Simples Economics of Crowsfunding, 2013. Crowdfunding is Impacting the Global Economy - Crowdfund Insider. Innovation means creating something that makes a process or product more efficient.

The result can be a price reduction passed on to consumers in the short run, or an increase in the speed at which a business operates. Ultimately, innovation serves as the backbone to overall economic and societal growth and can elevate standards of living. Today, equity crowdfunding is a one of these innovations. A global problem identified and uncontested by a majority of economists is the gap between rich and poor both nationally, and even more starkly, globally. Unfortunately, the expansion of technology may actually magnify this gap. In the United States, the middle class is not achieving quality income growth. In an interview with John Gosier, an investor, data-scientist, and serial tech entrepreneur, from Wired.com, the future of equity crowdfunding and its potential global impact is discussed in bold relief.

Mr. Mr. The Subtle Risks in Equity Crowdfunding the Industry Is Ignoring. Crowdfunding, the practice of funding a cause or project by raising small amounts of money from a large number of people, is a concept popularised by rewards and donations based crowdfunding platforms, the likes of Kickstarter, Indigogo and Kiva.

On such platforms individuals can pre-purchase products they can’t find anywhere else in the market (e.g. virtual reality headsets) or donate money directly to charitable causes they believe in (e.g. disaster relief efforts). Crowdfunding platforms have made it easy to build high impact and accessible funding pages, and by combining these with social media tools they have provided individuals and organisations the channels to reach vast national and international audiences. Innovation in economic development: new incentives for the 21st century - The Next Silicon Valley. As is widely accepted nowadays, economic development doesn’t involve initiatives implemented in isolation – it’s all about developing the entire ecosystem of incentives, infrastructure, entrepreneurship and talent.

A recent paper issued by Economic Development Research Partners (EDRP), the ‘think tank component of the International Economic Development Council (IEDC), explores how developers need to innovate to grow community wealth by creating an encouraging environment for private business development. Part of this is to explore innovative incentives designed for 21st century economic development, in terms of understanding of how to use incentives efficiently, responsibly, and cost-effectively. Definition of incentiveAn incentive is a reward intended to induce, incite, or spur action. Economic developers aim to improve the economic and social well-being of their communities by increasing private sector investment and employment. For more information visit the IEDC web site. Technavio - Discover Market Opportunities. Outlook of the global crowdfunding market Technavio’s market research analyst predicts the global crowdfunding market to grow at an impressive CAGR of nearly 27% by 2020.

The widespread availability of new crowdfunding platforms that were made available for a wide array of end-user segments is a key factor that promotes growth in this market. Due to the advent of new models, investors can choose how they want to be associated with a venture. This will encourage investors toward crowdfunding, which is becoming a primary source of revenue for many entrepreneurs.

Crowdfunding is the new seed funding for innovation. Crowdfunding is not necessarily new (remember the story behind the Statue of Liberty), but what it is doing in the modern age is funding an unprecedented global wave of innovation.

Two reports just out highlight the growth of various methods of crowdfunding, including rewards based and equity based. Seed funding has always proved difficult for both equity and, increasingly as we’ve moved to a knowledge economy, debt, leaving a gap at the start of the entrepreneurial funding ladder. The crowdfunding market is addressed with a number of business models, including: Peer-to-peer (P2P) lendingReward-basedEquity investmentDonationHybrid-basedRoyalty-based. Wb crowdfundingreport v12. Current State of Crowdfunding in Europe « CrowdfundingHub. Journals.uchicago. Culture CrowdMAPPING THE BENEFITS OF CROWDFUNDING FOR THE CULTURAL AND CREATIVE SECTORS. Two years after our initial research the market for crowdfunding in the cultural and creative industries has expanded exponentially across Europe and the rest of the world.

In the UK we know that most of the largest cultural organisations have either developed a crowdfunding campaign (but not executed it) or have actually done it with varying degrees of success. Culturecrowd worked with Shakespeare’s Globe Theatre in the final stages of their first campaign to fund a tour of Hamlet to all 201 territories of the world, and have some meaningful lessons to report. In Europe there has been a multiplication of sites offering unique specialized services, such as crowdfunding for archaeological digs (Digventures) sourcing not just funding for digs, but also people services; or Spacehive which “crowdfunds civic projects” (such as community cultural centres).

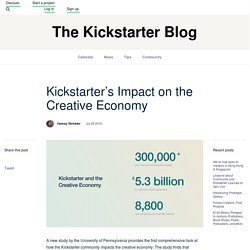

There has also been some consolidation amongst the biggest players. Article, 2014. Crowdfundin in the wake of global financial crisis. Crowdfunding: creative Trends, 2015. A Manifesto for the Creative Economy April13. Equity Crowdfunding for the Arts June 2013. Kickstarter’s Impact on the Creative Economy. A new study by the University of Pennsylvania provides the first comprehensive look at how the Kickstarter community impacts the creative economy.

The study finds that Kickstarter projects have: Employed 283,000 part-time collaborators in bringing creative projects to life. Created 8,800 new companies and nonprofits, and 29,600 full-time jobs. Generated more than $5.3 billion in direct economic impact for those creators and their communities. Here are the key findings from the research. A long-running challenge in the world of creative projects is the ability for collaborators to be paid for their contributions. While many Kickstarter projects are one-offs (films, books, albums, etc.), others are becoming ongoing, sustainable ventures that create new jobs.

An estimated 8,800 new companies and nonprofits have gotten their start through Kickstarter. WEF The future of financial services.