Trader @benoistrousseau andlil. Shock Doctrines. Reaction against Occupy. The Definitive Collection of Thomas Friedman Takedowns. I’m Thomas Friedman and I think…hard.

As my colleague and current couchmate Trevor Timm pointed out, it is ironic that today of all days I have chosen to compile the definitive collection of hilarious Thomas Friedman takedowns. Why today, you ask? Because today Thomas Friedman actually made sense. Mull that one over for a moment. It’s okay, take your time. As anyone who has seen me speak publicly knows, I delight in nothing more than a good jab at ol’ Friedman. As I’m sure more fantastic gems will eventually come our way, I will later issue a boxed set, then perhaps a B-side.

FRESH! Belen Fernandez takes on the redundancy of Friedman. Now with MORE FRIEDMAN! NEW! NEW! Ali Hazzah at the Egypt Monocle: Arab in NYCBelen Fernandez for Mondoweiss: Friedman’s Mirror NEW! Some fresh takedowns. Matt Taibbi at Rolling Stone - No Kidding: The Most Incoherent Friedman Column Ever – Nails it.Andrew at Current Events Inquiry – The sociopathy of Thomas L.

Ex-Lehman chief risk officer appointed World Bank treasurer. The World Bank has appointed Madelyn Antoncic as its new vice president and treasurer.

Ms Antoncic served as Lehman Brothers’ chief risk officer from 2002 to 2007 and following the collapse of the bank, stayed on for a year as managing director and senior advisor at the Lehman Estate, helping to maximise value for creditors. Having begun her career as an economist at the Federal Reserve Bank of New York, she has worked for Goldman Sachs in various posts (including head of market risk management), and for Barclays Capital, before joining Lehman Brothers in 1999.

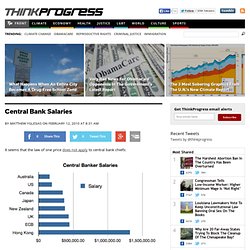

In her new role, Ms Antoncic will be responsible for maintaining the World Bank’s standing in financial markets and for managing an extensive client advisory, transaction, and asset management business. Commenting on the appointment, World Bank Group president Robert B Zoellick, says: “Known for her forthrightness, I am delighted Madelyn is taking up this important role.” Neo-liberalism only helps the corporations, nobody else « Antony Loewenstein. Tell me this isn't loathesome: Credit Card Cleverness - The Base. Blankfein of Goldman 'expecting $100m bonus' - Viewsflow. The gang of five, and how they nearly ruined us - Viewsflow. Matthew Yglesias » Central Bank Salaries. By Matthew Yglesias on February 12, 2010 at 8:31 am It seems that the law of one price does not apply to central bank chiefs: The Australia/New Zealand spread is especially dramatic.

The convention, I guess, is that you can’t just recruit a central banker from abroad. But considering that Australia and Canada have outperformed the larger economies during this crisis and have low-wage central banks, it seems like someone might want to consider poaching one of those guys to run a bigger economy. Grèce : le bal des hypocrites.

Le point de départ de cette nouvelle « affaire grecque » est un article du New York Times paru dans son édition du dimanche 14 février.

L’article explique comment la banque d’affaires Goldman Sachs, encore elle, a monté en 2001-2002, pour le compte de la Grèce, une opération de "cross currency swap" destinée à diminuer artificiellement d’un milliard d’euros le montant de dette publique. Accrochez-vous. La Grèce émet un emprunt de dix milliards de dollars (ça aurait pu être du yen ou du franc suisse) en plusieurs tranches d’une durée de 15 à 20 ans, emprunt que Goldman Sachs a été chargée de changer en dollars avec les euros fournis par la Grèce.

Elle le changera à nouveau au moment du remboursement en euros. Le problème est que le change ne s’est pas fait au taux du marché, mais à un taux artificiel, ce qui a en fait permis à Goldman Sachs de prêter de l’argent à la Grèce sans que cela n’apparaisse dans les statistiques. JP Morgan's Loss: The Explainer. All I know is that everyone's really mad about this JP Morgan mess.

What on earth happened? A JP Morgan trader, Bruno Iksil, has been accumulating a giant bet on U.S. corporate bonds. He used derivatives to do it, and he messed up the bet and lost $2 billion for the bank. He could end up losing $1 billion more if the market doesn't cooperate. Iksil was so powerful - and his bet was so large - that other traders nicknamed him the London Whale. Is this one of those "rogue traders" I keep hearing about? No, Iksil worked for JP Morgan and had the full support of the bank and did all his trades with the full knowledge of these four Very Important People at the top. How did no one know about this? Oh, they did. When the media, analysts and other traders raised concerns on JP Morgan's earnings conference call last month, JP Morgan CEO Jamie Dimon dismissed their worries as "a tempest in a teapot. " Hedge funds and the Whale, credit index edition. Bank Order Led to Losing Trades.

#flashcrash 6/5/2010. Elle perd son nouveau-né sur l'A20, faute de maternité près de chez elle.