Our financial advice is based on our understanding of your present and future cash flows and financial objectives. Wealthcare India. Introduction Are you one of those who at the end of every month is broke?

Are you the one who doesn’t have a track of any of their expenses, no matter how little they are? Then perhaps you don’t have a habit of preparing a budget. For most of us, certain expenses are fixed, like rent of the house/ flat we live in, expense on essentials like grocery expense and paying other bills, a shopping spree and partying. Since rent and household expense forms a major expense, most of us think that major chunk will be saved.

And by the end of every month, we are broke! You may think that you are not expending much, but actually, you are. Hence, preparing a budget is important and sticking to it is even more! Further, the habit of saving will definitely help you In achieving long-term goals, although SIP investment will do it sooner! Certified Financial Planner. Financial Advisor in Delhi. The Financial Planning Process. Things You Need to Know About SIP. Best SIP Investment Plan. PowerShow.com is a leading presentation/slideshow sharing website.

Whether your application is business, how-to, education, medicine, school, church, sales, marketing, online training or just for fun, PowerShow.com is a great resource. And, best of all, most of its cool features are free and easy to use. You can use PowerShow.com to find and download example online PowerPoint ppt presentations on just about any topic you can imagine so you can learn how to improve your own slides and presentations for free.

Or use it to find and download high-quality how-to PowerPoint ppt presentations with illustrated or animated slides that will teach you how to do something new, also for free. Or use it to upload your own PowerPoint slides so you can share them with your teachers, class, students, bosses, employees, customers, potential investors or the world. Wealthcare India. What is SIP?

Systematic Investment Plan is an investment route given by mutual funds, where one can place a fixed amount at regular intervals in a mutual fund scheme, say one month or one quarter a month, instead of investing in a lump sum. The payments can be as low as INR 500 per month and resemble a recurring deposit. Can SIP be started online? Ok, you don't have to deal with the paperwork or exercise your leg. Just put your leg up, turn on your screen, and you can start online from your home or office. Financial Planner Online. The Ultimate Guide to Choosing a Financial Advisor. Let's Connect Copy embed code: Added: This Presentation is Public Favorites:

Advantages Of Working With A Financial Advisor. Financial advisors are professionals that provide financial services to clients based on their financial situation.

They basically guide clients on how to manage their money. They give expert advice to clients in decisions making process on money matters, personal finances, and investments. Financial advisors make informed decisions on behalf of clients and aid. “It takes wealth to buy your desires, but it takes wealth management to keep up the abundance.” ― Sujit Lalwani. Investment Advisory Services. Certified Financial Planner. Retirement Planning. Mutual fund investment. If you have earned Long Term Capital Gains (LTCG) in the FY 2019-20, you are supposed to file your return.

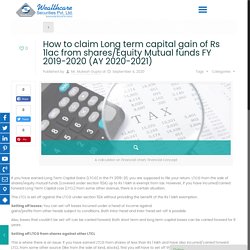

LTCG from the sale of shares/equity mutual funds (covered under section 112A) up to Rs 1 lakh is exempt from tax. However, if you have incurred/carried forward Long Term Capital Loss (LTCL) from some other avenue, there is a certain situation. This LTCL is set off against the LTCG under section 112A without providing the benefit of the Rs 1 lakh exemption. Setting off losses: You can set-off losses incurred under a head of income against gains/profits from other heads subject to conditions. Both intra-head and inter-head set-off is possible. Also, losses that couldn’t be set-off can be carried forward. Setting off LTCG from shares against other LTCL This is where there is an issue. If you have earned Long Term Capital Gains (LTCG) in the FY 2019-20, you are supposed to file your return. Also, losses that couldn’t be set-off can be carried forward.

Benefits of a Financial Advisor. SIP Investment Plan. What is SIP Investment?

Systematic Investment Plans or SIPs are modes of investment in a mutual fund scheme, where in you can purchase mutual fund units of the fixed price in regular intervals.This fixed amount gets deducted from your bank account at regular periods, which you decide before hand. It’s the best way of starting investing in equity market, and is one of the smart and easiest ways as well. Further, with mutual fund SIPs, you can choose to pause or stop the SIP whenever and wherever you feel the need to do so. Hence, Mutual Fund SIPs are flexible in nature. Mutual fund investment.

Trusting someone with your hard earned money is difficult indeed.

Choosing a scheme out of 18000+ schemes is worse. When you are investing, the kind of scheme you are putting in your money matters the most. It is extremely important to know how much risk you are ready to withstand, which again depends upon multitude of factors. Investment Advisory Services. Best Financial Planning Online. Benefits of Mutual Funds. Importance Of Mutual Fund Managers And Advisers.

A mutual fund is an indefinite professionally managed investment fund that pools money from investors and invests it in various products like stock, bonds, government instruments or invested into various companies operating in a different economy.

A mutual fund is a highly popular and favoured industry among investors. In recent years it has acquired a giant market and created a big hype. In the last ten years India’s mutual fund market as seen a rapid growth around 12.5% on average, putting behind even the developed countries. The total assets managed by the Indian mutual fund industry have increased to 27.28 trillion as of July 2020. 92.1 million Indians have invested in mutual funds as of July 31.

It offers a wide range of investment choices. Best Certified Financial Planner. Best Investment Advisory Services. What is Wealth Management?

Wealth Management encompasses all the advisory related services like, financial advisory, estate planning, legal advice, tax related advice, etc. These kinds of services generally entail HNI and ultra HNI clients. Hence, such services provide a holistic view for such clients, and they are assured that there is a single person/entity responsible for all of their financial life. The service aims to preserve and grow wealth in long term horizons. Investment Advisor. Post Retirement Planning. Retirement Benefits. Systematic Withdrawal Plan. Financial Planning Online. Financial Planning Services. Retirement Planning. Post Retirement Benefits Of A Financial Advisor – Wealth care India. During service, everyone wants to have a great time after retirement, but after retirement, not everyone knows how to manage the financial issues.

To solve your problem, we have brought this article. Financial advisors are full of needs even after you retire. Most people work with decades of hard work and dedication to ensure a happy retirement. Therefore, you must consult once before retirement. Certified Financial planner - Wealth Care India: Improve Your Future By Getting The Best Financial Planning Services In India.

Proper planning is required to improve financial problems. You can make a significant financial plan with just a few things in mind. You can handle your commercial enterprise well or work hard in your office. You are making first-class cash and spending it carefully. For financial planning service, Personal financial planning online can help you. You meet all your life goals, for example, retirement, children's future, debt management, insurance, and other such purposes. Our main proposal is built around impartial research and financial planning, which is our primary business. Investment advisor. Online Financial Planning Company & Services. Certified Financial Planner. Certified Financial Planner. Why Life Insurance is Required? - Wealthcare India. SIP investments by Wealthcare Inida. Covid19 Impact on SIP investments. Impact on SIP investments due to Covid19 Wealthcare india Testing time for Sip investors As per experts current scenario tested patience of investors and investors are bit conscious while invested large amount of money.

In current situation experts feel you can’t expect return of 15-20 %. But if you are understanding market and spending your time while judging everything things will become much smooth for you. Understand your financial goals and risk taking capability and invest accordingly. Impact of Covid19 is Global Coronavirus impact is not on Indian market only. India may expect surge in market and get benefited as we have seen lower crude oil prices. Covid19 Impact on SIP investments Aug 5, 2020 | Publisher: Wealthcare India | Category: Other | | Views: 4 | Likes: 1 800% 400% 200% 150% 125% 100% 75% 50% Full Width Full Height Full Page Show Text Download as... Include... Understand your financial health and make the right choice!

Most of us make investments, but are you losing your money consistently? Are you among those who are not sure about how they must invest or do not have any current estate strategy? If you fall into any of these cases, you surely need investment advisory services. These services will help you hire an investment advisor who will guide you through your wealth management.

Investment advisory services. What is an online Systematic Investment Plan (SIP)? It’s not easy to develop a financial advisory company. Letting go of a steady paycheck, hustling to attract clients, working out the customer care, and enforcement management back-office — those early years are challenging by any standard. Everybody needs capital. Nonetheless, other individuals are much more likely to gain more and more. Certified Financial planner - Wealth Care India: Impact on SIP investments due to Covid19. There is panic in market due to fluctuation of funds. As per industry experts this won’t remain for long time and after few days we will see improvement in market. Mutual Fund Investment. Best SIP Mutual Funds from SBI in India : inidawealthcare — LiveJournal. India is a trillion-dollar economy with thousands of mutual fund schemes offered by financial institutions.

On a personal level, it can be quite challenging for anyone to understand the market volatility and corresponding effect to that particular investment. Still, there are signs and market conditions that favor the growth of some mutual fund investments. Certified Financial planner - Wealth Care India: Benefits of Investing through a SIP. Systematic Investment Plan (SIP) has become one of the mainstays for investors in the last decade or so. Especially with mutual fund investments, SIPs provide a systematic way to accumulate wealth for the future. With market volatility and the rise of inflations, SIPs can help you overcome several challenges to ensure your future financially. Here are the main reasons to benefit from using SIP Investments in any market scenario. How Beneficial is Online Investment in today’s modern age? by Wealthcare Inida.

Online investment advisor. Investment planning for your child- the sooner the better! - Welcome. Introduction Raising the child right and gifting him/her secured future, is a dream for many. Every parent wants, that their child should be able to study in the best school and pursue higher studies in the college he/she wants. The day child is born, the least one can do is, start the investment planning for child, so that you don’t have to look up for loan at the time of any goal requirement – be it education, marriage, or anything else.

Untitled design 20. How Beneficial is Online Investment in today’s modern age? – Wealth care India. In this digital age, most of the businesses are now conducted online. Several verticals have completely changed their course for user interaction. Finances and Banking can be easily called as the one most benefitted from online management. Certified Financial planner. Online Financial Planning. Certified Financial planner - Wealth Care India: Why Financial Planning is a must for today's generation? Investment Tips in India: Ignore The Voices. Online Financial Planning Company & Services. Certified Financial Planner. Certified finnacial planners. Lookbook.