https://www.royalsundaram.in/two-wheeler-insurance

Related: radhika01 • mayapostHealth Insurance Premium Calculator With the rising medical costs, the most effective way to secure your future as well as your family’s future is to buy a health insurance cover. Buying a health insurance is an imperative step that you can take so as to protect yours and your loved one’s health. It gives you coverage against heavy medical expenses that may arise due to any sickness or health injury. Individual Health Insurance If you are a globe trotter and looking for a Health Insurance Plan which provides best coverage in India as well as Abroad, then Lifeline Elite is the plan for you. Any individual above 18 years of age can purchase Lifeline. Lifeline is offered as an Individual plan and as a Family Floater plan for self, spouse and children.

travel insurance plans Single trip travel insurance is designed for and caters to people who look for complete coverage of their one-off abroad trip mostly for leisure purpose. It covers almost every unforeseen event that might occur during the specific insured trip. Be it loss of passport, delay or cancelling of the trip or even medical expenses on the trip, the traveller is covered in it. While you’re out into a new place, looking for some quality time, the single trip insurance makes sure you’re focused on just that and not worried about anything that might go wrong.

Home Insurance: Property Insurance for your home Home Insurance offers protection to the house owner, in the event of physical destruction or damage caused to the home building by fire and allied perils like storm, tempest, flood and inundation. It also offers protection to the loss or damage caused to the household articles placed within the house. Key Features of the Home Building insurance

Advantages of a Joint Family Posted by Royal Sundaram on 07 Feb 2018 You know the feeling of excitement when someone give you a delicious scoop of ice-cream. Living in a joint family is like receiving a triple scoop of your favourite ice-cream. The concept of living in a joint family dates way back. Imagine a haveli filled with kids running around, a twenty-person dining table where everyone ate together and lots of drama. Finding joint families are rare today. Home Insurance Plans Insurance is the subject matter of solicitation. Royal Sundaram General Insurance Co. Limited. All Rights Reserved.

Personal Accident Insurance Plan If you need to make a claim under Personal Accident Insurance, here's a step-by-step guide: 1. Request a Claim Form To request for a claim form, call us at 1860 425 0000. You can also send an email to customer.services@royalsundaram.in at the earliest, and not later than 30 days after the accident. Please quote the Policy Number for our reference. Medical Insurance Plan Key features of Family Plus are as mentioned below: Coverage for 19 different relations in the same policy. Legally married spouse as long as he or she continues to be married to You Son Daughter-in-law Daughter Father Mother Father-in-law as long as Your spouse continues to be married to You Mother-in-law as long as Your spouse continues to be married to You Grandfather Grandmother Grandson Granddaughter Son-in-law Brother Sister Sister-in-law Brother-in-law Nephew Niece 1.

travel insurance plans for leisure trips Free look provision is applicable only in respect of an annual multi trip policy and annual student policy. At the inception of the policy, provided the trip has not commenced, insured will be allowed a period of 15 days (30 days for Telesales, Online and Web aggregators) from the date of receipt of the policy to review the terms and conditions of the policy and to return the same if not acceptable. Insured will be entitled to the following, provided no claim has been reported, settled or lodged for the period the policy has been in force: A refund of the premium paid less stamp duty charges or; where the risk has already commenced and the option of return of the policy is exercised, a deduction towards the proportionate risk premium for period on cover or; Where only a part of the risk has commenced, such proportionate risk premium commensurate with the risk covered during such period. However, please note free look is not applicable in the case of renewals.

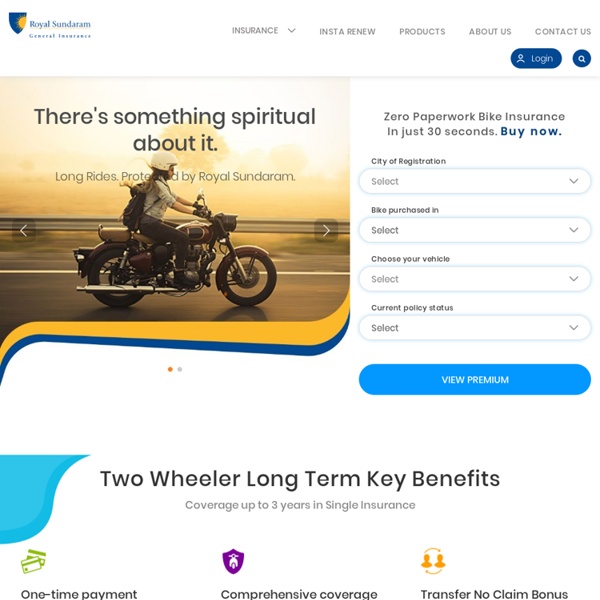

bike insurance status The Insurance and Regulatory Development Authority of India (IRDAI) regulates the two-wheeler bike insurance sector in India. Bike insurance insures your two-wheeler against damage, loss, theft, and covers the damages caused to a third party by the insured vehicle. It provides a “Personal Accident cover” to owner-driver, wherein if the vehicle meets with an accident, the owner-driver is covered against severe injury and even death. As per the new Supreme Court directive, insurance cover should be compulsorily purchased while buying the new two-wheeler and will be provided by the dealer himself (You have the option of suggesting the insurance company of your choice). For renewal of existing policies, just before the expiration of the policy term, you can renew the cover on the web portal of the insurer under the relevant section.

Maternity Insurance Pregnancy brings a lot of emotions in a woman’s life: the wonder of creating a new life, the joy of a cute baby, the uncertainty of the future, and fear of increasing finances. With all the happiness that pregnancy and motherhood brings, there is always a shadow of medical bills lurking in the background. Pregnant women require constant care and medical attention – right from vitamins to monthly tests to delivery, hospital bills just keep piling up. If not for the hospitalization and delivery itself, it’s the post-delivery care that is also equally expensive. This can be a huge burden to bear for expecting parents. travel insurance plans for students Free look provision is applicable only in respect of an annual multi trip policy and annual student policy. At the inception of the policy, provided the trip has not commenced, insured will be allowed a period of 15 days (30 days for Telesales, Online and Web aggregators) from the date of receipt of the policy to review the terms and conditions of the policy and to return the same if not acceptable. Insured will be entitled to the following, provided no claim has been reported, settled or lodged for the period the policy has been in force: A refund of the premium paid less stamp duty charges or; where the risk has already commenced and the option of return of the policy is exercised, a deduction towards the proportionate risk premium for period on cover or; Where only a part of the risk has commenced, such proportionate risk premium commensurate with the risk covered during such period. However, please note free look is not applicable in the case of renewals.

Asthma Insurance Asthma is a chronic inflammatory disease of the airways of the lungs in which the airways narrow, swell, and produce extra mucus. Asthma can make breathing difficult and trigger coughing, wheezing and shortness of breath. As many different factors come together to cause asthma, there are many different types of the disease, based on age and severity. For some people, asthma may be a minor nuisance. For others, it can be a severe problem that may interfere with daily activities and may lead to a life-threatening asthma attack.