The UK Economy. Pieria - The Falsified Religion of Austerity. In 2009 before he became Prime Minister, David Cameron outlined his economic strategythat "the money has run out" and that "the alternative to dealing with the debt crisis now is mounting debt, higher interest rates and a weaker economy".

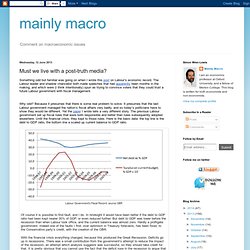

He went on to say that "unless we deal with this debt crisis, we risk becoming once again the sick man of Europe. Our recovery will be held back, and our children will be weighed down, by a millstone of debt. " On all counts, he couldn't have been more wrong. Cameron and his government have taken decisive action on real spending growth, cutting spending per capita harshly in a time of severe private sector deleveraging.

This has not returned Britain to growth as Cameron implied it would. And even while cutting spending per capita, Cameron has made no meaningful impact on debt levels, which continue to climb due to falling tax revenues in the depressed economy — suggesting that the austerity has been totally self-defeating. The opposite.

Must we live with a post-truth media? Of course it is possible to find fault, and I do.

In hindsight it would have been better if the debt to GDP ratio had been kept nearer 30% of GDP, or even reduced further. But debt to GDP was lower before the recession than when Labour took office, and the current balance was almost zero. Hardly a profligate government. Indeed one of the faults I find, over optimism in Treasury forecasts, has been fixed, to the Conservative party’s credit, with the creation of the OBR. With the financial crisis everything changed, because this produced the Great Recession.

UK Foreign Policy. If the confidence fairy ever existed, austerity has frightened her away. The UK is well ahead of the US and the EU in its use of fiscal rules. Much of the speculation leading up to the Chancellor’s Autumn Statement, as well as the debate which followed it, has centered around George Osborne’s fiscal rules.

In this post Simon Wren-Lewis examines the government’s surviving fiscal rule and some of the difficulties which surround it. In one area macroeconomic policy in the UK is well ahead of the US or the Eurozone: the use of fiscal rules. The US seems to prefer cliffs to rules – yes, I know that is a cheap jibe, but you know what I mean. In the Eurozone fiscal rules now come in packs, the individual parts of which are of variable quality and may not be consistent with each other. By contrast, the surviving UK fiscal rule (or ‘mandate’) makes some limited sense, as did Gordon Brown’s predecessors.

What is good about this rule? Two additional features of the UK rule are the use of the cyclically adjusted deficit and the exclusion of investment. As an example, we only need to look at the reaction to the Autumn Statement in the UK.

UK - curators... The third British Empire. London, United Kingdom - Historians tell us that there were two quite distinct British empires - the first an Atlantic empire built on North American colonies and Caribbean possessions and the second an Asian empire, built on control of India and coercive trade with China.

These two empires were deeply criminal projects, in the specific sense that they relied heavily on profits from slavery and the sale of narcotics. Empire on the British model was a moneymaking venture, where moral considerations took second place to the lure of super profits. The first British Empire came to an end when the Americans fought a revolutionary war for independence in the 1770s. The second British Empire began to fall apart with Indian independence in 1947. Arab and African nationalism progressively undermined British influence in the years that followed. Banking on billionaries Two news stories from last week help us sketch the outlines of this third, offshore empire. Capital of capitalism.

Empire...