Colonized by Corporations - Chris Hedges' Columns. Colonized by Corporations Posted on May 14, 2012 By Chris Hedges In Robert E.

Gamer’s book “The Developing Nations” is a chapter called “Why Men Do Not Revolt.” The Crisis of Global Capitalism: ten years on - 2009. Ralph Miliband Series on The Future of Global Capitalism Date: Wednesday 21 October 2009 Time: 6.30-8pm Venue: Old Theatre, Old Building Speaker: Professor John Gray Chair: Martin Jacques The financial upheavals of the past two years have occurred against the background of a decade of crisis in global capitalism.

Global capitalism and 21st century fascism. Story highlights The crisis of global capitalism is unprecedented, given its magnitude, its global reach, the extent of ecological degradation and social deterioration, and the scale of the means of violence.

We truly face a crisis of humanity. Is Modern Capitalism Sustainable? - Kenneth Rogoff. Exit from comment view mode.

Click to hide this space CAMBRIDGE – I am often asked if the recent global financial crisis marks the beginning of the end of modern capitalism. It is a curious question, because it seems to presume that there is a viable replacement waiting in the wings. The truth of the matter is that, for now at least, the only serious alternatives to today’s dominant Anglo-American paradigm are other forms of capitalism. Continental European capitalism, which combines generous health and social benefits with reasonable working hours, long vacation periods, early retirement, and relatively equal income distributions, would seem to have everything to recommend it – except sustainability.

Indeed, it is far from clear how far China’s political, economic, and financial structures will continue to transform themselves, and whether China will eventually morph into capitalism’s new exemplar. The Ideological Crisis of Western Capitalism - Joseph E. Stiglitz. Exit from comment view mode.

Click to hide this space. The Shift from Manufacturing to Service Economy. Wall Street’s Euthanasia of Industry. Michael interviewed on Guns N Butter with Bonnie FaulknerListen here “When I was in Norway one of the Norwegian politicians sat next to me at a dinner and said, “You know, there’s one good thing that President Obama has done that we never anticipated in Europe.

He’s shown the Europeans that we can never depend upon America again. There’s no president, no matter how good he sounds, no matter what he promises, we’re never again going to believe the patter talk of an American President. Mr. Obama has cured us. Topics: The jobless recovery; the debt ceiling and default charade; China; Greece: banks, not countries, receive the bailouts; financial warfare; IMF and EU; European Central Bank; US credit default swaps; US agricultural exports create food dependency; currency devaluation devalues the price of labor; class war of banks against the rest of society. I’m Bonnie Faulkner. That’s why the stock market is down 160 points today. Somebody has to lose when loans go bad. Rep. Ms. Mr. Mr. The Great Decoupling of Corporate Profits from Jobs) Second-quarter earnings reports are coming in, and they’re making Wall Street smile.

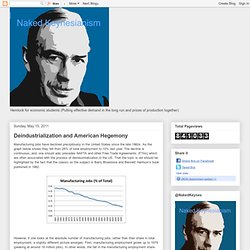

Corporate profits are up. And big American companies are sitting on a gigantic pile of money. The 500 largest non-financial firms held almost a trillion dollars in the second quarter, and that money pile is growing larger this quarter. Deindustrialization and American Hegemony. Manufacturing jobs have declined precipitously in the United States since the late 1960s.

As the graph below shows they fell from 28% of total employment to 10% last year. The decline is continuous, and, one should add, precedes NAFTA and other Free Trade Agreements, (FTAs) which are often associated with the process of deindustrialization in the US. That the topic is old should be highlighted by the fact that the classic on the subject is Barry Bluestone and Bennett Harrison’s book published in 1982. However, if one looks at the absolute number of manufacturing jobs, rather than their share in total employment, a slightly different picture emerges.

First, manufacturing employment grows up to 1979 (peaking at around 19 million jobs). However, after 2001 (the year China entered into the World Trade Organization, WTO) manufacturing jobs collapse, with only 11.5 million jobs in 2010. Michael Hudson: Banks Weren’t Meant to Be Like This. By Michael Hudson, a research professor of Economics at University of Missouri, Kansas City and a research associate at the Levy Economics Institute of Bard College A shorter version of this article in German will run in the Frankfurter Algemeine Zeitung on January 28. 2012 The inherently symbiotic relationship between banks and governments recently has been reversed.

In medieval times, wealthy bankers lent to kings and princes as their major customers. But now it is the banks that are needy, relying on governments for funding – capped by the post-2008 bailouts to save them from going bankrupt from their bad private-sector loans and gambles. Yet the banks now browbeat governments – not by having ready cash but by threatening to go bust and drag the economy down with them if they are not given control of public tax policy, spending and planning.