bondevalue

BondEValue App provides electronic bond trading to track live bond prices, corporate bond prices, sovereign bonds, investment grade bonds, hong kong bonds and high yield bond. It also provides new bond issue alerts and Asian bond market news.

Perpetual Bonds - BondEvalue. Sovereign Bonds - BondEvalue. Asian Dollar Bond Market Seeing Tremendous Interest for the First Time in Years. Bond orders for primary issuance of Asian dollar bonds hit a record 6.7 times of their issuance sizes in February, the highest since January 2016.

This statistic is in line with the record demand for bond sales in Asia ex-Japan of $64.5 billion since the start of 2019. It appears investors have moved past last year’s underperformance in Asian bonds, where the product sold off the most ever in a decade, to support this market’s best start in 7 years. Reasons for the change in sentiment include recent dovish signals from the Federal Reserve and policy loosening out of China. Driving this demand is the robust investor interest in the bonds of Chinese property developers, where the ratio of orders to actual deal sizes hit 7.6 times, also in February. Chinese builders have sold a record bond market $22.7 billion dollar-denominated bonds since the start of the year. High Yield Bonds Lead The July Recovery. July has been a month of recovery for the bond market, with $ 10.1 billion added to the market value of all US dollar bonds in the BEV universe.

This accounts for almost a quarter of the $ 45 billion lost in the first half of 2018, as reported in our previous newsletter. 53.5% of the bonds in the BEV universe increased in price in July, compared to 3.6% in the first six months of 2018. Of the $ 10.1 billion, $ 7.9 billion is attributable to high yield bonds, as compared to $ 2.1 billion attributable to investment grade bonds. Brazil and Indonesia stood out when comparing average prices of bonds from the top countries of risk in the BEV universe.

As seen from the chart below, Brazil led the rally in July with an increase of 3.9%, followed by Indonesia with an increase of 3%. This is also evident from the narrowing of CDS spreads for the two countries in July. Source: BondEvalue, Bloomberg |*Temasek CDS as a proxy for Singapore. Posh Spice; Only high-quality Masala bonds to be permitted under new RBI regulations - BondEvalue. Tesla Upgraded; Asian Investors Pile Up on Long Tenor Bonds; Deep Dive on Sovereign Ratings - BondEvalue. Sentiment has soured overnight in Wall Street as an unexpected increase in the US initial jobless claims number by 109K to 1.416mn, raised concerns that the recent lockdowns are stalling the economic recovery.

Spiking coronavirus cases and rising US China tensions didn’t help investor sentiment. European shares fared better than the US but still ended the session in the red. US Treasuries found some safe haven demand with the 10Y and 30Y yields falling 2-7 basis points. New issues saw a very slow week but Asian dollar credit spreads continue to tighten. Asian markers are opening lower this morning. Bond Market Data & Bespoke Workflow Solutions for Bond Market Professionals - BondEvalue. Bond Market Data & Bespoke Workflow Solutions for Bond Market Professionals - BondEvalue. Best bond trading platform offer by -Bondevalue. Daimler’s €100 Million Ethereum Bond: How Blockchain Can Change the Bond Game - BondEvalue.

Daimler, parent company of Mercedes-Benz, transacted €100 million in a one-year corporate bond completely via an ethereum based blockchain system just last month, June 2017.

This issuance, also known in German as Schuldschein, notably carried out the “entire transaction … from origination, distribution, allocation and execution to the next stage of confirmation of repayment and interest payments” over blockchain. This pilot project aimed to test the use of blockchain technology in increasing efficiency of their transactions and financial processes, adds Bodo Uebber, AG board member. Blockchain is essentially a data processing platform, in the form of a distributed ledger, with a secure trust infrastructure that can automate and settle data/transactions over cryptocurrencies like Bitcoin and Ethereum. Increasingly, blockchain technology has garnered interest across banking institutions across the world, as a tool for lending and trade financing.

Corporate bonds hong kong. Times, Powerlong, Wens Food Launch $ Bonds; Oman Raises $2bn via Bonds; Tesla Reports Record Operating Income S&P ended marginally lower by 0.2%.

Energy and industrials were down over 1% while communication services were up 1%. Intel, American Airlines and Coca Cola are scheduled to report earnings amongst others. US stimulus hopes are mixed for a last minute deal by the... Where to find bond prices. Bonde Value. AgBank, Kaisa Launch $ Bonds; Tahoe Group Defaults on Local Bond; Softbank-Airtel JV to Issue $600mn US Benchmark & Global Indices 8 Jul Wall Street broke its streak last night with the S&P down 1.08% as new spikes across the US fanned concerns that business re-openings may be scaled back.

The Dow Jones was down 1.51% and the Nasdaq was down 0.86% after hitting a record intraday high. European stocks were also weighed down by the European Commission’s warning of a deeper recession than previously thought. Treasuries found a safe haven bid and the 10Y and 30Y yields fell by 2-5bp. Trade Fractional Bonds on an Electronic Bond Exchange – BondbloX by BondEvalue. Dim Sum Bonds - Serving Up Again. Already seeing low levels of issuance from around 2012 due to weakened expectations of renminbi appreciation, the offshore renminbi bond market spluttered to a standstill when China stunned global markets by devaluing its currency over two consecutive days in August 2015.

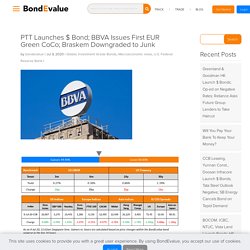

For most of the last two years there has been no public Dim Sum issuance, largely due to the negative medium- to long-term outlook on the renminbi, such that issuers would have to compensate investors through offering debt at higher yields. With the narrowing of the cross currency basis swap and improving sentiment on the positive direction of the renminbi, there are signs that this asset class is starting to enjoy attention from both issuers and investors again. PTT Launches $ Bond; BBVA Issues First EUR Green CoCo; Braskem Downgraded to Junk - BondEvalue. Markets climbed late in the overnight session with Nasdaq hitting a fresh high.

Despite a lack of fresh data, recovery hopes are still outweighing coronavirus concerns. Apple and Microsoft stocks led the tech sector gains. European shares declined and long dated treasuries slipped slightly. Spreads on Asian dollar bonds tightened to their lowest in nearly four months and deal momentum remained strong. We have introduced new dates to our Bond Traders’ Masterclass in August. BondEvalue: PTT Launches $ Bond; BBVA Issues First EUR Green CoCo; Braskem Downgraded to Junk - BondEvalue. Markets climbed late in the overnight session with Nasdaq hitting a fresh high.

Despite a lack of fresh data, recovery hopes are still outweighing coronavirus concerns. Apple and Microsoft stocks led the tech sector gains. European shares declined and long dated treasuries slipped slightly. Spreads on Asian dollar bonds tightened to their lowest in nearly four months and deal momentum remained strong. Bonde Value. CCB Leasing, Yunnan Const., Doosan Infracore Launch $ Bonds; Tata Steel Outlook Negative; SB Energy Cancels Bond on Tepid Demand US Benchmark & Global Indices 14 Jul Asian markets are opening with a risk-off tone after a late sell-off in Wall Street triggered when California reversed its policy for reopening the economy.

Increasing tensions between the US and China over the South China Sea also weighed on sentiment. Major indices had gained 1% earlier in the day but were down about the same by end of day. The news triggered profit taking in major tech stocks like Microsoft, Amazon and Tesla. Track Live Corporate Bond Prices Online on Mobile - BondEValue. Emirates NBD & JG Summit Launch $ Bonds; World’s Most Valuable Carmaker Is Rated Junk; Lufthansa Dow by bondevalue123. PTT Launches $ Bond; BBVA Issues First EUR Green CoCo; Braskem Downgraded to Junk - BondEvalue. BOCOM, ICBC, NTUC, Vista Land Launch Bonds; HK Airlines to Defer Coupon on Its Perp; FCOT Bondholders Exercise Put - BondEvalue. Wall Street gained on Friday after positive headlines from Remdesivir, Gilead Sciences’ antiviral drug, which came out claiming to reduce the risk of death and significantly improve conditions of severely ill patients.

This comes despite surging cases in the US and an uptick in daily deaths. Financial stocks rallied but the Nasdaq underperformed the S&P and DJI as investors move money out of the booming tech sector. European shares also fared well and Treasuries gave up some of their gains from Thursday. The European Council is set to meet starting this Friday in Brussels to discuss details about the EU’s COVID-19 recovery package.

The deal is not guaranteed as there is still disagreement between the member states and the frugal quartet over whether the €750bn package would be in the form of grants or loans. We have introduced new dates to our Bond Traders’ Masterclass in August. NFP for June at a Record High of +4.8mn; US Junk Bond Funds Witness Big Outflows; SAIC to Buy Stake in CAR Inc. Stronger than expected US NFP data of 4.8 million in June vs 3 million expected gave a knee-jerk rally for stocks. The unemployment rate also fell to 11.1% from 13.3% last month.

The intraday rally was short-lived and reversed much of the gains as many are concerned that the recent spike in coronavirus cases is stalling the recovery. The jobless claims number that came out yesterday as well showed that about 19.3 million people are collecting ongoing unemployment benefits. New claims totaled 1.4 million and were higher than expected. The monthly jobs report reflects data collected in the week of June 12, while the continuing claims data is more current, reflecting last week’s activity. NFP June 2020. Bond Evalue — Nomura, BDO, Sunac & Shimao Launch $ Bonds; Fitch... U.S.Treasury Yields Again Climbs Against Fed Policy. Yields on the benchmark 10-year U.S. Treasury note topped 3% on Friday, 14 September for the first time since 2 August and continued to fall early this week as investors weighed conflicting data on the economy and Federal Reserve policy. Yields have been creeping up since the start of September as market expectations for economic growth increased.

In particular, a revision in the retail sales figures out on 14 September appears to be the reason for the latest push higher in rates. The Commerce Department reported that retail sales edged up 0.1% in August, the smallest rise since February whereas July’s figures were revised higher to show sales rising 0.7% instead of the previously announced 0.5% increase.

Retail sales, or consumer spending, accounts for more than two-thirds of U.S. economic output and is often considered a forward-looking measure for gross domestic product. Sovereign Bonds - BondEvalue. Indonesian Textile Bond Highlights Risks in Junk Bonds Market. Delta Merlin Dunia Textile (DMDT), an Indonesian textile manufacturer within the Sumitro family’s Duniatex group, had its bonds plummet by nearly 67 cents on the dollar last week in a shocking sell-off prompted by a missed loan payment by another group subsidiary. This comes just 4 months after its US$300 million debut bond issuance, which was rated BB-/BB- (S&P/Fitch) in line with the issuer. DMDT’s bonds had garnered over US$1 billion in investor orders, despite the issuer being a private company and sourcing 100% of its raw materials from the Duniatex group’s yarn spinning affiliates, the lack of adequate disclosure and investor concerns about financial transparency on affiliate transactions.

Bond Market Data & Bespoke Workflow Solutions for Bond Market Professionals - BondEvalue. HSBC 6% Perpetual - US404280BL25 - Bond Price. Bank Of China 5.9% Perpetual - US06428YAA47 - Bond Price. Perpetual Bonds - BondEvalue. China High Yield Bonds - BondEvalue. Masala Bonds - BondEvalue. ICTSI, BOCOM, Greentown Launch $ Bonds; Delhi Int Airport Downgraded; Pemex Defers Payments to Contractors - BondEvalue. Asian markets are opening lower this morning despite a good rally overnight in western markets. Following the strong NFP number last week, the US ISM services index came out yesterday at 57.1 for June compared to 45.4 for May prompting confidence in the economic recovery. Amazon and Tesla led a 2.2% rally in Nasdaq that closed at its all time high while the S&P and DJI gained 1.6% and 1.8%.

Treasury yields were higher by around 1-2 bps across the curve. IG CDS (Term of the day, explained below) spreads in the US and Europe narrowed 2-4 bps. Monday also saw $8.5bn in issuance in the Asian dollar bond market led by Mizuho Bank and Nomura Holdings. We have introduced new dates to our Bond Traders’ Masterclass in August. PTT Launches $ Bond; BBVA Issues First EUR Green CoCo; Braskem Downgraded to Junk - BondEvalue. Posh Spice; Only high-quality Masala bonds to be permitted under new RBI regulations - BondEvalue. CoCos Dive Again; Softbank & WeWork Bond Yields Spike - BondEvalue. Asian markets struggled on Wednesday despite stimulus spending plans announced by various governments as the threat from a global recession loomed. S&P Global has forecast a global recession this year and their economists estimate world GDP growth in 2020 will be just 1.0%-1.5%, with risks remaining firmly on the downside.

“The initial data from China suggests that its economy was hit far harder than projected, though a tentative stabilization has begun,” said S&P Global’s Chief Economist Paul Gruenwald. “Europe and the U.S. are following a similar path, as increasing restrictions on person-to-person contacts presage a demand collapse that will take activity sharply lower in the second quarter before a recovery begins later in the year.”

Overnight, the US administration discussed a $1 trillion stimulus plan, the UK announced a $420 billion lifeline for corporates and France said it would guarantee 300 billion euros worth of loans. Sign up for the daily newsletter here CoCos Dive Again. First High Yield Issue by Yum Brands After Weeks of Lull; Sri Lankan Bond Prices Lower - BondEvalue. As the worst quarter for global equities since 2008 comes to a close, investors see some hope from the wide stimulus measures. The US and other developed markets continue higher in contrast with Asian and other emerging markets that are still struggling to find some ground and had mixed moves.

Emirates NBD & JG Summit Launch $ Bonds; World's Most Valuable Carmaker Is Rated Junk; Lufthansa Downgraded; TAQA Upgraded - BondEvalue. Sentiment picks up as positive news about an early vaccine trial along with good economic data sent Wall Street higher. Nasdaq hit a new record. NFP for June at a Record High of +4.8mn; US Junk Bond Funds Witness Big Outflows; SAIC to Buy Stake in CAR Inc - BondEvalue.

Stronger than expected US NFP data of 4.8 million in June vs 3 million expected gave a knee-jerk rally for stocks. The unemployment rate also fell to 11.1% from 13.3% last month. The intraday rally was short-lived and reversed much of the gains as many are concerned that the recent spike in coronavirus cases is stalling the recovery. ICTSI, BOCOM, Greentown Launch $ Bonds; Delhi Int Airport Downgraded; Pemex Defers Payments to Contractors - BondEvalue. Nomura, BDO Launch $ Bonds; Fitch Expects More Sovereign Downgrades.

Markets are opening higher this morning despite a lack of any major news. The US was on holiday on Friday for Independence Day and US index futures are recovering Friday’s losses this morning and then some. July 3rd saw the record for daily cases globally but investors still find comfort from recent economic data that economies are picking up. Trade Fractional Bonds on an Electronic Bond Exchange – BondbloX by BondEvalue. The Troubled Bond Market - When Sellers Can’t Sell and Buyers Can’t Buy - BondEvalue. Aberdeen Says There Is Little Value Left in Bonds - BondEvalue. Q2 Sees 81% of $ Bonds Trade Higher, MTM Gain of $226bn, Record Global Issuance of $646bn - BondEvalue. It was the best of quarters, it was the worst of quarters. As Q2 2020 came to a close, many equity markets saw some of their best performances this quarter despite the world being in the midst of a pandemic that has impacted almost every individual, business and government.

Central banks have taken never-before-seen stimulus measures to tackle a drop in economic activity during a time when most of the world came to a standstill. BondEvalue Unveils BondbloX - World’s First Blockchain-Based Bond Exchange - BondEvalue. Press Release4 November 2019 Platform to launch via the Monetary Authority of Singapore’s Sandbox ExpressBondEvalue to make bonds accessible by reducing denominations to US$1,000. Where Can Bond Investors Find Bond Prices? - BondEvalue. Before we get into details about where investors can find bond prices, it is important to understand how bonds are traded and how the trading process is different from stocks.

Trading Process for Stocks vs. Thai Oil, MGM Launch $ Bonds; Garuda Extends Sukuk Maturity by 3Y; Delta Issues $1.25bn 5Y Bonds - BondEvalue. Markets have turned defensive after a gloomy FOMC meeting where Fed officials said that they would keep interest rates close to zero until at least the end of 2022 and that it would take years to bring joblessness back to pre-pandemic levels. SMFG & Times China Launch $ Bonds; S&P 'Junks' Axis Bank & PFC; Fed Discloses Bond Purchases - BondEvalue. A Sea of Red; Wynn Macau Launches $ Bond; EU Proposes Relief Measures for Banks Bond market - Download - 4shared - Bond Evalue. Perpetual Bonds - Impact of Call Dates and Resets on Prices - BondEvalue by bondevalue123. BEA Launches $ Bond; US IG Issuance Crosses $1tn; Sri Lanka Says It Won't Default, $ Bonds Rally - BondEvalue. Tata Motors Downgraded; BoE Ramps Up Purchases by £100bn; ECB Offers Loans to Banks at -1% - BondEvalue. PLN, Fosun, CLP Power & Minor Int Launch $ Bonds; Aeromexico Considers Filing Chp 11; Modernland & Grupa Posadas Downgraded.

CoCo Bonds - BondEvalue. Sovereign Bonds - BondEvalue. Perpetual Bonds - Key Risks to Know Before Investing - BondEvalue. BondEvalue: Sino-Ocean Cap, Agile, Ronshine Launch $ Bonds; Hilong Defaults; Lufthansa Deal Hits Roadblock. SG Technologies Launches S$ Perp; Austria Sells 100Y Bond at 0.88%; Canada Loses AAA Rating - BondEvalue. Occidental, Serba Dinamik, Omani Corporates Downgraded; Bain Cap to Buy Virgin Australia - BondEvalue. NFP Estimate -7.5mn; Vedanta Seeks to Amend Covenants; FAB to Redeem $750mn AT1s; BEV Term of the Day: STAGFLATION - BondEvalue % Perpetual Bonds - Impact of Call Dates and Resets on Prices - BondEvalue. A Sea of Red; Wynn Macau Launches $ Bond; EU Proposes Relief Measures for Banks - bondevalue’s diary. Trade Fractional Bonds on an Electronic Bond Exchange – BondbloX by BondEvalue. Oil Rallies On A Tweet; Tata Motors & JLR Ratings Cut; HSBC & Agile Group’s Outlook Negative.

BondEvalue: BondEvalue Unveils BondbloX – World’s First Blockchain-Based Bond Exchange. DJIA Rallies 11%, Dollar Halts Rally, Bond Prices Take a Breather. Bond Evalue — Perpetual Bonds - Impact of Call Dates and Resets... A Sea of Red; Wynn Macau Launches $ Bond; EU Proposes Relief Measures for Banks - bondevalue’s diary. Bond Market: NFP Estimate -7.5mn; Vedanta Seeks to Amend Covenants; FAB to Redeem $750mn AT1s; BEV Term of the Day: STAGFLATION. Tata Motors Downgraded; BoE Ramps Up Purchases by £100bn; ECB Offers Loans to Banks at -1% - BondEvalue.

High Yield Bonds Lead The July Recovery. Where Can Bond Investors Find Bond Prices? - BondEvalue. Trade Fractional Bonds on an Electronic Bond Exchange – BondbloX by BondEvalue. Track Live Corporate Bond Prices Online on Mobile - BondEValue. Green Bonds – Everything You Need to Know. Asian Dollar Bond Market Seeing Tremendous Interest for the First Time in Years. Corporate New Bonds Hong Kong - BondEvalue by bondevalue123. Corporate Bonds Hong Kong - BondEvalue by bondevalue123. Masala Bonds – Everything You Need to Know – BondEvalue. Who are the issuers of green bonds? Corporate Bonds Hong Kong - BondEvalue. Track Live Corporate Bond Prices & Manage Your Bond Portfolio on Mobile by bondevalue123. Track Live Corporate Bond Prices & Manage Your Bond Portfolio on Mobile. Indian Dollar Bonds Outperform; Brazil's Bonds Under Pressure; BoA Sells $1bn COVID-19 Bond - BondEvalue. Australia's Outlook Lowered; Maldives Downgraded; L Brands Bonds Rise on Bath & Body Works' Earnings; Fallen Angel List - BondEvalue.

Track Live Corporate Bond Prices Online on Mobile - BondEValue. Asian Bond Market News Hong Kong – BondEvalue. Masala Bonds – Everything You Need to Know. Bank Of China 5.9% Perpetual - US06428YAA47 - Bond Price. Junk bonds. Masala Bonds - BondEvalue. What are Investment Grade Bonds? Decoding The Robust Growth Of Bond Market Hong Kong. Some Interesting facts Revealed on issuance of Bonds. Bond yields.