Fundamentals of Industrial Catalytic Processes - C. H. Bartholomew, Robert J. Farrauto. BioWeb. What’s in store for China in 2012? - McKinsey Quarterly - Economic Studies - Productivity & Performance. Renewable Energy Tests U.S. IPO Market in First Deal of 2012. Renewable Energy Group Inc.

(REGI), the biodiesel maker that hasn’t posted an annual profit since 2008, will test investor demand for new shares in the first U.S. initial public offering this year. The Ames, Iowa-based company, which turns ingredients including soybean oil into biodiesel for cars and trucks, plans to raise as much as $108 million offering 7.2 million shares for $13 to $15 each today, according to a regulatory filing. Renewable will use the proceeds to buy a factory it is currently leasing and to invest in new processing technologies. The biodiesel maker is one of at least eight companies that have scheduled dates to complete U.S. offerings so far this year, even as those that went public in 2011 fell an average of 5.9 percent through Jan. 13, data compiled by Bloomberg show.

Renewable is attempting the first biofuel IPO since June, when Kior Inc. raised $162 million and then lost more than 30 percent of its value. Renewable’s Value. Our Thinking. Discussions about Energy and Our Future. U.S. to become world’s top oil producer: Goldman Sachs - MINING.com. Who do you think will be the world’s largest oil producer a few years from now?

Saudi Arabia? Russia? Canada with its Oil Sands? Evidently it could be good old Uncle Sam, says Goldman Sachs. And you can thank the Shale Revolution for putting America on top. The Sunday Times in England recently quoted a report released by Goldman Sachs that predicts America will become the world's largest oil producer by the year 2017. (I have to confess, I searched everywhere for this report and couldn’t directly access a copy of it. N-Butanol. Isobutanol. Butane. Butane (/ˈbjuːteɪn/) is an organic compound with the formula C4H10 that is an alkane with four carbon atoms.

Butane is a gas at room temperature and atmospheric pressure. The term may refer to either of two structural isomers, n-butane or isobutane (or "methylpropane"), or to a mixture of these isomers. In the IUPAC nomenclature, however, "butane" refers only to the n-butane isomer (which is the isomer with the unbranched structure). Butanes are highly flammable, colorless, easily liquefied gases. The name butane comes from the roots but- (from butyric acid) and -ane.

Isomers[edit] Rotation about the central C-C bond produces two different conformations (trans and gauche) for n-butane.[4] [edit] When oxygen is plentiful, butane burns to form carbon dioxide and water vapor; when oxygen is limited, carbon (soot) or carbon monoxide may also be formed. When there is sufficient oxygen: When oxygen is limited: Uses[edit] Cordless hair irons are usually powered by butane cartridges.[10] See also[edit]

CO2 Emissions From Refining Gasoline. Natural Gas Glossary. Yanzhou Coal Buys Gloucester for $2.1 Billion to Gain Port, Mines Access. Yanzhou Coal Mining Co. (1171), China’s fourth-biggest coal producer, agreed to buy Gloucester Coal Ltd. for about A$2.1 billion ($2.1 billion) in cash and shares to gain more mines and port access in Australia. The deal values Gloucester at as much as A$10.16 a share, subject to conditions, according to a statement from the Sydney- based company. That’s 45 percent more than its Dec. 19 close, the day before the stock was halted. Buying Gloucester, controlled by commodity trader Noble Group Ltd. (NOBL), will almost double Yanzhou’s coal mines in Australia, the world’s biggest exporter, as well as expand its access to ports.

The proposed deal looked more expensive than recent industry transactions, Nomura Holdings Inc. said in a report before the deal announcement. “There is an overall premium to recent share prices and I think the market has captured a good proportion of that,” Lawrence Grech, a resources analyst at Austock Group Ltd. in Melbourne, said by phone. Merger Ratio. More trouble ahead for Bixby Energy founder? A former consultant to Bixby Energy, the troubled Ramsey, Minn., developer of a coal-to-natural-gas technology, has implicated a former officer of the company in what federal authorities describe as a $60 million securities fraud scheme.

Dennis Desender, 64, pleaded guilty Wednesday to one count of securities fraud and implicated "Individual A," identified in court papers as an officer of Bixby, in a scheme that allegedly duped investors in a venture to sell coal-gasification technology to China. Desender pleaded guilty earlier to one count of tax evasion. That agreement did not require his cooperation in the Bixby investigation, but the new plea bargain does. Coller Capital - Coller International Partners V.

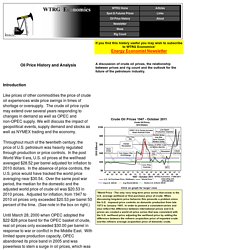

World Energy Outlook Homepage. Historical Oil Prices Table. The first table shows the Annual Average Crude Oil Price from 1946 to the present.

Prices are adjusted for Inflation to January 2014 prices using the Consumer Price Index (CPI-U) as presented by the Bureau of Labor Statistics. Note: Since these are ANNUAL Average prices they will not show the absolute peak price and will differ slightly from the Monthly Averages in our Oil Price Data in Chart Form. Also note that although the monthly Oil prices peaked in December 1979 the annual peak didn't occur until 1980 since the average of all the monthly prices was higher in 1980. Inflation adjusted oil prices reached an all-time low in 1998 (lower than the price in 1946)! And then just ten years later Oil prices were at the all time high for crude oil (above the 1979-1980 prices) in real inflation adjusted terms (although not quite on an annual basis). History and Analysis -Crude Oil Prices. OPEC has seldom been effective at controlling prices.

Often described as a cartel, OPEC does not fully satisfy the definition. One of the primary requirements of a cartel is a mechanism to enforce member quotas. An elderly Texas oil man posed a rhetorical question: What is the difference between OPEC and the Texas Railroad Commission? His answer: OPEC doesn't have any Texas Rangers! The Texas Railroad Commission could control prices because the state could enforce cutbacks on producers. With enough spare capacity to be able to increase production sufficiently to offset the impact of lower prices on its own revenue, Saudi Arabia could enforce discipline by threatening to increase production enough to crash prices. During the 1979-1980 period of rapidly increasing prices, Saudi Arabia's oil minister Ahmed Yamani repeatedly warned other members of OPEC that high prices would lead to a reduction in demand. Unfortunately for OPEC only the global recession was temporary. HISTORY OF CRUDE OIL PRICES. Crude Oil Price Chart from 1977 to 2003 Monthly Price Chart 1998-July 2013 History & Analysis of Crude Oil Prices from WTRG Economics Year, Month, Monthly Average, and Yearly Average.