Tax Tips for Online Entrepreneurs. A quick look at money-saving deductions, how to classify the people who work for you and more When tax time rolls around, you can hear the collective groan of all the businesspeople who have to start sorting their financial records and finding out just how much they're going to have pay the government this year.

Chances are that even though you operate an online business, you're feeling pretty much the same way as the dreaded tax season approaches. However, there are some facts about your taxes that might help ease your woes. For example, do you operate your business from your home? The majority of online entrepreneurs do, and that entitles them to take some significant tax deductions if you meet certain IRS conditions. Do I Have to Pay Taxes for an Internet Business? Tax on Internet Sales. TurboTax® Tax Preparation Software, FREE Tax Filing, Efile Taxes, Income Tax Returns.

How Much Self-Employment Tax Will I Pay? Self employment taxes are comprised of two parts: Social Security and Medicare.

You will pay 6.2 percent and your employer will pay Social Security taxes of 6.2 percent on the first $117,000 of your covered wages. You each also pay Medicare taxes of 1.45 percent on all your wages - no limit. If you are self-employed, your Social Security tax rate is 12.4 percent and your Medicare tax is 2.9 percent on those same amounts of earnings but you are able to deduct the employer portion. You will pay an additional 0.9% Medicare tax on the amount that your annual income exceeds $200,000 for single filers, $250,000 for married filing jointly, and $125,000 married filing separate. Use this calculator to estimate your self-employment taxes. This information may help you analyze your financial needs. Taxation in the United States. The United States of America is a federal republic with autonomous state and local governments.

Taxes are imposed in the United States at each of these levels. These include taxes on income, payroll, property, sales, imports, estates and gifts, as well as various fees. In 2010 taxes collected by federal, state and municipal governments amounted to 24.8% of GDP. In the OECD, only Chile and Mexico taxed less as a share of GDP.[1] The United States also has one of the most progressive tax systems in the industrialized world.[2][3][4] A Beginner's Guide To America's Tax System. Beginner's guide to tax : Directgov - Money, tax and benefits. Reporting Your Taxes. Visual Artists.

ShareThis.

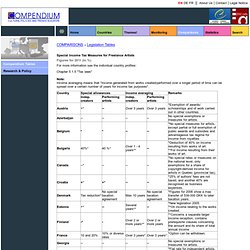

Special Income Tax Measures for Freelance Artists. Figures for 2011 (in %) For more information see the individual country profiles: Chapter 5.1.5 "Tax laws" Note: Income averaging means that "income generated from works created/performed over a longer period of time can be spread over a certain number of years for income tax purposes".

Sources: Council of Europe/ERICarts Compendium of Cultural Policies and Trends in Europe, 12th edition 2011, based on data provided in the country profiles (chapter 5) and on compilations of the ERICarts Institute for the study "The Status of Artists in Europe", European Parliament. Additional information was found in the report by the European Arts and Entertainment Alliance (EAEA)"Study Relating to the Various Regimes of Employment and Social Protection of Cultural Workers in the European Union", 2002. Additional source material: UNESCO: The Artist and Society. Additional material. Artists Exemption Information and Guidelines. Section 195 Taxes Consolidation Act 1997 empowers the Revenue Commissioners to make a determination that certain artistic works are original and creative works generally recognised as having cultural or artistic merit.

The first €40,000 per annum of profits or gains earned by writers, composers, visual artists and sculptors from the sale of their work is exempt from income tax in Ireland in certain circumstances. The €40,000 limit was introduced in the tax year 2011. Guidelines have been drawn up by the Arts Council and Minister for Arts Heritage and the Gaeltacht, with the consent of the Minister for Finance, for determining for the purposes of Section 195 whether a work is an original and creative work and whether it has, or is generally recognised has having cultural or artistic merit. The Revenue Commissioners may consult with a person or body of persons, such as The Arts Council, which may be of assistance to them in reaching decisions in relation to Artists Exemption. Back to Top. Artist's exemption from income tax. Information Income earned by writers, composers, visual artists and sculptors from the sale of their works is exempt from tax in Ireland in certain circumstances.

Section 195 of the Taxes Consolidation Act, 1997 allows the Revenue Commissioners to determine that certain artistic works are original and creative works generally recognised as having cultural or artistic merit. Earnings derived from these works are exempt from income tax from the year in which the claim is made.

Guidelines have been drawn up by for determining whether a work is an original and creative work and whether it has or is generally recognised as having cultural or artistic merit. The Revenue Commissioners may, having regard to the Guidelines, consult with a person or body of persons who may help them in reaching decisions in relation to Artist's Exemption. The Revenue Commissioners can make determinations in respect of artistic works in the following categories: Artist directory for western states.

An archive of articles with tips and information about art as a profession.

Any comments, questions, suggestions, please Contact Us March 2, 2000Tax Filing for Artists Stephen J. Drahos Once an artist jumps into the commercial arena, the most important aspect of the artist's business (besides making a profit) is the filing of taxes. This article will explain the various types of taxes affecting an artist and give some general guidelines on certain pitfalls to avoid. The New Tax Guide for Aritsts of Every Persuasion. ShareThis CLICK HERE to order from Amazon.com CLICK HERE to order from Barnes & Noble The New (5th Edition) Tax Guide forWriters, Artists, Performers & Other Creative People, by Peter Jason Riley, CPA is the only complete tax guide available specifically for the working artist.

Now in its fifth edition, available January 2012 from Focus Publishing. My goal in writing this book was to give the artist an overall understanding of the unique aspects of taxation for people in the arts. Tax Information for Self-Employed « Homepreneurs's Blog. The tax information below comes directly from the IRS website.

Contrary to popular belief, the IRS can be quite helpful and has many resources available for small and home business. The IRS website is full of useful information, links to forms and publications, and a list of frequently asked questions. They have information for small business, individual business, partnerships, tax professionals and more. If you are confused about taxes – who isn’t – the IRS site or their contact line probably has an answer for you. Beginner's Guide To Tax Efficient Investing.

Tax efficiency is essential to maximizing returns. Due to the complexities of both investing and U.S. tax laws, many investors don't understand how to manage their portfolio to minimize their tax burden. Internal Revenue Service. Small Business and Self-Employed Tax Center - Your Small Business Advantage. Types of Taxes You Pay When Running a Small Business. Www.irs.gov/pub/irs-pdf/f1040.pdf. Www.irs.gov/pub/irs-pdf/p505.pdf. Tax Code, Regulations and Official Guidance. Tax. Social Security Publications. Most people who pay into Social Security work for an employer.

Their employer deducts Social Security taxes from their paycheck, matches that contribution and sends taxes to the Internal Revenue Service (IRS) and reports wages to Social Security. But self-employed people must report their earnings and pay their taxes directly to IRS. You are self-employed if you operate a trade, business or profession, either by yourself or as a partner. Personal - Retirement Plans. Almost everyone can benefit from a First Bank retirement plan. Start enjoying the benefits of a retirement account and make your future more secure. Now, more than ever, a First Bank retirement plan can help you achieve your financial goals. Compare IRA plans To find out more about our Individual Retirement Plans, call or visit the First Bank location nearest you. Personal Retirement Accounts. Nothing is more important to America’s economic future than the development of a workforce with the skills and knowledge required to compete in the global economy.

That development starts in the classroom and extends the length of a working person’s career. The reality, however, is that America’s K-12 education system is not adequately preparing students for careers or postsecondary education, and worker training programs are not, in many cases, teaching the skills demanded in the marketplace. Retirement Planning and Savings Plans - Retirement Calculator - Money Magazine. One do-it-yourself option is to use an online portfolio analysis tool. Personal Retirement Plans.