Le hedge fund Verrazzano Capital ouvre ses portes à Paris. Guillaume Rambourg, l'ancien gérant star du hedge fund britannique Gartmore, va mettre sur les rails, début mars, deux fonds long/short actions: Verrazzano European Opportunities et Verrazzano European Focus.

Ils seront domiciliés en Irlande. «Le premier, à faible volatilité, sera investi sur 40 à 80 positions avec un stop loss de 10% et une exposition réduite au marché. Le second, plus agressif, avec un beta potentiellement plus élevé, aura un portefeuille plus concentré autour de 20 à 30 noms. Le levier maximum autorisé sera de 250%», indique-t-il à L'Agefi.La liquidité sera mensuelle avec un préavis de 30 jours. Un « hedge fund » a gagné 500 millions de dollars sur la Grèce. Gestion alternative. Un article de Wikipédia, l'encyclopédie libre.

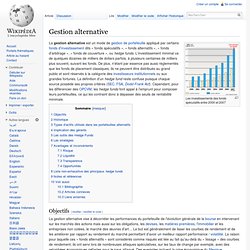

Les investissements des fonds spéculatifs entre 2000 et 2007 La gestion alternative est un mode de gestion de portefeuille appliqué par certains fonds d'investissement dits « fonds spéculatifs », « fonds alternatifs », « fonds d'arbitrage », « fonds de couverture », ou hedge funds. L'investissement minimal va de quelques dizaines de milliers de dollars parfois, à plusieurs centaines de milliers plus souvent, suivant les fonds.

De plus, n'étant par essence pas aussi réglementés que les fonds de placement classiques, ils ne peuvent être distribués au grand public et sont réservés à la catégorie des investisseurs institutionnels ou aux grandes fortunes. Corporate raid. In business, a corporate raid refers to buying a large stake in a corporation and then using shareholder voting rights to require the company to undertake novel measures designed to increase the share value, generally in opposition to the desires and practices of the corporation's current management. The measures might include replacing top executives, downsizing operations, or liquidating the company. Corporate raids were particularly common in the 1970s and 1980s in the United States. By the end of the 1980s, management of many large publicly traded corporations had adopted legal countermeasures designed to thwart potential hostile takeovers and corporate raids, including poison pills, golden parachutes, and increases in debt levels on the company's balance sheet.

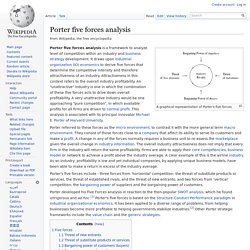

In later years, corporate raiders have since turned to being "activist shareholders", purchasing equity stakes in a corporation to influence its board of directors to put public pressure on its management. History[edit] T. 7 Hedge Fund Manager Startup Tips. Liste des hedge funds à Paris (France) Porter five forces analysis. A graphical representation of Porter's five forces Porter's five forces include - three forces from 'horizontal' competition: the threat of substitute products or services, the threat of established rivals, and the threat of new entrants; and two forces from 'vertical' competition: the bargaining power of suppliers and the bargaining power of customers.

Porter developed his Five Forces analysis in reaction to the then-popular SWOT analysis, which he found unrigorous and ad hoc.[1] Porter's five forces is based on the Structure-Conduct-Performance paradigm in industrial organizational economics. It has been applied to a diverse range of problems, from helping businesses become more profitable to helping governments stabilize industries.[2] Other Porter strategic frameworks include the value chain and the generic strategies. Five forces[edit] Threat of new entrants[edit] Profitable markets that yield high returns will attract new firms.

Threat of substitute products or services[edit] Qunb - Find and Visualize numerical data. Web Bot. Web Bot is an Internet Bot computer program whose developers claim is able to predict future events by tracking keywords entered on the internet.

It was developed in 1997, originally to predict stock market trends.[1] The creator of the Web Bot Project, Clif High, along with his associate George Ure, keep the technology and algorithms largely secret and sell the predictions via the website. Methodology[edit] Internet bots monitor news articles, blogs, forums, and other forms of Internet chatter. Words in the lexicon are assigned numeric values for emotional quantifiers such as duration, impact, immediacy, intensity, and others. The lexicon is dynamic, and changes according to shifts in emotional tension, and how humans communicate those changes using the Internet. Predictions[edit] Claimed hits[edit] Misses[edit] A massive earthquake in Vancouver, Canada and the Pacific Northwest was predicted to occur on 12 December 2008.[7]The US dollar completely collapses, or Israel bombs Iran in 2011.