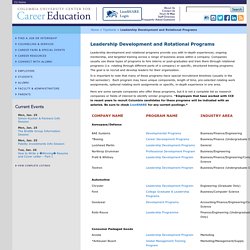

GE. Leadership Development and Rotational Programs. Leadership development and rotational programs provide you with in-depth experiences, ongoing mentorship, and targeted training across a range of business areas within a company.

Companies usually use these types of programs to hire interns or post-graduates and train them through rotational programs (i.e. rotating through different parts of a company) or specific, structured training programs. The goal is to recruit and develop leaders for their organization. It is important to note that many of these programs have special recruitment timelines (usually in the fall semester). Each program may have unique components, length of time, pre-selected rotating work assignments, optional rotating work assignments or specific, in-depth experience in one area. Here are some sample companies who offer these programs, but it is not a complete list so research companies or fields of interest to identify similar programs. The Economist GMAT Tutor. Graduate job search: Financial Careers With Excellent Salaries.

Risk manager: Career development.

Banking vs. Consulting. - McKinsey & Co. or Goldman Sachs? McKinsey & Company I colloqui in consulenza. Big 4 Guide. The Best of the Best: McKinsey's Problem Solving Test, Case Interviews, and Life. 8 insider secrets to Bain recruiting - Management Consulted. 5 surprising secrets of a killer McKinsey resume. Haven’t you always wondered what a McKinsey resume looks like?

Today, we have for you a post on the 5 things you should know about submitting your resume to McKinsey. After the rave reviews we received from our McKinsey firm profile, we decided to give you even more insight on the world’s top consulting firm – this time letting you in on the secrets of what it takes to make it past the resume screen at McKinsey.

Now, there are the standard set of rules for your consulting resume that apply for any firm – a results-oriented resume, formatting consistency, using proactive language, quantifying competitive accomplishments, providing context for key activities, etc. – and you can get more on those in our Resume & Cover Letter Bible.

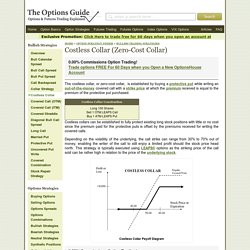

Explicit cookie consent. Costless Collar (Zero-Cost Collar) Explained. Home > Option Strategy Finder > Bullish Trading Strategies The costless collar, or zero-cost collar, is established by buying a protective put while writing an out-of-the-money covered call with a strike price at which the premium received is equal to the premium of the protective put purchased.

Costless collars can be established to fully protect existing long stock positions with little or no cost since the premium paid for the protective puts is offset by the premiums received for writing the covered calls. Depending on the volatility of the underlying, the call strike can range from 30% to 70% out of money, enabling the writer of the call to still enjoy a limited profit should the stock price head north. This strategy is typically executed using LEAPS® options as the striking price of the call sold can be rather high in relation to the price of the underlying stock.

Limited Profit Potential. Investment Banking Definition. How to get "elite" jobs: Dartmouth is not good enough - 80,000 Hours. I just came across a study of what top-tier investment banks, law firms, and management consulting firms look for when recruiting.

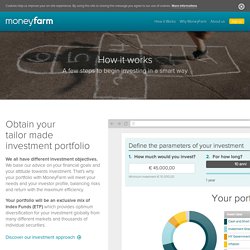

The author of the study interviewed over 100 recruiters at these firms to find out what criteria they used. The Chronicle of Higher Education summed up the results: Amazon.com: See Levitt and Dubner's 10 Books to Read on Economics. Università Ca' Foscari. Database. How it Works. MoneyFarm is an independent financial services company, registered as a broker dealer firm and authorized by Consob and Bank of Italy.

Outline of economics. The following outline is provided as an overview of and topical guide to economics: Nature of economics[edit] Economics can be described as all of the following: Academic discipline – body of knowledge given to - or received by - a disciple (student); a branch or sphere of knowledge, or field of study, that an individual has chosen to specialise in.Field of science – widely-recognized category of specialized expertise within science, and typically embodies its own terminology and nomenclature.

Such a field will usually be represented by one or more scientific journals, where peer reviewed research is published. There are many sociology-related scientific journals. Index of accounting articles. Index of accounting articles From Wikipedia, the free encyclopedia Jump to: navigation, search This page is an index of accounting topics.

Main article: Accounting Contents. Outline of finance. The following outline is provided as an overview of and topical guide to finance: Finance – addresses the ways in which individuals and organizations raise and allocate monetary resources over time, taking into account the risks entailed in their projects.

Overview[edit] The word finance may incorporate any of the following: The study of money and other assetsThe management and control of those assetsProfiling and managing project risks Fundamental financial concepts[edit] History[edit] Finance terms, by field[edit] Accounting (financial record keeping)[edit] Main articles: Accounting and List of accounting topics Banking[edit] Corporate finance[edit] Investment management[edit] World Economic Forum: Global Shapers. List of Rankings. Free Online EPSO Simulation Demo - Practice EPSO Tests. Learn Accounting Online for Free.

Elenco Aziende > Treviso (TV) > SOCIETÀ QUOTATE IN BORSA. Businessinsider. Turn your LinkedIn Profile into a Resume. The Ultimate Cheat Sheet for Mastering LinkedIn. Opportunità di studio. Come affrontare un colloquio di lavoro (3+1 consigli efficaci) Vault.com - Get the inside scoop on companies, schools, internships, jobs and more. S Top 25 Most Difficult Companies To Interview (2013)

Interviewing at any company isn’t easy, but at some companies, the interview process is even tougher.

To make things even more difficult, the average length of the entire interview process is increasing, from an average of 12 days in 2010 to an average of 23 days thus far in 2013, according to job candidate feedback shared on Glassdoor. Glassdoor’s third annual report of the Top 25 Most Difficult Companies to Interview (2013)* uncovers which companies have the toughest interview process, according to job candidates over the past year, along with average interview duration, average interview experience (positive vs. negative), and overall employee satisfaction ratings to shed light into the question: Does a tough interview correlate to higher employee satisfaction? Marketing Tips For The Technically Gifted: The Power Of Customer Self-Selection.

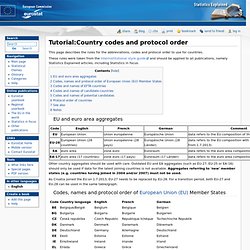

Businessinsider. Initiative on Global Markets. Banking industry news & analysis of international finance. Tutorial:Country codes and protocol order. This page describes the rules for the abbreviations, codes and protocol order to use for countries.

These rules were taken from the Interinstitutional style guide and should be applied to all publications, namely Statistics Explained articles, including Statistics in focus. EU and euro area aggregates Other country aggregates should be used with care. PACIFIC Exchange Rate Service. International Monetary Fund Home Page. Eurostat Home. Exchange Rates - X-Rates.

Bloomberg - Business, Financial & Economic News, Stock Quotes. Bloomberg Billionaires. Investopedia - Educating the world about finance. Breaking News, Business News, Financial and Investing News & More. Financial Stability Board. IMF World Economic Outlook Database. The World Economic Outlook (WEO) database contains selected macroeconomic data series from the statistical appendix of the World Economic Outlook report, which presents the IMF staff's analysis and projections of economic developments at the global level, in major country groups and in many individual countries. The WEO is released in April and September/October each year. Use this database to find data on national accounts, inflation, unemployment rates, balance of payments, fiscal indicators, trade for countries and country groups (aggregates), and commodity prices whose data are reported by the IMF.