Information about Australia's coast, including its estuaries and coastal waterways and climate change impact. Global action - facts and fiction. Department of Climate Change and Energy Efficiency - Home. Comparing Carbon Policies Internationally: the 'challenges' - Productivity Commission. Emission Reduction Policies and Carbon Prices in Key Economies - Productivity Commission. Commissioned study This study has concluded.

The final report was sent to government on 31 May 2011 and released on 9 June 2011. A supplement to this report was released on 16 December 2011. The Australian Government asked the Productivity Commission to undertake a study on the effective carbon prices that result from emissions and energy reduction policies in Australia and other key economies. Effective carbon prices include both explicit carbon prices from emission taxes and tradeable permits, and the implicit prices of other measures, such as direct regulation of technologies, renewable energy targets, or subsidies for low emissions technology.

Carbon market overview - Products & services - Point Carbon. Climate change is mainly caused by an accumulation of greenhouse gases (GHGs) in the atmosphere.

At the Rio Conference in 1992, there was a broad international recognition of the need for a common effort in order to mitigate climate change. This resulted in the first international legally binding agreement aiming to curb greenhouse gas emissions – the United Nations Framework Convention on Climate Change (UNFCCC). According to the UNFCCC, industrialised countries, or Annex I countries, have the main responsibility to mitigate climate change. In 1997, concrete targets for curbing GHG emissions were established in the Kyoto Protocol. Each Annex I country that has ratified the Kyoto Protocol is obliged to reach a domestic target for carbon dioxide (CO2) equivalent emissions, on average of 5.2 % below 1990 emission levels, by the first commitment period of 2008 to 2012. 13.3.3.4 Actions - AR4 WGIII Chapter 13: Policies, instruments, and co-operative arrangements. 13.3.3.4.1 Targets While many types of commitments are identified in the literature on climate change, the most frequently evaluated commitment is that of the binding absolute emission reduction target as included in the Kyoto Protocol for Annex I countries.

The broad conclusion that can be drawn from the literature is that such targets provide certainty about future emission levels of the participating countries (assuming targets will be met). These targets can also be reached in a flexible manner across GHGs and sectors as well as across borders through emission trading and/or project-based mechanisms (in the Kyoto Protocol case, this is referred to as Joint Implementation (JI) and as the Clean Development Mechanism (CDM).

One crucial element is defining and agreeing on the level of the emission targets. Examples of processes to agree on a target include: Participating countries make proposals (pledges) for individual reductions on a bottom-up basis. 13.3.3.4.2 Flexibility provisions. 11.7.6 Technological spillover - AR4 WGIII Chapter 11: Mitigation from a cross-sectoral perspective. Mitigation action may lead to more advances in mitigation technologies.

Transfer of these technologies, typically from industrialized nations to developing countries, is another avenue for spillover effects. Emissions trading. Stern Review on the Economics of Climate Change - HM Treasury. Sir Nicholas Stern, Head of the Government Economic Service and Adviser to the Government on the economics of climate change and development, is delighted to present his report to the Prime Minister and the Chancellor of the Exchequer on the Economics of Climate Change: The Stern team has moved to the Office of Climate Change.

Publications posted after the Stern Review including the series of papers printed in the World Economics Journal, are now available on the Stern team page on the Office of Climate Change website. Some of the above documents are available in Adobe Acrobat Portable Document Format (PDF). If you do not have Adobe Acrobat installed on your computer you can download the software free of charge from the Adobe website. For alternative ways to read PDF documents and further information on website accessibility visit the HM Treasury accessibility page. 11.7.2 Carbon leakage - AR4 WGIII Chapter 11: Mitigation from a cross-sectoral perspective.

The Story of Cap & Trade IPCC WGII - AR4 Review Comments. Intergovernmental Panel on Climate Change. EXECUTIVE SUMMARY - AR4 WGIII Chapter 11: Mitigation from a cross-sectoral perspective. Mitigation potentials and costs from sectoral studies The economic potentials for GHG mitigation at different costs have been reviewed for 2030 on the basis of bottom-up studies.

The review confirms the Third Assessment Report (TAR) finding that there are substantial opportunities for mitigation levels of about 6 GtCO2-eq involving net benefits (costs less than 0), with a large share being located in the buildings sector. Additional potentials are 7 GtCO2-eq at a unit cost (carbon price) of less than 20 US$/tCO2-eq, with the total, low-cost, potential being in the range of 9 to 18 GtCO2-eq. The total range is estimated to be 13 to 26 GtCO2-eq, at a cost of less than 50 US$/tCO2-eq and 16 to 31 GtCO2-eq at a cost of less than 100 US$/tCO2-eq (370 US$/tC-eq). As reported in Chapter 3, these ranges are comparable with those suggested by the top-down models for these carbon prices by 2030, although there are differences in sectoral attribution (medium agreement, medium evidence).

Bioenergy. Intergovernmental Panel on Climate Change. Click to the link below to read details: Assessment Reports: These are published materials composed of the full scientific and technical assessment of climate change, generally in three volumes, one for each of the Working Groups of the IPCC, together with their Summaries for Policymakers, plus a Synthesis Report Special Reports: These are materials that provide an assessment of a specific issue and generally follow the same structure as a volume of an Assessment ReportMethodology Reports: These are materials that provide practical guidelines for the preparation of greenhouse gas inventories Translations in non-UN languagesReporting an Error These are published materials composed of the full scientific and technical assessment of climate change, generally in three volumes, one for each of the Working Groups of the IPCC, plus a Synthesis Report.

Each of the Working Group volumes is composed of individual chapters, an optional Technical Summary and a Summary for Policymakers. Cover. Carbon Tax Information, Carbon Tax Reference Articles - CanadaSpace Reference. Economic Cost of Sea Level Rise. This project will develop methodological templates for investigating adaptation to the threat of rising sea in the context of coastal storms, for calibrating the value of information, for modeling how information is used (including the results of integrated assessments) and exploring other issues of related to assessing vulnerability to climate change in particular and global change more generally.

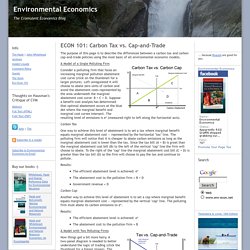

Insight will be developed into (1) how to apply and adapt the method to coastal zones that lie beyond the boundaries of developed economies, how to bring state of the art erosion modeling to bear on the method and (2) how to incorporate a wide variety of institutional environments that restrict or enhance the efficacy of local adaptation decisions and strategies. We expect, as well, to foster analyses of coastal zones in developing regions of the world. The role of adaptation in determining vulnerability to global change and/or global change policy will continue to be a second focus. ECON 101: Carbon Tax vs. Cap-and-Trade. The purpose of this page is to describe the differences between a carbon tax and carbon cap-and-trade policies using the most basic of all environmental economic models.

A Model of a Single Polluting Firm Consider a polluting firm that faces an increasing marginal pollution abatement cost curve (click on the thumbnail for a larger picture). Supreme Court aces climate change ruling By Douglas A.

Henderson, Peter S. Glaser Last week, the Supreme Court tackled one of the country’s most contentious environmental issues, climate change, in AEP v. Connecticut. Without taking sides in the climate change debate, a unanimous court rejected an attempt by California, New York and six other states to circumvent the authority of Congress to determine national energy policy and to force certain industries to cap their carbon dioxide emissions by judicial fiat.

Written by Clinton-appointee Justice Ruth Bader Ginsburg, the Supreme Court’s decision is not pro-business or anti-business, and it’s surely not pro-environment or anti-environment. Rather, the case is pro-Constitution. Carbon Tax Center. Carbon Tax Center » Demographics. Carbon taxes, to be effective, will raise large sums of revenue. But generating revenue for the government isn’t their main job; indeed, swapping out revenues from existing and onerous taxes like payroll taxes against new revenues from carbon taxes, in revenue-neutral “tax shifts,” is built into many carbon tax proposals and is strongly supported by the Carbon Tax Center. Rather, the intent of robustly taxing carbon emissions is to cut those emissions by decisively raising prices of fossil fuels relative to conservation, efficiency and clean energy such as renewables. We don’t need more tax revenue in order to cut CO2 emissions, we need to shift more of the total tax burden onto dirty energy, and to do so without harming low- and middle-income families..

We NEED a CARBON TAX! (Yes we do!) - Ars Technica OpenForum. Excelon -- since I am absolutely certain that this will be a bone of enormous contention in the coming years, let me point out that the statutory basis for this is as thoroughly established as it can possibly be. SCOTUS (and indeed a supreme court with a clear majority of "very conservative" Jurors) ruled that CO2 is a pollutant under the Clean Air Act, and that the EPA must proceed with it's regulatory responsibilities.

The only way to stop this is for Congress to revise the Clean Air Act, which of course people are now threatening to do. See here for reportage of the Supreme Court Decision www.nytimes.com/2007/04/03/.../03scotus.html See here for Wikipedia's more detailed discussion of Mass. vs EPA 549 US 497 and links to original documents: ... ion_Agency. Essential Background. Intergovernmental Panel on Climate Change. To publicize and disseminate findings of its reports to its key audiences, including the scientific and policymaker communities worldwide, IPCC produces outreach materials and organizes outreach activities such as events and presentations by IPCC representatives at various national and international meetings.

This page contains information on these events, outreach materials produced by the IPCC and its partner organizations. Emissions-euets.com. EUA/CER spread tendency and the legal framework for CER’s after 2012. Despite an extensive variety of provisions relating to the status of CER units in the post-2012 legal framework of the Directive 2009/29/EC (aiming generally at securing stability of the long-term green investments), at least one of these provisions should be of particular concern to the CER buyers and investors. The relevant legal scheme for the CER’s use in the framework of the EU ETS in the third trading period is set out in the Article 11a of the Directive 2009/29/EC (Use of CERs and ERUs from project activities in the Community scheme before the entry into force of an international agreement on climate change).

Those interested in particulars should refer to the body of the text of the Directive and now I would like to concentrate only on paragraph 9 of that Article, which states: “9. From 1 January 2013, measures may be applied to restrict the use of specific credits from project types. This problem is of course important, but, obviously, not the only one. Sustainable 60 >Sustainable 60.

Home - Point Carbon - Providing critical insights into energy and environmental markets. Stern Review final report - HM Treasury. 2.2 Concept of Radiative Forcing - AR4 WGI Chapter 2: Changes in Atmospheric Constituents and in Radiative Forcing. The definition of RF from the TAR and earlier IPCC assessment reports is retained. Ramaswamy et al. (2001) define it as ‘the change in net (down minus up) irradiance (solar plus longwave; in W m–2) at the tropopause after allowing for stratospheric temperatures to readjust to radiative equilibrium, but with surface and tropospheric temperatures and state held fixed at the unperturbed values’.

IPCC Third Assessment Report - Climate Change 2001 - Complete online versions. Economic Instruments and Environmental Policy. IPCC Third Assessment Report - Climate Change 2001 - Complete online versions. 13.2.1.2 Taxes and charges - AR4 WGIII Chapter 13: Policies, instruments, and co-operative arrangements. An emission tax on GHG emissions requires individual emitters to pay a fee, charge or tax for every tonne of GHG released into the atmosphere. An emitter must pay this per-unit tax or fee regardless of how much emission reduction is being undertaken. Each emitter weighs the cost of emissions control against the cost of emitting and paying the tax; the end result is that polluters undertake to implement those emission reductions that are cheaper than paying the tax, but they do not implement those that are more expensive, (IPCC, 1996, Section 11.5.1; IPCC, 2001, Section 6.2.2.2; Kolstad, 2000).