Please Update to the Latest Version. This is a legally binding contract between you and the installer.

By downloading, installing, copying, running, or using any content of recommendedupdate.com, you are agreeing to be bound by the terms of this Agreement. You are also agreeing to our Privacy Policy. If you do not agree to our terms, you must navigate away from our Sites, you may not download the Content, and you must destroy any copies of the Content in your possession. If you are under 18, you must have your parent or guardian's permission before you use our Sites or download Content. In an effort to comply with the Children's Online Privacy Protection Act, we will not knowingly collect personally identifiable information from children under the age of 13.

This Agreement may be modified by us from time to time. 1. Your download and software installation is managed by the Installer. 2. 3. Please Update to the Latest Version. HMRC: Login. Registering for Self Assessment. You should register with HM Revenue & Customs (HMRC) if you need to complete a Self Assessment tax return.

For example you may have started self-employment or letting property. HMRC will then decide if you need a tax return. If you do, they'll set up your tax records and send you a Unique Taxpayer Reference. Working for yourself (self-employed) If you work for yourself in the UK, or set up your own business in the UK, you are 'self-employed'.

You must register with HM Revenue & Customs (HMRC) and pay your own tax and National Insurance. On this page: Registering with HMRC. Class 2 National Insurance contributions. If you're self-employed you normally have to pay Class 2 National Insurance contributions.

This guide explains how much you pay and the circumstances when you may be exempt from paying. To find out about your wider tax and National Insurance responsibilities when you're self-employed, read the related guide 'Self-employed tax and National Insurance' - you'll find the link under 'Further information' at the end of the page. On this page: Class 2 National Insurance - how much you pay You pay Class 2 National Insurance contributions at a flat rate of £2.75 a week. Top Class 2 National Insurance contributions and state benefits Class 2 contributions count towards certain benefits, like the basic State Pension, Maternity Allowance and Bereavement Benefit. Do you need to top up your National Insurance contributions? If you've got gaps in your National Insurance contributions record, your entitlement to the State Pension and certain bereavement benefits could be affected.

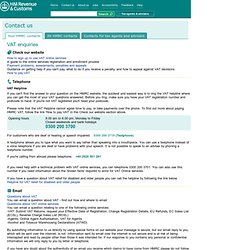

You may want to consider filling in the gaps by paying voluntary National Insurance contributions. On this page: National Insurance contributions and your State Pension The amount of State Pension (and certain bereavement benefits) you're entitled to is based on your National Insurance contributions record over your working life from age 16 until State Pension age. This record is made up from National Insurance contributions paid and/or credited to you in each tax year. Read more about how you qualify for the State Pension on GOV.UK (Opens new window) Top. VAT enquiries. -VAT: Submit VAT Returns, request your Effective Date of Registration, Change Registration Details, EU Refunds, EC Sales List (ECSL), Reverse Charge Sales List (RCSL)-Agents: Online Agent Authorisation, VAT for Agents -Alcohol and Tobacco Warehousing Declarations (ATWD) By submitting information to us directly by using special forms on our website your message is secure, but our email reply to you, which will be sent over the internet, is not.

Information sent by email over the internet is not secure and is at risk of being intercepted and read by people other than those it was intended for. If our response to you contains any personal or confidential information we will only reply to you by letter or telephone. If you have any doubt about the authenticity of an email you receive which claims to have come from HMRC please do not follow any links within the email, disclose any personal details or respond to it. Follow the link below to report HMRC related phishing emails.