Commentaries - Warren Bevan. We’re in the midst of an amazing run off the recent lows in the stock market.

As tempting as it is to buy some of leaders now, I think it would be a grave mistake. Nothing goes straight up so we have to be patient and wait for the proper buy points. Gold and silver had a nice week and look ready to move one way or the other in the next couple days and the mining stocks are unbelievably cheap right now. If you’re not close to, or already accumulating these mining stock that are on sale then you’ve got to really take a hard look at things. We are not going through another 2008, so as far as I can see the low has already been put in for most mining stocks. Fortunes will be made from owning the right miners going forward. Metals review Gold rose 2.47% for the week and contrary to most observers opinions on the technical picture I think it looks good here. Last week I said it was a toss up at the time if the pattern was a bearish bear flag or a bullish U pattern one.

Fundamental Review. Anwendungen von Silber in Industrie - Angebot und Nachfrage. Das chemische Symbol „Ag“ leitet sich vom lateinischen Wort Argentum für „Silber“ ab.

Silber ist ein chemisches Element der Kupfergruppe. Silber ist ein weißglänzendes Edelmetall mit einzigartigen physikalischen und chemischen Eigenschaften. Es leitet von allen Metallen Elektrizität und Wärme am besten und hat eine ausgeprägte optische Reflexionsfähigkeit. Dadurch ist es für Anwendungen in Elektrik und Optik prädestiniert.

Silber hat eine Vergangenheit und vielleicht sogar eine Zukunft als Geld. Silberbestecke und Schmuck: Commentaries - Jeb Handwerger. The boards have been awash in a sea of red for precious metal investors.

After Operation Twist many forget the underlying reasons why the U.S. dollar (UUP) is rallying. A few weeks ago we highlighted that Japan(FXY) and Switzerland(FXF) fired a shot heard around the world in an attempt to remain competitive in the global marketplace. The rapid rise of the yen, a traditional safe haven currency, threatens Japan’s economic survival in an increasingly competitive world arena. This holds true for the Swiss as well. The franc and the yen were seen as safe havens compared to the U.S. The world markets sensing international monetary fear, regards Japan and Switzerland’s move as a shot across the bow. Will the Fed or European Central Bankers through a Euro TARP come riding to the rescue in time to avert further bloodshed? Operation Twist has gotten the market to ask, “May we have some more QE...please?” Commentaries - Jim Willie CB. Use the above link to subscribe to the paid research reports, which include coverage of critically important factors at work during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces.

An historically unprecedented mess has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy. Wow!! The billboard signals of extreme crisis are overwhelming. "Cash is King" : Gold fällt unter 1600 Dollar. Wirtschaft Montag, 26.

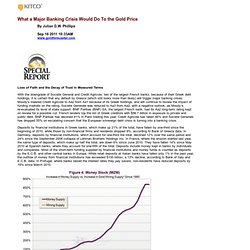

September 2011 Die Preise für Edelmetalle geraten zum Wochenauftakt stark unter Druck. Der Goldpreis rutscht erstmals seit Juli zeitweise wieder unter die Marke von 1600 US-Dollar, der Silberpreis bricht zweistellig ein. Neben der immer weiter steigenden Unsicherheit wegen der Staatsschuldenkrise belasten auch höhere Sicherheitsanforderungen am Terminmarkt die Gewinnaussichten. Angesichts wachsender Zweifel am Management der europäischen Schuldenkrise fliehen Anleger in hellen Scharen aus den Edelmetallmärkten. Commentaries. Loss of Faith and the Decay of Trust in Measured Terms With the downgrade of Societe General and Credit Agricole, two of the largest French banks, because of their Greek debt holdings, it is certain that any default by Greece (which still looks more than likely) will trigger major banking crises.

Moody’s lowered Credit Agricole to Aa2 from Aa1 because of its Greek holdings, and will continue to review the impact of funding markets on the rating. Societe Generale was reduced to Aa3 from Aa2, with a negative outlook, as Moody’s re-evaluated its level of state support. BNP Paribas (BNP) SA, the largest French bank, had its Aa2 long-term rating kept on review for a possible cut. Goldreporter. Silver Coin Melt Values - Coinflation.com (Updated Daily) Zitate zum Geldsystem - Die Wurzel allen Übels. Vollständige Version anzeigen : Zitate zum Geldsystem - Die Wurzel allen Übels Zitate zum Geldsystem - Die Wurzel allen Übels "Eigentlich ist es gut, dass die Menschen der Nation unser Banken- und Geldsystem nicht verstehen.

Würden sie es nämlich, so hätten wir eine Revolution noch vor morgen früh_" - Henry Ford (1863-1947), Gründer der Ford Motor Company "Die Wenigen, die das System verstehen, werden dermaßen an seinen Profiten interessiert oder so abhängig von seinen Vorzügen sein, dass aus ihren Reihen niemals eine Opposition hervorgehen wird. Gold.de - Edelmetall Preisvergleich für Gold, Silber, Barren und Münzen kaufen. FutureMoneyTrends.com. Silberinfo: Silber und Gold Investment Plattform. The online coin catalog. Kitco - Silver Page.