'Labor Union Decline, Not Computerization, Main Cause of Rising Corporate Profits' I haven't read this paper, so I can't say a lot about how much confidence to place in the results, but it did grab my attention (and I believe it's in one of the top journals for sociology): Labor union decline, not computerization, main cause of rising corporate profits, EurekAlert : A new study suggests that the decline of labor unions, partly as an outcome of computerization, is the main reason why U.S. corporate profits have surged as a share of national income while workers' wages and other compensation have declined.

The study, "The Capitalist Machine: Computerization, Workers' Power, and the Decline in Labor's Share within U.S. Inequality and Institutions in 20th Century America by Frank Levy, Peter Temin. Frank S.

Levy Massachusetts Institute of Technology (MIT) - Department of Urban Studies & Planning Peter Temin Massachusetts Institute of Technology (MIT) - Department of Economics; National Bureau of Economic Research (NBER)June 27, 2007 MIT Department of Economics Working Paper No. 07-17. Aljazeera on Income Disparity in the US. A Guide to Statistics on Historical Trends in Income Inequality. The broad facts of income inequality over the past six decades are easily summarized: There Will Be Rich Always: Finding a New Way to Think About Income Inequality. On Monday, Aaron Edlin and I published a cri de coeur op-ed in the New York Times calling for a Brandeis tax, an automatic tax that would put the brakes on income inequality.

The Great Decoupling of Income Growth for Middle-Class Households. David Ignatius Hides Upward Redistribution Policies as Market Outcomes. People are inclined to give much more legitimacy to market outcomes than policy outcomes engineered by governments.

Niall Ferguson: A Conservative Take on America's Economic Divide. The One Percent. Real Wages Remain Below Their Peak for 39th Straight Year. The release last month of the Economic Report of the President has elicited a great deal of commentary, but none that I have seen touches on what I consider the best measure of long-term income trends, real weekly wages of production and non-supervisory workers, which is contained in Appendix Table B-47, "Hours and earnings in private non-agricultural industries, 1965-2011.

" According to a Bureau of Labor Statistics staffer I spoke to some years ago (so the percentages may have changed slightly), this covers 62% of the entire workforce and 80% of the non-government workforce. This lets us focus on average workers and excludes what is happening to high-salary workers. Using weekly rather than hourly real wages takes out the impact of varying hours worked per week over the years. The table below extracts from B-47 to reduce its size. The inflation is adjusted using 1982-84 dollars as its base. Loading ... There are other ways to track the income of average workers. Attention Americans: You Won’t All Be Rich Tomorrow. (Source: Census.gov)> If we were all to become suddenly rich tomorrow, the government’s revenue problems are solved at the current tax rates, so no worries in that case.

But I place long odds on that, so let’s move on to what’s actually happening. It’s as if the entire country has turned into Lake Wobegon, as if we’ve been overcome by an epidemic of illusory superiority. As I’ve watched the Republican debates, I’ve listened closely for the applause lines, paid close attention to the questions and answers. I also keenly read a variety of papers and occasionally watched Fox News. My conclusion? I am convinced that when President Obama mentions raising taxes on “the wealthiest Americans,” everyone thinks he is talking about them. Poverty Rate Highest Since 1993; Median Income Reveals Lost Decade and a Half. Both official data and numerous news stories confirm how badly average citizens have fared in the wake of the global financial crisis.

Food stamp use has fallen only a tad from record high levels. WalMart has reinstituted layaway. The average home with a mortgage has no equity in it. Further confirmation comes via the Census Bureau release that showed the US poverty rate has risen a full percent in the last year to 15.1%, a level not seen since 1993, the end of a short but nasty downturn. And 1/4 of American children are living in poverty. “To have hit 15.1 per cent is truly extraordinary,” said Alice O’Connor, a professor who studies poverty at the University of California, Santa Barbara. Median income plunged 2.3% in 2010, is are down a full 7% from their high in 1999.

Study: America's Wealth Not Widely Distributed. Copyright © 2011 NPR.

For personal, noncommercial use only. See Terms of Use. For other uses, prior permission required. There's America—and Then There's Washington - Andrew Cohen - Politics. Does the prosperity of the capital region color the perspectives of the journalists and lawmakers who live there?

Rob Shenk/Flickr Over at Harper's, Thomas Frank has an interesting essay that touches, among other things, on the destructive disconnect that exists between Washington, D.C., and the rest of the nation. I've written about this growing gulf from a political perspective. I've written about it from a media perspective. But Frank writes about it from an economic perspective and expresses quite eloquently what those of us outside Washington, D.C often think of what goes on there. Frank's piece, "The Bleakness Stakes," isn't yet freely available online. Washington's optimism isn't that hard to understand, really. Frank continues: While the familiar critique of Washington insularity gets some important facts wrong -- most federal employees are, for example, paid considerably less than people doing equivalent work in the private sector -- it gets the big story right.

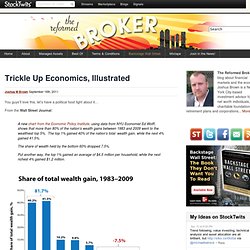

Trickle Up Economics, Illustrated. You guys’ll love this, let’s have a political food fight about it… From the Wall Street Journal: A new chart from the Economic Policy Institute, using data from NYU Economist Ed Wolff, shows that more than 80% of the nation’s wealth gains between 1983 and 2009 went to the wealthiest top 5%.

15 Mind-Blowing Facts About Wealth And Inequality In America.