Is Silver Money? Gold is a metal that is garnering some attention these days as the "alternative currency" while the world seems bent on debasing all other currency.

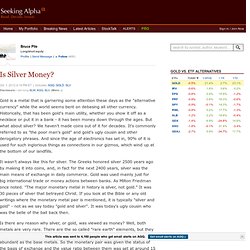

Historically, that has been gold's main utility, whether you show it off as a necklace or put it in a bank - it has been money down through the ages. But what about silver? We haven't made coins out of it for decades. It's commonly referred to as "the poor man's gold" and gold's ugly cousin and other derogatory phrases. And since the age of electronics has set in, 90% of it is used for such inglorious things as connections in our gizmos, which wind up at the bottom of our landfills. It wasn't always like this for silver. Is there any reason why silver, or gold, was viewed as money? The first few Congressional coinage acts in America specifically set the gold/silver ratio at various numbers around 15. Impressed by this author? Follow and be the first to know when they publish. Follow Bruce Pile (495 followers) Long/short equity New! Silver Chart. The National Budget, Debt & Deficit. General Information National Budget. Druckenmiller Calls Out The Treasury Ponzi Scheme: "It's Not A Free Market, It's Not A Clean Market", Identifies The Real Bond Threat.

We hadn't heard much from legendary investor Stanley Druckenmiller since last August when he decided to shut down his Duquesne Capital hedge fund.

Until today. In a must read interview, the man who took on the Bank of England in 1992 and won, says that he join the camp of Bill Gross et al, making it all too clear that all the recent fearmongering about the lack of a debt ceiling hike by the likes of Tim Geithner, Ben Bernanke and, of course, all of Wall Street, is misplaced, and that the real threat to the country is the continuation of the current profligate pathway of endless spending. From the WSJ: "Mr. Druckenmiller had already recognized that the government had embarked on a long-term march to financial ruin.

So he publicly opposed the hysterical warnings from financial eminences, similar to those we hear today. EEUU llega a su límite de endeudamiento,Datos macroeconómicos, economía y política - Expansión. El endeudamiento del Gobierno estadounidense ha alcanzado el límite legal de 14,29 billones de dólares permitido por los legisladores.

Ante esta situación, el secretario del Tesoro, Timothy Geithner, ha enviado una carta al Congreso de Estados Unidos instando a Harry Reid, líder del senado, a subir el límite de endeudamiento. Hay que elevar el límite "para proteger la confianza y el crédito de Estados Unidos y evitar catastróficas consecuencias sobre los ciudadanos", sostiene Geithner. Mientras tanto, el Gobierno estadounidense ha decidido suspender las inversiones en dos planes de pensiones, lo que permitirá a la Administración un empréstito adicional, según ha informado el Departamento del tesoro. Pese a alcanzar su máximo permitido, Geithner ha asegurado hoy a los congresistas que EEUU aún tiene margen de endeudamiento hasta el 2 de agosto ya que las medidas adoptadas aportan a Washingtong once semanas de prórroga.

Noticias Relacionadas. JIM ROGERS BLOG. Kitco's Analytical Charts. CME Group. The corporate world headquarters are in Chicago in the Loop.

The corporation was formed by the 2007 merger of the Chicago Mercantile Exchange (CME) and the Chicago Board of Trade (CBOT). On March 17, 2008, CME Group announced it had acquired NYMEX Holdings, Inc., the parent company of the New York Mercantile Exchange and Commodity Exchange, Inc (COMEX). The acquisition was formally completed on August 22, 2008.[3] The four exchanges now operate as designated contract markets (DCM) of the CME Group.[4] On February 10, 2010, CME announced its purchase of 90% of Dow Jones Indexes, including the Dow Jones Industrial Average.[5] Dow Jones Indexes subsequently became S&P Dow Jones Indices, in which CME has a 24.4% ownership interest.[6] CME Group owns a 5% stake in BM&F Bovespa, the São Paulo based exchange operator.

On October 17, 2012, CME announced it was acquiring the Kansas City Board of Trade for $126 Million in cash. See also[edit] References[edit] External links[edit] Silver Options Explained. Home > Futures Options Silver options are option contracts in which the underlying asset is a silver futures contract.

The holder of a silver option possesses the right (but not the obligation) to assume a long position (in the case of a call option) or a short position (in the case of a put option) in the underlying silver futures at the strike price. This right will cease to exist when the option expire after market close on expiration date. Silver Option Exchanges Silver option contracts are available for trading at New York Mercantile Exchange (NYMEX). NYMEX Silver option prices are quoted in dollars and cents per ounce and their underlying futures are traded in lots of 5000 troy ounces of silver.

Call and Put Options Options are divided into two classes - calls and puts. Buying calls or puts is not the only way to trade options. Silver Options vs. Additional Leverage Limit Potential Losses Flexibility Time Decay. Silver Options. Silver Futures.