Home Page

We use cookies to improve your site experience, to assess content usage and to support marketing of our services. We want to be completely transparent about the cookies we use and to make their control as easy as possible for you. Our cookies are broken down in to five categories - you can 'mouse over' the icons on the right for a summary or click the icon for more detail. From the links on the right you can download an information guide on managing cookies, the exact detail of all the cookies for review offline and see the latest audit status.

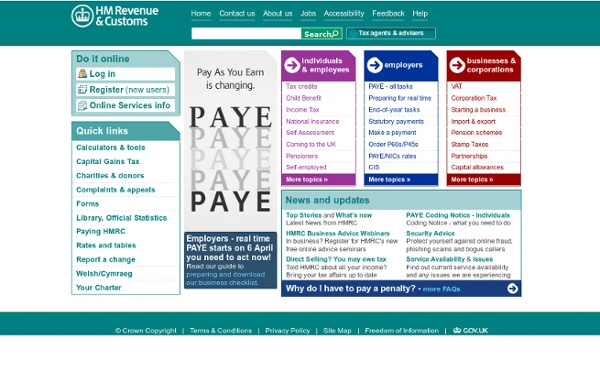

http://www.hmrc.gov.uk/

Home – Government Legal Service

The Civil Service - Information and news about the UK Civil Service

Citizens Advice - the charity for your community

Related: