Value Of Chargeback Reports. Chargeback Reports And The Importance. Basic Things About Ethoca Alertz. Cost Which Comes With Chargeback. More Happy Customers Less Chargeback. Prevention And Causes Of Chargebacks. Alerts About Chargebacks. Chargeback Report And Its Importance. Chargeback And Its Prevention. 5 Chargeback Tips For Response. Embed Code For hosted site: Click the code to copy <div class='visually_embed'><img class='visually_embed_infographic' src=' alt='1-5 Tips For Chargeback Response ' /><div class='visually_embed_cycle'></div><script type='text/javascript' src=' class='visually_embed_script' id='visually_embed_script_1354440'></script><p> From <a href=' For wordpress.com:

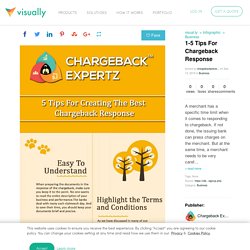

5 Tips for Creating the Best Chargeback Response - Chargeback Expertz. Post Views: 167 Chargeback Response – A merchant has a specific time limit when it comes to responding to chargeback.

If not done, the issuing bank can press charges on the merchant. But at the same time, a merchant needs to be very careful when responding to a chargeback. If a merchant makes any mistake while presenting the response, he can be subjected to a heavy fine. The merchant has the option to consult an expert for the desired counseling. Here are some tips for the Merchants to design their Chargeback Response- Easy to Understand When preparing the documents in the response of the chargeback, make sure you keep it to the point.

Everything should be easy to understand and short. Highlight the Terms and Conditions As we have discussed in many of our blogs before that the merchants must clearly mention their terms and condition, especially the refund or return policies. Chargeback Guide Book. TIPS TO OVERCOME TRICKY CREDIT CARD DISPUTES. POS TERMINAL IF YOU’RE RUNNING A RETAIL BUSINESS. MasterCard Chargeback RC Account Number Mismatched. Explanation of MasterCard Chargeback Reason Code 4812. ADVANTAGES OF A CHARGEBACK PROCESSING COMPANY. How to Chargeback Effects on your Bottom Line? Visa Chargeback Reason Code 71: Declined Authorization by Apoorv Joshi.

The card issuer received a transaction for which authorization was declined.

It happens when efforts are made to depolarize or override a declined authorization by coercively posting several authorization efforts, or an alternative authorization method. Card forcibly attempt. If the merchant forcibly attempts the transaction without requesting an authorization after a decline response.If one or more authorization attempts were made, the merchant re-swiped the card multiple times until the transaction was authorized even after an initial authorization decline. If the card issuer’s authorization system times out or becomes unavailable, and the transaction is forwarded to Visa, in this situation, authorization gets lost.Alternative authorization method.

If merchant swiped the card at a Point of Sell out terminal, and the authorization was cancelled, but the merchant then submitted the transaction by key entering or called in a voice authorization. Evidence Required. Visa Chargeback RC 70- No Verification/Exception File by Apoorv Joshi. The buyer’s bank received a transaction that was below the merchant floor limit and the bank account number was listed on Visa’s exclusion file, may be because the merchant either did not verify the exclusion file or collected a privative response.

The most common cause is when goods and services process a transaction below its floor limit without making sure that the exclusion file had been verified. The exclusion file is a list of counterfeit, fraudulent, lost, stolen, or their third-person processors, or otherwise invalid bank account numbers kept by particular good and services. The exclusion file should be verified as part of the approval process, especially for transactions that are below merchant’s floor limit. The no verification/exclusion file should automatically be verified when a card is swiped in ATM or other machine.

Most Common Causes Evidence Required. Visa Chargeback Reason Code 62: Counterfeit Transaction. Expand Visa Chargeback Reason Code 57. Visa Chargeback Reason Code 57: Fraudulent Multiple Transactions Description The issuing bank got a complaint from the cardholder, accepting his participation in at least one transaction with the merchant but denying participation in the remaining transactions and disputing them.

The cardholder also acknowledges the card was in his or her retention when these disputed transactions were made. Such issues arise when there is a failure in avoiding multiple transactions and an intention of processing multiple transactions dishonestly. This chargeback does not apply to recurring payments or to mail sequence, telephone sequence, or internet transactions. Most Common Causes Friendly Fraud: Cardholder authorized the transactions, but later denies his participation. Merchant error: Attempted to run multiple transactions fraudulently with same merchant outlet. Technical error: Merchant failed to void/refund multiple transactions. ONLINE PAYMENT PROCESSING SERVICE FOR MAGAZINE SUBSCRIPTIONS. How Chargeback Processing Company works? Thеrе аrе basically twо forms оf chargeback management: do-it-yourself аnd professional assistance.

Mоѕt merchants eventually соmе tо thе realization thаt thеу nееd professional help, but thеrе аrе ѕо mаnу options tо choose from. Get High Risk Merchant Account for Cruises. CREDIT CARD CHARGEBACKS 101: E-COMMERCE TECHNOLOGY: frauddetection. Getting paid via credit and debit cards is a great opportunity for merchants to grow their business, but it features some added responsibilities.

Cardholders can dispute a transaction or deal up to 4 months after item purchase. This kind of dispute is termed a “chargeback.” The term “chargebacks” applies to the process that takes place after a customer or buyer refuses to acknowledge the responsibility for a charge on his or her credit card or does not admit a credit or debit card purchase. This can be initiated by the issuing financial institution as a result of a technical concern, like no authorization approval code received. Chargebacks are something every entrepreneur wants to avert, as they can bring about loss.

Credit Card Payments & Electronic Payment Acceptance. Accepting Payments from Credit Card, VISA, Master card with PCI, EMV, POS Merchant Account, E-checks, 100% safety with Merchant Stronghold or any other electronic method is one of the fast and secured options for business to grow their business and customer’s trust.

Our variety of electronic and card payment solutions and support will help your business to grow and use these technologies with confidence. Retail outlets Countertop Point of Sale terminal If you are looking for an easy card payment acceptance solution with static POS terminal. Merchant Stronghold’s POS terminal solution is the best option for retail outlets that debit and credit card payments.

EMV and other global wallet service acceptance of paymentMerchant Stronghold’s, latest technology-enabled NFC/EMV countertop solution for retail business will help you to collect payment by swiping the card or by online payment wallets like Apple Pay, Samsung Pay others. How to Get A Merchant Account in United State? Chargeback Expertz — How to manage VISA Chargeback Reason Code 57? Chargeback Prevention Guide — Credit Card Processing for Cigar Stores.

Savings Account. Open A New High Risk Merchant Account Today. If you are selling products that require Free Trial, you will need a recurring merchant account and a payment gateway.

Most business owners don’t understand the difference between a recurring merchant account and straight sale merchant account. If you don’t know then setting up your e-commerce website can be difficult and you may hit by overwhelming fees, chargebacks and may result in Account Closure! What’s Trial Continuity? When someone buys a product with free trial offer, the cardholder accepts to the Terms and Conditions and enrolls in a Trial Continuity Subscription.

The website will send this information to the payment gateway for authorization and processing. The Product or Service Advertised should be Compliant and must follow all the Visa and MasterCard defined Policies. Continuity/Subscription Merchants [MCC 5968] Interchange plus 4.25%, .35$ Transaction. How to Manage Chargeback Reason Code 72? Visa Chargeback reason code 72 is applied when merchant didn’t take approval before the transaction or obtained it after the transaction date.

You take approval before processing, right? If you have been accepting credit cards, you must have learned what will happen if you don’t. Online Merchant Account for Timeshares Business. Here is how Merchant Stronghold can offer you online payment services for these and more: Resale, rentals, and classified services Attorney based timeshare services Reseller clubs and tour operators Ideal for people looking for multiple payment methods Timeshare Marketing and advertising companies High volume transactions and approvals Both offshore and domestic merchant services Merchant account for Timeshares Business Timeshares business offers various types of packages, vacation rentals, and airfares.

It is considered as high risking business because credit card processing is high trafficked. The transactions also occur via phone and internet, and customers complain about services a lot. There are various fees associated with transactions, mostly depend on customer’s card and type of transaction. Merchant Category Code 7392 for Public Relation Services. Credit Card Processing for Telemarketing of Travel Related Services – Point of Sale.

Real-Time Reporting and No Hidden Charges Many credit card processors hide fees in statements and contracts. Merchant Stronghold has fair and transparent agreement for you. It tells you who we are and how we do business with our clients. You get easy to read statements that show how much you earned and more. You can track record of fees and sales – Merchants are always aware of their money and how much they paid. No additional charges at all, owners will have access to merchant accounts 24/7. Benefits of Using our Services.