Private Capital Markets - Data & Insights - VC Experts. Book 0 Introduction to Venture Capital and Private Equity Finance Book 1 Terms and Definitions: The Building Blocks of Private Equity and Venture Capital Book 2 Organizing the Entity: Choice of Entity and Structuring Private Equity.

Deal Terms: The Missing Piece of the Valuation Puzzle. The following is an excerpt from VC Experts Reference.

156 Startup Failure Post-Mortems. No survivorship bias here.

A compilation of startup failure post-mortems by founders and investors. On his many failed experiments, Thomas Edison once said, I have learned fifty thousand ways it cannot be done and therefore I am fifty thousand times nearer the final successful experiment. Elsewhere, we have dug into the data on startups that died (as well as those acquihired) and found they usually die 20 months after raising financing and after having raised about $1.3 million. So we thought it would be useful to see how startup founders and investors describe their failures. The Truth About Convertible Debt at Startups and The Hidden Terms You Didn't Understand. This article initially appeared on TechCrunch – with a minor update highlighted in red below.

Ah. We’re back to discussing convertible debt again. This time by the efforts of Adeo Ressi to introduce a new kind of structure called “convertible equity.” I applaud all efforts by people to take on this issue and especially be Adeo who – let’s be honest – was really the first champion of trying to make the VC world more transparent by launching TheFunded, which didn’t exactly endear him to VCs initially. The Truth About Convertible Debt at Startups and The Hidden Terms You Didn't Understand. About - European Crowdfunding Network. The European Crowdfunding Network AISBL (ECN) is the professional network promoting adequate transparency, (self) regulation and governance while offering a combined voice in policy discussion and public opinion building, incorporated as an international not-for-profit organisation in Brussels, Belgium.

We support our members in carrying initiatives aimed at innovating, representing, promoting and protecting the European crowdfunding industry. We aim to increase the understanding of the key roles that crowdfunding can play in supporting entrepreneurship of all types and its role in funding the creation and protection jobs, the enrichment of European society, culture and economy, and the protection of our environment. In that capacity we help developing professional standards, providing industry research, as well as, professional networking opportunities in order to facilitate interaction between our members and key industry participants. Bridging a Gap Using a Convertible Note. Most startups think of a convertible note as the most common fundraising vehicle used during the pre-seed and seed stages (see related article titled “Convertible Note Basics“).

What they might not know is that convertible notes are also used for what’s called a “bridge round”. It is just like it sounds, bridging the gap between today and some point in the future. This article describes the use of convertible notes for such a scenario and, more specifically, the differences and nuances versus using them for seed rounds. The Importance of Timing Bridge rounds are quite common and there’s a reason. The Amount raised yields both Time and Resources in which to accomplish various OutcomesOutcomes drive ValuationThe Amount raised compared to the Valuation determines dilution A bridge round is specifically pursued to buy more time and there are only two scenarios driving the situation: BeingMCuBE : Digital Strategy Consulting — Angel Investing at Today’s Market Rates is a... BeingMCuBE : Digital Strategy Consulting — Angel Investing at Today’s Market Rates is a...

Join beyond. Startup-Advice & Strategy. Red Rocket Ventures Blog (Startup Advisor & Growth Consulting) Having a great, defensible business idea in a scalable market is only half of the puzzle to attracting venture capital.

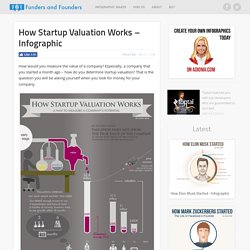

The other half is having a backable management team. Revenue Multiples And Growth. How Startup Valuation Works - Illustrated. How would you measure the value of a company?

Especially, a company that you started a month ago – how do you determine startup valuation? That is the question you will be asking yourself when you look for money for your company. Create an infographic timeline like this on Adioma Let’s lay down the basics. Assessing a Business Model Attractiveness. In our previous posts, we learnt how to visually represent the business models of different companies using the Business Model Canvas.

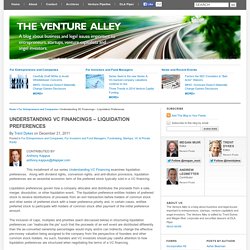

Our first post, Understanding Business Model Fundamentals, answered why we should study Business Models and how Business Model Canvas helps with the visual representation of a Business Model. How-to Content for Entrepreneurs... Understanding VC Financings - Liquidation Preferences. CONTRIBUTED BYAnthony Kappusanthony.kappus@dlapiper.com This installment of our series Understanding VC Financing examines liquidation preferences.

Along with dividend rights, conversion rights, and anti‑dilution provisions, liquidation preferences are an essential economic term of the preferred stock typically sold in a VC financing. Liquidation preference and deemed liquidation. The liquidation preference is a right which can be required by venture capital investors in recognition of the risk they bear on their capital contribution. While there are many variations, the liquidation preference typically provides that, in the event the company is liquidated or subject to a deemed liquidation (see below), the preferred shareholders will receive a certain amount of the proceeds before any other shareholders. This preference amount may be equal to the amount of the preferred shareholders’ investment, or a multiple of it.

The remaining proceeds are often then shared amongst the preferred and ordinary shareholders. Calculate Liquidation Preference of Preferred Stock in a Venture Capital Financing. What Drives SaaS Company Valuation? Growth! If you’ve ever wondered what drives the valuation of a SaaS vendor, then take a look at this chart that a banker showed me the other day. The answer, pretty clearly, is revenue growth. The correlation is stunning. Taking some points off the line: 10% growth gets you an on-premises-like valuation of 2x (forward) revenues20% growth gets you 3x30% growth gets you 4x50% growth gets you nearly 6x Basically (growth rate % / 10) + 1 = forward revenue multiple.

How Funding Rounds Differ: Seed, Series A, Series B, and C... Raising venture capital? Make sure your company is ready before you pitch! By Peter Adams The main reason companies that have been screened and approved to pitch to angel groups do not raise capital quickly is not that the company isn’t any good – it is more often because the company has not achieved sufficient readiness in the eyes of the investors. These companies may go back to work for a year or more to refine their plan and gain traction before pitching again. Startup companies should be moving fast, but they have to have the basics down before most angel groups or VCs are willing to invest.

Some of the key points of readiness are as follows: 1) People: The team is considered the most important factor to most investors. 2) Plan: Startups need a strategic plan that charts their strategy for growth, market penetration, team development and more. How much equity should I give away to co-founders/early employees?- The Nordic Nine. 2014 SaaS Survey (Part 1) - A Survey of key metrics in over 300 SaaS companies.

For the third year in a row, we worked together with Pacific Crest Securities, an investment banking firm with a specific focus on SaaS, to survey 306 SaaS companies. Angel Capital Association. Www.angelcapitalassociation.org/data/Documents/Resources/AngelCapitalEducation/ACEF_-_Valuing_Pre-revenue_Companies.pdf. Valuation of Pre-revenue Companies: The Venture Capital Method. William H. (Bill) Payne, Senior Program Consultant, Kauffman Foundation. Boosting Valuation Before You Have Revenue Traction. Once you have a product in the market with an increasing number of paying customers, your valuation will increasingly be driven based on financial metrics.

Don’t get me wrong, establishing a financial valuation for an early stage company is part art and part science. So it is true that meaningful strategic partnerships, a robust product roadmap, and other non-financial items can help drive valuation. Wp-content/uploads/2011/01/Scorecard-Valuation-Methodology-Jan111.pdf.