IndiaBulls. RBL Bank Limited. Citi Bank. ICICI Bank. Kotak Mahindra Bank. HDFC Bank. HDFC Bank. Sbi pic. Tata capitall. Loans from Tata Capital Financial Services Limited. Canara Bank. Get loan from Canara Bank @ Lowest interest rates. CANARA BANK was established by Shri.

Ammembal Subba Rao Pai, who was an ambitious and futuristic patron. The bank observed a remarkable growth and significant success during its long journey of over a century. Bajaj. Bajaj Finance Limited. Bandhanbank. Get Loan from Bandhan Bank Limited. Bandhan Financial Services Limited was established in the year 2001 under the chairmanship of Mr.Chandra Shekhar Ghosh who has been awarded as “Entrepreneur of the Year” by Forbes 2014 and Economic Times 2014.

BSFL has been actively providing loans to small borrowers, who had no or minimal access to any proper financial services. Over the last 15 years, BSFL has achieved immense integrity as well as honour for taking up the task of financing an average entrepreneur. Get Loan from IDBI Bank Limited. IDBI Bank Limited is one of the largest commercial banks in India.

The bank has been playing a role of nation-building for over a period of 40 years, initially as Development Financial Institution (DFI) from 1 July 1964 to 30 September 2004 in the financial sector and later as a full service commercial Bank from 1 October 2004 on wards. IDBI was converted into a banking organization on 1 October 2004 which is today known as Industrial Development Bank of India Limited(IDBI).

IDBI Bank broadened its scope of financial services by offering a spectrum of services apart from project financing across various regions in the country with a revived and renewed enterprising spirit and development of a dynamic capital market. The bank is one of the young and dynamic bank that has an aggregate Balance sheet of Rs. 3,56,031 crores and total business of Rs. 4,68213 crores at the financial closure of the year 2015 along with the net profit after tax of Rs. 837 crores.

Home Loan. HDB Finance Services. Get Loan from HDB Financial Services Limited. HDB Financial Services Limited is a subsidiary company of Housing Development Finance Corporation (HDFC).

HDFC was one of the pioneer banks to obtain an “in principal” approval from Reserve Bank of India (RBI) to operate as a private bank, together as a part of RBI’s liberalization of Indian Banking Industry in the year 1994. The bank was established in August 1994 under the name of HDFC Bank Limited with its headquarters in Mumbai, India and it started its operations as a Scheduled Commercial Bank in January 1995. HDB Financial serves a large segment of clients through various types of financial schemes and services. The bank provides various secure as well as unsecured loans to a large segment of clients. The bank is keen in meeting the need of a common man right from home loan, children’s education loan, your holiday package to your marriage, the bank has specialized products to meet your requirement and a dedicated team of professionals to guide you.

Choose Loan against Securities at lowest ROI. Leverage your investments in securities for loans “to meet unforeseen expenses.

You can Avail Loan against Securities for meeting contingencies and needs of personal nature. From Debentures to Life Insurance Policies you can pledge your securities and investments to get loan for meeting your surprised unexpected expenses. Now a days the demand of loan against securities are rising in India. Fullerton india. Reasons to avail Business Loans from Fullerton India. About Fullerton India Credit Company Limited Since its launch in January 2007, Fullerton India has successfully and strongly established itself, spread across the country's broad financial landscape, with a network of over 445 branches and serving over a million customers.

Our primary services constitute financing of SME for working capital and growth, loans for commercial vehicles and two-wheelers, home improvement loans, loans against property, personal loans, working capital loans for urban self-employed and loans for rural livelihood advancement, rural housing finance and financing of various rural micro enterprises.

Reasons to take Home Loan from India Bulls. About Indiabulls Indiabulls Housing Finance Ltd.

(IBHFL) ranks as the 2nd largest private sector housing finance organization in India. Indiabulls is regulated by the National Housing Bank (NHB). The organization bears the highest rating of AAA from CARE ratings and Brickwork ratings. Car refinance. Get Car Refinance Loan with lowest interest rates. Taxi car letzbank.

Avail a Taxi Car Loan from Letzbank @12.99% Loan against Developers Property at lowest ROI. Certain things are to be taken care of by the developer.

He needs to focus on the finer details of the project he is working on. This includes is not limited to: type of property and/or development; necessary funds; and a basic timeline. He should review his project from time to time and determine what type of loan product is best.Financing through us is not only the best option, but it's a smart choice. Non-recourse real estate loans are hard to come by right now. Complete the application process and we will see if you are right for this loan product.Our tie ups with almost every financial institution across the country help us to serve you betterOur top lending partners pan India offers you valuable and affordable deals that the customer can’t resist.Our service end will give you the best and fast service as we are looking forward to excel in this cadre.

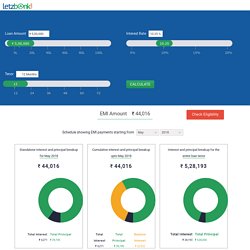

Year after year, the commercial real estate development financing market changes evolves. Get Commercial Equipments Loans @ 10.15% Get Gold Loan in financial need at lowest ROI. Educational Loans for a bright future @ 11.99% Get business loan for related financial needs. Get business loan for related financial needs. Personal Loan at quick approval and lowest ROI. Car Loan EMI Calculator. EMI Calculator for Car Loan Turning your dream into reality is now made very easy.

Own your favourite car that you have always dreamt for with attractive features from our incredible letzbank.com. Here we come forward with the following features to serve you better 1. Loan amount up to 100% of ex-showroom price 2. Loan tenure up to 7 years 3. Parameters required for calculating the Car Loan EMI is as follows Loan amount - Enter the loan amount you wish to borrow. How it works and what you can see on the screen As soon as you enter the specific inputs you get the EMI for your car loan. Why to Use the Car loan EMI calculator by Letzbank.com? Following are the advantages for the same 1. Reasons to avail Home Loans from LIC.

LIC Housing Finance Ltd. is one the leading Housing Finance organization in India.

LIC Housing Finance Ltd. was established dated 19 June, ¸under the Companies Act, 1956. The main objective of the LIC Housing Finance Ltd is to provide loan term finance for • Purchase or construction of a residential (Flat/House) • Repair and renovation of existing flats or houses. • The firm also provides finances on existing property for business as well as personal needs • Professional loans - for purchase or construction of Clinics, Nursing Homes, Diagnostic Centres, to procure an office Space and also for purchase of equipments.

Avail Home Loan from Kotak Mahindra Bank. About Kotak Mahindra Bank Kotak Mahindra Bank is the fourth largest bank in India was incorporated in the year 1985 by Mr. Uday Kotak to offer infinite solutions and possibilities for financial needs of Indian lives. Kotak Mahindra Finance Limited (KMFL) the flagship organization for Kotak group received its banking license from the Reserve Bank of India (RBI) in February, 2003. With the license obtained by KMFL, KMFL merged as the first non-banking organization to be transformed into a bank now known as Kotak Mahindra Bank Limited (KMBL). As per the study of Brand Finance Banking 500, that was published in February 2014 by Banker Magazine, KMBL ranks 245 among leading 500 banks in the world with its brand evaluation of around half a billion dollars ($481) and brand rating of AA+ .

Avail Personal loan from Kotak Mahindra Bank, Apply Today at Letzbank. Kotak Mahindra Bank, bears the position of being the fourth largest bank in the country. The bank was established in 1985 by Mr.Uday Kotak with an aim to meet the financial needs of many Indians. Personal Loans with Kotak Mahindra Bank • Attractive loan amount starting from Rs.50,000/- to Rs. 20,00,000/- Any salaried individual can apply for a personal loan varying from Rs.50,000 to Rs.20,00,000 for any type of personal requirement such as planning vacations, travel, weddings, etc. • Longer tenure upto 5 years.

Top 5 Banks for Personal Loans. Get one step closer to achieve your dreams and goals by availing Personal Loan. To meet all your personal unexpected expenses from travelling to shopping, dream wedding to repay your hand loans, buying consumer items to some newly introduced gadget in market, house renovation to educational expenses etc. Personal Loan details for Individuals- Eligibility: Almost all banks offer personal loans to individuals.

You should be minimum 21 years of age to avail a Personal Loan. 9 Perfect Reasons to Avail a CAR LOAN! 1. End of the Year Sale on Cars December often comes with offers that would drive you crazy with numerous exciting offers on your cars. Often car dealers come up with exiting offers to sell of their stock for that year. And you do not want to miss on such offers to drive home your dream car. 5 Reasons to avail your Personal Loan with Letzbank. Personal loan - The only difference between ordinary and extraordinary is that little “Extra” and when it comes to little “Extra Money” who does not want it? Everyone aspires to have that bit extra money for endless reasons, like wedding round the corner, planning your dream vacation, travelling, furnishing your homes, immediate cash need.

Personal loans surely are the quickest and easiest way of meeting your need, here are some reasons why: 1. Personal Loans are Easy to Avail It is now easy to avail a personal loan when you need it without any hassle. Professional Loan for Doctors, CA, CS and Architects! Best Education Needs Best Education Loan! Get Home-Sweet-Home-Loans Today!!!