet. No geo-restrictions using @AtomicWallet to trade on @Binance_DEX… Decentralized Exchanges: The Top 8 DEXs Compared. Nearly everyone in the blockchain space agrees that decentralized exchanges are the future of cryptocurrency trading.

That’s because, in today’s industry, trading digital assets is neither secure nor simple. To start trading, you must first buy assets with a fiat currency (USD, EUR, GBP, AUD, etc.) through fiat gateway services, which often charge high fees and offer terrible exchange rates. Only a few major digital currencies are available. Once you’ve made the purchase, you no longer have control of your own funds— the exchange does.

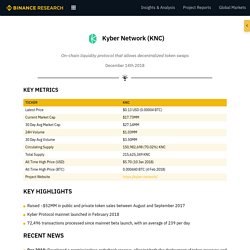

This system forces centralized exchanges to be responsible for holding and protecting all users’ funds. As enforcement bites, decentralized protocols promise a different future. Top DEX Stats. Digital Assets and Cryptocurrencies. On-chain liquidity protocol that allows decentralized token swapsDecember 14th 2018 Raised ~$52MM in public and private token sales between August and September 2017Kyber Protocol mainnet launched in February 201872,496 transactions processed since mainnet beta launch, with an average of 239 per day Dec 2018: Developed a permissionless orderbook reserve, allowing both the deployment of token reserves and contribution of liquidity in a permissionless mannerDec 2018: Developed an Automated Market Maker reserve, allowing the calculation of conversion rates entirely on-chain and reducing costs incurred by reserve managersNov 2018: Launched Kyber Trading API, a REST API that gives users access to on-chain liquidity with minimal smart contract experienceOct 2018: Initiated the Wrapped BTC ("WBTC") Community Initiative alongside BitGo, Republic Protocol, and many more ecosystem partnersOct 2018: Introduced the KyberWidget, a simple way to buy and sell tokens directly within DApps and websites.

DeFi.

Defi Lending Platforms. Serum (SRM) Binance Chain & DEX. Derivatives DEX. DDEX - Decentralized Margin Exchange. dYdX. Fulcrum. Crypto Margin Trading. Stats, Charts and Guide. Stats, Charts and Guide. Stats, Charts and Guide. Understanding a Decentralized Exchange – TheBlocknet. The single greatest need in the crypto-ecosystem is a truly decentralized exchange.

Why is decentralized exchange so important? An estimated one in sixteen bitcoins have been stolen. More exchanges than may easily be kept track of have been hacked, defrauded, or stolen from. The Trouble with Centralized Exchanges… – TheBlocknet. As the Cryptocurrency environment matures, the inherent problems with centralized exchanges present themselves on an almost daily basis and highlight why the need for decentralized exchanges is now more urgent than ever.

Volume Problems On Sunday the 12th of November, during a surge of volume across the cryptocurrency trading platforms, many of the major exchanges experienced delays and technical difficulties as their servers were unable to cope with the massive influx of activity. Bithumb alone experienced a minimum downtime of 90 minutes during a peak trading period; the estimated impact is more than 60,000 Bitcoin (BTC) worth of lost trade volume. Bithumb also made an organizational decision to cancel all outstanding orders without notice and to put the exchange on pause, causing untold loss for short-term traders, leaving them in confusion and unable to act. During this downtime, the price of BitcoinCash (BCC/BCH) almost halved in value.