Www.irs.gov/pub/irs-pdf/p557.pdf. Www.irs.gov/pub/irs-pdf/p1828.pdf. Www.irs.gov/pub/irs-pdf/k1024.pdf. Apply for an Employer Identification Number (EIN) Online. Español Hours of operation: Monday through Friday 7:00 a.m. to 10:00 p.m.

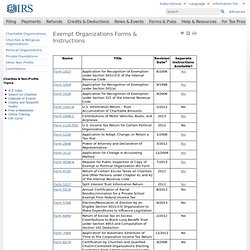

Eastern Time Important. Application for Recognition of Exemption. Www.irs.gov/pub/irs-pdf/f1023.pdf. Www.sos.wa.gov/_assets/charities/QuickGuideHandbookFeb2011.pdf. Charities & Trusts. Exempt Organizations Forms and Instructions. 1This column indicates the revision date of forms currently being accepted by the Exempt Organizations Determinations office.

Outdated forms will be returned without any action by the Service on the request. 2Because Form 8871 must be filed electronically, a paper version of Form 8871 may not be filed and is not available for download. The freely available Adobe Acrobat Reader software is required to view, print, and search the items listed above. Form 990 Resources and Tools for Exempt Organizations.