Family Travel Insurance Plans

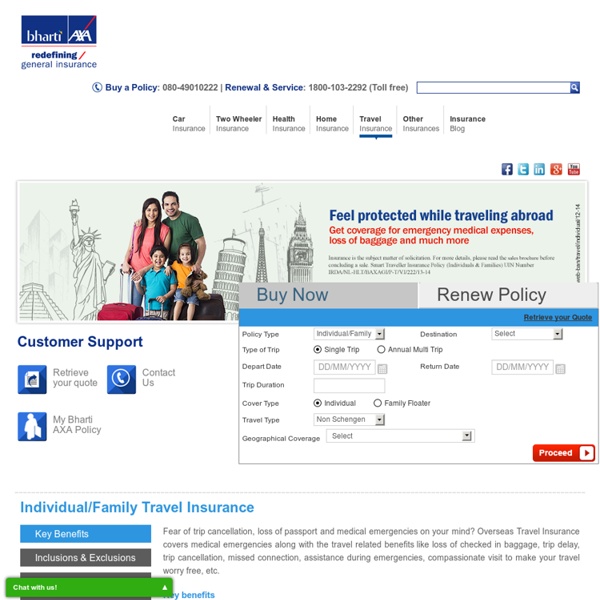

Fear of trip cancellation, loss of passport and medical emergencies on your mind? Overseas Travel Insurance covers medical emergencies along with the travel related benefits like loss of checked in baggage, trip delay, trip cancellation, missed connection, assistance during emergencies, compassionate visit to make your travel worry free, etc. Key benefits Instant policy, no health check-up up to 70 years Wider and affordable overage 24x7 worldwide AXA assistance Recognized by Schengen* Embassies Covers all travel related emergencies What is Schengen Area comprising of 26 European countries. We have 3 products as per your needs 1. This is for the people travelling to major countries like US, UK, Canada, Japan, Australia etc. Find Out More 2. If you are travelling to Schengen countries, travel Insurance is compulsory. Find Out More 3. We recommend Annual Multi Trip plan in case you travel abroad more than once in a year. Find Out More

http://www.bharti-axagi.co.in/travel-insurance/individual-family-insurance

Medical Insurance Policy

With Bharti AXA GI’s Comprehensive Health Insurance plans you can enjoy product benefits that address not just your health insurance needs but the requirements of your entire family. Pick from any of our three affordable plans that provide you with the flexibility to suit your needs and budget. Bharti AXA GI offers 3 innovative plans – Rs 2 lakhs, Rs 3 lakhs and Rs 5 Lakhs Plans on Rs.3 lakhs and Rs.5 lakhs provide double the sum insured in case of a critical illness. What’s more is that this amount could be received in form of lump sum compensation that can help not just with hospitalization costs but daily expenses too. (As shown in TV commercial) Refer table below.

Bike Insurance Renewal

Let go of all concerns of liability, theft and accident and enjoy an untroubled worry free ride with Bharti AXA GI’s Two Wheeler Insurance. Our product gives you access to a vast pan India cashless network constituting over 2,000 garages. Enjoy benefits of 24x7 claims assistance and the convenience of hassle free claim settlement process.

Best Retirement Plan-Exide Life

Who should buy? This plan is suitable for you if you have a child (with up to 15 years of age). Key Features Min / Max Entry Age

Car Insurance Online: Policy, Quotes & Renewal

Choosing the right car insurance is as important as choosing of the right car. At Bharti AXA, we make this process simple for you. Key benefits Instant policy 24 X 7 Claims help Get Cashless claims at 2700+ garagesGet No Claim Bonus up to 50% 12 Add on covers to choose from Road side assistance Accident death coverage for other passengers up to 2 lakhs

ULIP Plans from Exide Life Insurance

What is Exide Life Wealth Maxima? Your goals and responsibilities increase with every growing stage of life. No wonder, there is a need to invest to not only maximize your wealth but also ensure a strong financial foundation to realize your goals. Presenting Exide Life Wealth Maxima, a Unit Linked Insurance Plan that not only helps make the most out of your wealth but also adapts to offer higher life cover at every new phase of life.

ULIP Plans from Exide Life Insurance

What is Exide Life Wealth Maxima? Your goals and responsibilities increase with every growing stage of life. No wonder, there is a need to invest to not only maximize your wealth but also ensure a strong financial foundation to realize your goals. Presenting Exide Life Wealth Maxima, a Unit Linked Insurance Plan that not only helps make the most out of your wealth but also adapts to offer higher life cover at every new phase of life. Funds available under this product

Exide Life My Term Insurance

What is Exide Life My Term Insurance Plan? A pure term insurance plan allows you to build strong family's financial foundation at a nominal price. Life cover starting 25 lakhs to 25 crore Limited premium payment options

Monsoons are here

Monsoons are here: Get maximum protection for your car with these motor insurance add-on covers While monsoons for you mean lush green foliage and curling up with a good paperback and a steaming cup of coffee, for your car it’s four months of constant wading through floods, engine issues, and mouldy closed-car smell. Whether it is breakdown due to being stranded in flood or rusting of exposed metallic car parts, monsoons can wreak havoc on your car and the worst part is that your motor insurance might not even cover these damages. A basic car insurance policy may not be sufficient:

2-Minute Guide to Sub-Limits in Health Insurance

Quick question: Your health insurance cover is Rs. 2 Lakh, your medical bill is Rs 1 Lakh. How much of your bill will get reimbursed when you make a claim? Most people think that they will get full reimbursement of the medical bill. Well, not really! There is a possibility that you will only be partially reimbursed by your insurer. Which means you have to pay the balance amount of the bill from your own pocket despite having an insurance policy.

Is your company insurance enough to cover for a major illness?

Approach anyone for advice on choosing the right health plan and they would undoubtedly suggest taking one with a low or no deductible. With close to 1,300 Indians succumbing to cancer every day and obesity already having reached epidemic proportions, Indians are facing more health problems than ever. It’s not just the health concerns that are inching upwards but also healthcare cost. While a common Heart Valve Surgery would cost anywhere around Rs. 1,00,000 – 3,50,000, the cost of a liver transplant will easily reach Rs. 30 lakhs and up. Even the annual cost for a diabetic comes to Rs. 10,000 and a regular full body health check-up is anywhere between Rs. 12,000 – 15,000. Almost every company these days provide health care benefits to its employees, with 96% providing for at least hospitalization cost.

Related:

Related: