Paul Craig Roberts: The Fiscal Cliff Is A Diversion: The Derivatives Tsunami and the Dollar Bubble. The Fiscal Cliff Is A Diversion: The Derivatives Tsunami and the Dollar Bubble By Paul Craig Roberts December 18, 2012 "Information Clearing House" - The “fiscal cliff” is another hoax designed to shift the attention of policymakers, the media, and the attentive public, if any, from huge problems to small ones.

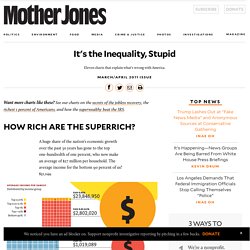

The fiscal cliff is automatic spending cuts and tax increases in order to reduce the deficit by an insignificant amount over ten years if Congress takes no action itself to cut spending and to raise taxes. It's the Inequality, Stupid. Want more charts like these?

See our charts on the secrets of the jobless recovery, the richest 1 percent of Americans, and how the superwealthy beat the IRS. How Rich Are the Superrich?

Libéralisme, TINA etc.. The American Dream By The Provocateur Network. Crise-2010-La_suite. Raging Bulls: How Wall Street Got Addicted to Light-Speed Trading. Photo: Tim Flach/Getty Wall Street used to bet on companies that build things.

Latest Market Glitch Shows 'Trading Out of Control' - US Business News. Cashin: Humans Prevented Another 'Flash Crash' In this excerpt from "Closing Bell," Art Cashin of UBS talks with Bob Pisani, Bill Griffeth, and Maria Bartiromo, about today's apparent technological problem that disrupted the trading of almost 150 stocks this morning. He notes there were trading errors even before computers took over the process.

Traders, though, have grown weary of the problems and say the high-speed environment has changed the market in a bad way. "When markets would have a big move, when things were really crazy, I would go out into the street and talk to people and they knew. Now, you get these big moves and people just don't care anymore," Silverman says. Why Investors Willingly Pay Speed Traders Extra Billions. When high-frequency traders defend themselves against criticism that they’re screwing up the stock market by distorting prices or making it more volatile, their argument usually goes like this: Yes, but we’ve lowered the costs of trading.

Which is true, in a way. The bid-ask spread for many stocks—the difference between what it costs to buy or sell a share—is often just a penny, much narrower than it used to be. As speed traders have proliferated over the last few years, they’ve made the U.S. stock market considerably more liquid, meaning there’s almost always someone willing to take the other side of your trade. The problem is that when slower, long-term investors try to buy or sell shares, they often find themselves at the back of the line. They are leapfrogged by thousands of lightning-quick traders who make their living jumping in and out of shares of “ultra liquid” stocks such as Bank of America (BAC). COMMENT FURENT AUTORISES LES PARIS SUR LES FLUCTUATIONS DE PRIX (V) CE QU’IL CONVIENT DE FAIRE MAINTENANT. J’ai attendu de disposer d’un texte complet sur l’exception de jeu avant de vous le proposer en cinq livraisons.

Comment la Chine rachète la Grèce. Deux petits drapeaux grec et chinois trônent sur le bureau de Constantine Yannidis, à Athènes.

Le jour est important : le président de la Chambre de commerce sino-hellénique reçoit la visite d? Une dizaine d? Entrepreneurs venus de la province chinoise de Jiang-Su. Ces dernières années, les Chinois montrent un intérêt croissant pour la Grèce, et les délégations investissent le bureau de M.

Crapules & Banquiers. Liborgate. PME a la rue. #Bankster reloaded : jusqu’à quand? “La chute du couperet est amortie par deux puissants ressorts à boudin caoutchoutés placés en dessous” . Ne me demandez pas ce que ça veut dire, mais faites le vous même. Empire US en vrac. Bernie Sanders Says It Is Time To Break Up The Big Banks As They. Big Banks Move to Mask Risk Levels. Le paradoxe de la part salariale. Il faut avoir la bonne mine de Jean Peyrelevade pour soutenir face caméra sourire aux lèvres que la part salariale n’a pas varié « depuis cinquante ans » [1].

Il est vrai que Jean Peyrelevade est le seul à dire aussi ouvertement que la part des salaires dans la valeur ajoutée est bien trop élevée et qu’il s’agirait qu’elle rende au plus vite 3 ou 4 points au profit [2]. Admettons qu’il y a là un certain courage dans la joyeuse provocation, à moins qu’il ne s’agisse plus classiquement d’une combinaison de persévérance dans l’erreur caparaçonnée et de certitude de soi. Il est aussi le seul à ne pas avoir vu que, de 1970 à aujourd’hui, la part salariale a connu un formidable coup d’accordéon, avec une croissance très forte de 1970 jusqu’au point haut de 1982, suivie d’une décrue encore plus forte dont l’essentiel est acquis dès la fin des années 80. C’est à ce moment qu’il faudrait commencer à parler chiffres. Aussitôt deux questions. Brève histoire du pendule. "Showdown In Chicago": Protesters Crash Bankers Convention, (VID. Alex Parker attended the event on behalf of the Huffington Post and collected this video.

Parker took shots various shots of the protesters in Chicago today and spoke to George Goehl, director of National People's Action. Bruno Waterfield in Brussels. It is not surprising that European Union finance ministers looked ashen faced in Brussels on Tuesday.

The EU faces vast costs and spiralling government debt The breakfast meeting discussed how EU governments should deal with, in other words pay for, the "toxic" banking assets that triggered the economic crisis. As discussed here on Monday, the European Commission warned that government attempts to buy up or underwrite "impaired" assets could plunge the EU into a deeper crisis, one that threatens the Union. Everyone is terrified that a second bank bailout will push up government borrowing at a time when bond markets have growing doubts over the ability of countries such as Spain, Greece, Portugal, Ireland, Italy and Britain, to pay it back.

Après Dubaï, attention à la Grèce - Géopolitique. Moody's 'axe blow' to rating on Spanish debts. Surveys: IT job satisfaction plummets to all-time low. News January 6, 2010 04:42 PM ET Computerworld - The recession and its accompanying reorganizations, layoffs and corporate turns to outsourcing have been corrosive to IT employee job satisfaction.

And that job dissatisfaction is increasing concerns among many employment experts that key employees may leave current jobs as soon as they get what they perceive is a better offer. A mid-2009 job satisfaction survey by the Corporate Executive Board, a Washington-based advisory firm that counts many Fortune 500 firms among its clients, found that the number of dissatisfied workers continues to increase. 20,3 milliards de dollars de bonus pour Wall Street en 2009 - BA. Tax heaven create poverty - Intox2007.info. Janet Tavakoli: "Goldman Sachs: Spinning Gold"

The Beginning Of The End For Ernst & Young? Auditor Back In Spot. With the spate of corruption news out of Wall Street and seismic updates out of Iceland dominating headlines in the past month, everybody forgot about the culprit in the Lehman Repo 105 fraud. Well, almost everybody - the Lehman unsecured creditor committee, or basically the post reorganized equity estate, has decided to seek a probe of Ernst & Young to see "if the estate may have causes of action against the auditor arising out of Lehman's use of a the controversial accounting technique, Repo 105" reports Reuters.

In court papers filed on Monday, a group of unsecured creditors asked the bankruptcy court to order that Ernst & Young produce certain documents and its employees and partners submit to an oral examination. "It is unlikely that Ernst & Young will voluntarily provide this information to the committee," the unsecured creditors said.When contacted, Ernst & Young declined to comment on the filing. The specific nature of the UCC's request as disclosed in the filing: Failed Bond Auction In... CHINA? - The Market Ticker.

Consumer Credit: OUCH! - The Market Ticker. Citigroup’s Chuck Prince confirms that risky behavior drives out. Network. Encore ce bon vieux Greenspan ! - Jean-Pierre CHEVALLIER, busine. A World Without Banks. Submitted by Chindit13.