Two Wheeler Insurance The NCB will be offered as per your eligibility on renewal. Three Year Policy: For a New vehicle, the NCB will normally begin at 0% and will remain so for the duration of the policy. If there is no accident during the currency of the policy, we will offer 35% NCB on renewal of the policy for the next slab of 3 years. You will be given a choice to opt for either a 2 year or 3 year policy at the time of renewal. If one claim is reported during any of the three years, the NCB on next renewal will drop by one slab to 25%. Two Year Policy: For a New vehicle, the NCB will begin at 0% and will remain so for the duration of the policy. Expiring Policy Tenure - 3 Years

Buy Backpacking Bag Online | Decathlon The most essential must-haves of a hiker is a backpack. The right hiking bag, with the right volume, can make your hiking easy and enjoyable. And, it’s wise to think and invest wisely in your hiking bag as it will go with you for a long duration and you don’t want to waste money again on a new backpack. This is why we, at decathlon, design hiking backpacks for hikers like you who are looking for a technical bag to not just store but organize all the accessories neatly. We have classified our backpacks from 10 litres to 40 litres depending on the duration and needs of the hiker. Quechua Hiking Backpack has been divided into 2 categories, Nature Hiking and Mountain Hiking. On the duration front, we have classified the backpacks into 4 capacities, half a day hike (10 Liter), full-day hike (20 Liter), more than a day hike (30 & 40 Liters). How to choose the right backpack: All our Backpacks have a warranty of 10 years. Some of the features that our hiking bags offer are:

Home Insurance Online Home Insurance offers protection to the house owner, in the event of physical destruction or damage caused to the home building by fire and allied perils like storm, tempest, flood and inundation. It also offers protection to the loss or damage caused to the household articles placed within the house. Key Features of the Home Building insurance Policy can be taken for a longer tenure of up to 20 years. Home Insurance offers protection to the house owner, in the event of physical destruction or damage caused to the home building by fire and allied perils like storm, tempest, flood and inundation. Policy can be taken for a longer tenure of up to 20 years.

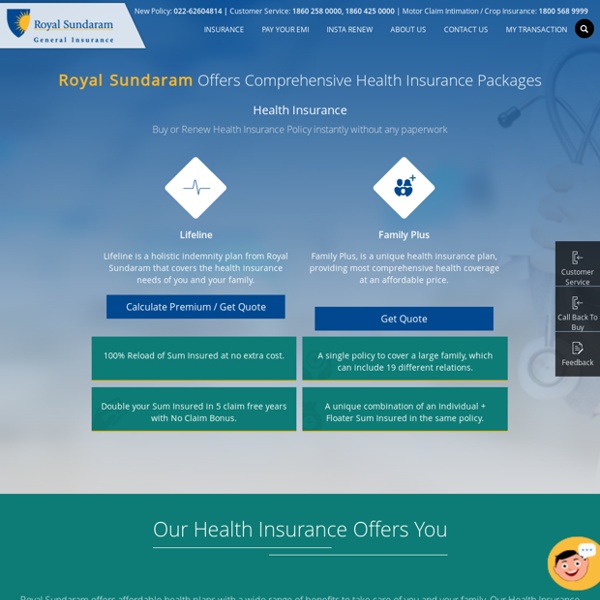

Individual Health Insurance If you are a globe trotter and looking for a Health Insurance Plan which provides best coverage in India as well as Abroad, then Lifeline Elite is the plan for you. Any individual above 18 years of age can purchase Lifeline. Lifeline is offered as an Individual plan and as a Family Floater plan for self, spouse and children. Cover Options: In an effort to give you the best of current day medical and healthcare facilities, Royal Sundaram has launched the Lifeline Elite Health Insurance Plan which offers comprehensive health cover with Sum Insured options of Rs.25 lacs, Rs.30 lacs, Rs.50 lacs, Rs.1 crore and Rs.1.5 crores. In addition to high Sum Insured options, Lifeline Elite comes with a wide range of medical benefits covering critical illnesses, international treatment, maternity expenses (covers up to 2 deliveries if both husband and wife are covered under the same family floater policy), severe medical conditions and accidents. Key Benefits: Cover Options: Key Benefits:

Bpharm course Post independence, pharmacy education in India has undergone tremendous changes to meet the requirements of industry and community at large. The Diploma on Pharmacy is able to meet the requirements of community and hospital stores only partly. The degree program (BPharm) is developed to address all other demands of the profession of pharmacy. However, BPharm education today is facing the challenge of meeting the changing needs the of industry. The four-year BPharm course offered by Manipal College of Pharmaceutical Sciences, Manipal Academy of Higher Education, is prepared considering the needs of the industry, which gives more impetus for skill development. Programme Educational Objectives (PEOs) Programme Outcomes (POs) Course Outcomes (COs) B. Hands-on trainingLaboratory teachingCase studiesGroup discussionConferences for UG students B. Click here to view the regulations for BPharm- Choice based credit system (CBCS) programme

Coronavirus Insurance Coronavirus is the newly diagnosed common human virus known to have originated from Wuhan, China. The virus is spreading fast across the nation and travelling to other countries, taking a toll on the lives of many people along the way. More than 4500 people have been diagnosed with symptoms, and hundreds of them have lost the battle fighting the disease. Here are some insights into Coronavirus: Symptoms, Causes and Treatment; We will be covering the following: * What is Coronavirus* Coronavirus Symptoms* Coronavirus Causes* Coronavirus Treatment* Other Diseases What is Coronavirus? Coronavirus is a family of viruses that originally affects animals, but due to increased exposure to animal meat, seafood, and dairy products, these viruses have made a transition to humans as well. Common cold, fever, and tiredness are the early symptoms in the infected person. SARS is known to have travelled from civet cats to humans, and MERS comes from Camels. Symptoms of Coronavirus Treatment of Coronavirus

Balenciaga: Shop Luxury Jackets, Jeans & Clothing | Le Mill The Balenciaga of today is mentioned in the same breath as game changing streetwear. It is known to create cutting edge fashion that everyone from Kendall Jenner to Cardi B have sported time and again. The brand has always tapped into the future of fashion, not just in design but with it’s ideologies too. It’s unmatched drive for innovation has created a space for Balenciaga clothing in the industry with a disruptive energy. Right from the beginning Balenciaga clothing was always revered as an avant garde couture house, rooted in it’s exquisite display of sculpted tailoring. Since it’s inception in 1937, Balenciaga clothing has crafted contemporized clothing in ground breaking feminine silhouettes in state-of-the-art shapes, thus, paving the path for modern design. After Cristóbal, many Creative Directors came and left, but the one that got Balenciaga it’s ‘It’ status back was Nicolas Ghesquiere. Currently, Balenciaga clothing is headed by street fashion savant Demna Gvasalia.

Pregnancy insurance cover Pregnancy brings a lot of emotions in a woman’s life: the wonder of creating a new life, the joy of a cute baby, the uncertainty of the future, and fear of increasing finances. With all the happiness that pregnancy and motherhood brings, there is always a shadow of medical bills lurking in the background. Pregnant women require constant care and medical attention – right from vitamins to monthly tests to delivery, hospital bills just keep piling up. If not for the hospitalization and delivery itself, it’s the post-delivery care that is also equally expensive. This can be a huge burden to bear for expecting parents. A viable solution to tackle this burden is to avail a maternity benefit. What is maternity health insurance coverage? A maternity insurance is a plan designed to cover for the maternity and health care cost to expecting mothers and their new-borns. What to look for in a pregnancy health insurance policy? What’s covered under a maternity health insurance plan? Buy it online –