5 Things Successful Leaders Know That Make Us Want To Follow Them. Turbocharge Business Results through Marketing Insights. Performance indicator. "Key Performance Indicator" redirects here.

A performance indicator or key performance indicator (KPI) is a type of performance measurement.[1] KPIs evaluate the success of an organization or of a particular activity in which it engages. Often success is simply the repeated, periodic achievement of some levels of operational goal (e.g. zero defects, 10/10 customer satisfaction, etc.), and sometimes success is defined in terms of making progress toward strategic goals.[2] Accordingly, choosing the right KPIs relies upon a good understanding of what is important to the organization.[3] 'What is important' often depends on the department measuring the performance - e.g. the KPIs useful to finance will really differ from the KPIs assigned to sales.

KPI. Los KPI, del inglés Key Performance Indicators, o Indicadores Clave de Desempeño, miden el nivel del desempeño de un proceso, centrándose en el "cómo" e indicando el rendimiento de los procesos, de forma que se pueda alcanzar el objetivo fijado.

Los indicadores clave de desempeño son métricas financieras o no financieras, utilizadas para cuantificar objetivos que reflejan el rendimiento de una organización, y que generalmente se recogen en su plan estratégico. Estos indicadores son utilizados en inteligencia de negocio para asistir o ayudar al estado actual de un negocio a prescribir una línea de acción futura. El acto de monitorizar los indicadores clave de desempeño en tiempo real se conoce como monitorización de actividad de negocio.

Los indicadores de rendimiento son frecuentemente utilizados para "valorar" actividades complicadas de medir como los beneficios de desarrollos líderes, compromiso de empleados, servicio o satisfacción. Usado para calcular, entre otros: SWOT analysis. A SWOT analysis, with its four elements in a 2×2 matrix.

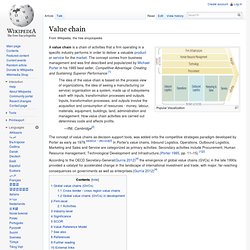

A SWOT analysis (alternatively SWOT matrix) is a structured planning method used to evaluate the strengths, weaknesses, opportunities and threats involved in a project or in a business venture. A SWOT analysis can be carried out for a product, place, industry or person. It involves specifying the objective of the business venture or project and identifying the internal and external factors that are favorable and unfavorable to achieve that objective. Some authors credit SWOT to Albert Humphrey, who led a convention at the Stanford Research Institute (now SRI International) in the 1960s and 1970s using data from Fortune 500 companies.[1][2] However, Humphrey himself does not claim the creation of SWOT, and the origins remain obscure.

The degree to which the internal environment of the firm matches with the external environment is expressed by the concept of strategic fit. Matching and converting[edit] Value chain. Popular Visualization The idea of the value chain is based on the process view of organizations, the idea of seeing a manufacturing (or service) organisation as a system, made up of subsystems each with inputs, transformation processes and outputs.

Inputs, transformation processes, and outputs involve the acquisition and consumption of resources - money, labour, materials, equipment, buildings, land, administration and management. How value chain activities are carried out determines costs and affects profits. The concept of value chains as decision support tools, was added onto the competitive strategies paradigm developed by Porter as early as 1979. [dubious ][3] In Porter's value chains, Inbound Logistics, Operations, Outbound Logistics, Marketing and Sales and Service are categorized as primary activities. Global value chains (GVCs)[edit] Cross border / cross region value chains[edit] Global value chains (GVCs) in development[edit] Firm-level[edit]

Product lining. Related jargon[edit] The number of different categories of a company is referred to as width of product mix.

The total number of products sold in all lines is referred to as length of product mix. Brand equity. Brand equity is a phrase used in the marketing industry which describes the value of having a well-known brand name, based on the idea that the owner of a well-known brand name can generate more money from products with that brand name than from products with a less well known name, as consumers believe that a product with a well-known name is better than products with less well-known names.[1][2][3][4] Some marketing researchers have concluded that brands are one of the most valuable assets a company has,[5] as brand equity is one of the factors which can increase the financial value of a brand to the brand owner, although not the only one.[6] Elements that can be included in the valuation of brand equity include (but not limited to): changing market share, profit margins, consumer recognition of logos and other visual elements, brand language associations made by consumers, consumers' perceptions of quality and other relevant brand values.

Marketing mix. The marketing mix is a business tool used in marketing and by marketers.

The marketing mix is often crucial when determining a product or brand's offer, and is often associated with the four P's: price, product, promotion, and place.[1] In service marketing, however, the four Ps are expanded to the seven P's[2] or Seven P's to address the different nature of services.