Empire - Fuelling geopolitics: The oil saga.

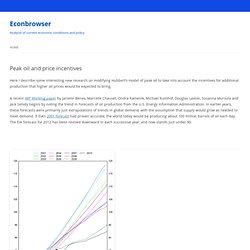

Multinational Oil Companies. How to follow the politics of oil? Peak oil and price incentives. Here I describe some interesting new research on modifying Hubbert’s model of peak oil to take into account the incentives for additional production that higher oil prices would be expected to bring.

A recent IMF Working paper by Jaromir Benes, Marcelle Chauvet, Ondra Kamenik, Michael Kumhof, Douglas Laxton, Susanna Mursula and Jack Selody begins by noting the trend in forecasts of oil production from the U.S. Energy Information Administration. In earlier years, these forecasts were primarily just extrapolations of trends in global demand, with the assumption that supply would grow as needed to meet demand. If EIA’s 2001 forecast had proven accurate, the world today would be producing about 100 million barrels of oil each day. The EIA forecast for 2012 has been revised downward in each successive year, and now stands just under 90. Debating the 'Rentier state' What Next for the Oil and Gas Industry? Download Executive Summary The oil and gas industry is under pressures that will transform it.

The effect of other industries on oil demand, the increasing opportunities for non-conventional oil and gas that offset perceptions of limits to conventional resources, and the shift of growth to Asia will all compel the industry to look for growth in value rather than volume, to distinguish between the expanding markets of developing countries and the declining markets of the private sector in developed countries, and to target technologies to a diversity of resource opportunities outside the state sector and to specialized partnerships within it.

How the industry changes is important for those who invest in it, depend on its products or try to avoid the environmental and social effects of using them, or who look for tax revenues from its activities. This report focuses on several critical challenges facing the industry: Figures Below are several figures from the report. Ottoman History Podcast: Oil, Grand Strategy and the Ottoman Empire with Anand Toprani. 9.

Oil in Ottoman Iraq. Oil and imperialism have played a major role in shaping the modern Middle East. Anand Toprani sits down to discuss the origins of the Turkish Petroleum Company and international speculation on Iraq's oil reserves, beginning with the Ottomans at the and leading up to the invasion of Iraq in 2003. Anand Toprani is a PhD candidate studying oil and grand strategy in the history of the twentieth century at Georgetown UniversityChris Gratien is a PhD student studying the history of the modern Middle East at Georgetown University (see academia.edu)Emrah Safa Gurkan is a PhD candidate studying the history of the early modern Mediterranean at Georgetown University (see academia.edu) Select bibliography Earle, Edward Mead, “The Turkish Petroleum Company – A Study in Oleaginous Diplomacy,” Political Science Quarterly 39: 2 (June 1924), 265-277.

Mission accomplished for Big Oil? In 2011, after nearly nine years of war and occupation, US troops finally left Iraq.

In their place, Big Oil is now present in force and the country’s oil output, crippled for decades, is growing again. Iraq recently reclaimed the number two position in the Organisation of the Petroleum Exporting Countries (OPEC), overtaking oil-sanctioned Iran. Now, there's talk of a new world petroleum glut. So is this finally mission accomplished? Well, not exactly. Here, as a start, is a little scorecard of what’s gone on in Iraq since Big Oil arrived two and a half years ago: corruption’s skyrocketed; two Western oil companies are being investigated for either giving or receiving bribes; the Iraqi government is paying oil companies a per-barrel fee according to wildly unrealistic production targets they've set, whether or not they deliver that number of barrels; contractors are heavily over-charging for drilling wells, which the companies don’t mind since the Iraqi government picks up the tab.

The political economy of oil - reading...

Imagine an Open Oil industry… Understanding oil markets... What the IMF should say and think about the global oil industry. This is the first in a two part series on how the International Monetary Fund should interact with the global oil industry.

Berlin, Germany - The US and Israel are threatening to bomb Iran, and, even without and before that, petrol prices are nudging back towards the historic highs of 2008. Brent already stands at $125 per barrel, and we know from the last commodity boom that it can't go much higher before a lot of poor people get hurt - because we now understand the linkage between high fuel prices and high food prices that afflicted hundreds of millions of people around the world in the middle of the last decade. In such times, even if you follow the cut and thrust of energy politics, you might think news of a public consultation this month by the International Monetary Fund (IMF) on how they should advise governments around the world to tax oil and natural resource economies is a little marginal. It might have a certain novelty value. What’s fueling the food crisis?

Why is food so expensive right now?

Ask 10 experts and you might get 10 different answers. Bad weather, export restrictions, hoarding and speculation are all popular explanations for the continuing rise in the cost of basic food staples. But it is hard to argue that the price of fuel, in particular oil, is not playing a significant role.