Mason Hawkins and Staley Cates on Today’s Opportunities for Value Investors. Mason Hawkins and Staley Cates on Today's Opportunities for Value Investors By Robert HuebscherMarch 15, 2011 O.

Mason Hawkins and G. Staley Cates are two of the most respected value investors. Based in Memphis, TN, their firm, Southeastern Asset Management, is a $35-billion, independently owned, registered investment advisory firm. Value Investing: Tools and Techniques for Intelligent Investment. James Montier Suggested Reading List. Tim du Toit is the editor and founder of Eurosharelab.

He has more than 20 year of institutional and personal investing experience in emerging and developed markets. Tim is based in Hamburg, Germany. GMO - LLC - Asset Allocation. A Decade of Delusions: From Speculative Contagion to the Great Recession. Martin Capital Management. Frank K.

Martin, CFA - Founder and Owner Frank Martin has more than 40 years of investment industry experience. In 1987, he founded McDonald Capital Management, Inc. The firm was reorganized as a partnership in 1991 and renamed Martin Capital Management with headquarters in Elkhart, Indiana. The Alchemy of Finance. Active Value Investing: Making Money in Range-Bound Markets. Recommended Book List 2010. Updated for 2010 and in time for the holidays, here is the latest installment of my recommended books.

I originally wrote this list in 2008 and again last year. I intend to keep adding to and revising it every year. It contains seven sections: Selling, Think Like an Investor, Behavioral Investing, Economics, Stock Market History, Risk and Books for the Soul. I hope you enjoy it. In these crazy times, all one could ask for is sanity.

Here is my advice: read. Selling I’ll start with Its When You Sell That Counts, by Donald Cassidy, which aims to help readers recalibrate their decisions about when to sell stocks. In secular bull markets, on average, sell decisions are not as rewarding as hold decisions, as market valuations are expanding and even the second-rate dogs of the equity markets start looking like pedigreed cocker spaniels. William J. Ruane - The Making of a Superinvestor. William J.

Ruane (1925-2005), founder and former Chairman of Ruane, Cunniff & Co. Inc., was an average student at school and had a hard time with engineering courses. More Than You Know. Interview with Michael Mauboussin, author of More Than You Know. In More Than You Know, Mauboussin shares his secret to becoming an insightful investor and provides invaluable tools to better understand the concepts of choice and risk.

Question: More Than You Know comes at the world of investing from a very different perspective than the average book. Can these nonconventional ideas really help an investor succeed? Michael Mauboussin: This book celebrates the notion that a multidisciplinary approach is best for solving complex problems, including those in investing. Too much of our learning narrows perspective. We can gain great insight by learning the important ideas from various disciplines and appropriately applying them to investing. Michael Mauboussin. A Random Walk Down Wall Street: The Time-Tested Strategy for Successful Investing.

Book Description Publication Date: 13 Feb 2004 Using the dot-com crash as an object lesson in how not to manage your portfolio, this is an informative guide to navigating the turbulence of the market and managing investments with confidence.

With its life-cycle guide to investing, this book matches the needs of investors at any age bracket. The author shows how to analyse the potential returns, not only for stocks and bonds but also for the full range of investment opportunities, from money market accounts and real estate investments trusts to insurance, home ownership and tangible assets like gold and collectibles. Frequently Bought Together Customers Who Bought This Item Also Bought Product Description Review. Seth Klarman's Recommended Reading List. In the past, we've detailed various investment book recommendations from some truly notable investors.

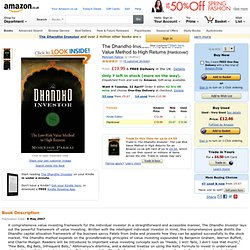

Margin of Safety: Risk-Averse Value Investing Strategies for the Thoughtful Investor (9780887305108): Seth A. Klarman. Market Wizards: Interviews with Top Traders. Contrarian Investment Strategies - David Dreman. Dreman. The Intelligent Investor. Common Stocks and Uncommon Profits. The Aggressive Conservative Investor. The Dhandho Investor: The Low Risk Value Method to High Returns. 2007 Wiley, 196 pages (of which 183 pages form the main body of the book) On the back of the Dhandho Investor is some blurb by Whitney Tilson saying that he read the book from start to finish in one sitting.

How We Know What isn't So: Fallibility of Human Reason in Everyday Life. The Most Important Thing. Howard Marks April, 2011 Cloth, 200 pages, ISBN: 978-0-231-15368-3 $29.95 / £19.95 "Everyone knows about the anticipation leading up to Warren Buffett’s annual shareholder letters.

But for a certain Wall Street set, there are equally high expectations for the writings of Howard Marks. " — Peter Lattman, Wall Street Journal "Regular recipients of Howard Marks's investment memos eagerly await their arrival for the essential truths and unique insights they contain. Now the wisdom and experience of this great investor are available to all. "When I see memos from Howard Marks in my mail, they're the first thing I open and read.

"Few books on investing match the high standards set by Howard Marks in The Most Important Thing. "The Most Important Thing is destined to become an investment classic-it should easily earn its place on every thinking investor's bookshelf. Behavioral Finance Recommended Reading From Hedge Fund Blue Ridge Capital.

This is the fourth and final installment of hedge fund Blue Ridge Capital's recommended reading list. Previously, we've revealed Blue Ridge's recommended Analytical Reading List, their Historical/Biographical List, and their Economics List. This week, we'll turn to their recommended Behavioral Finance reads. Long-time blog readers will know that we track Blue Ridge because they are the pure definition of a 'Tiger Cub'.