Eurozone in crisis in graphics: Deficit

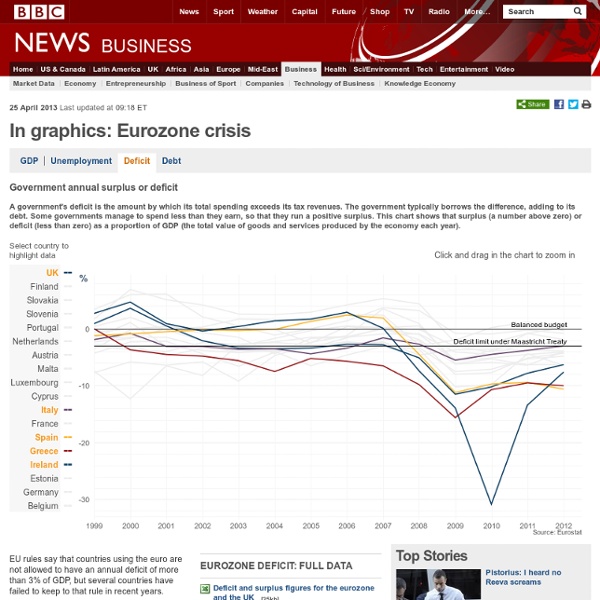

Continue reading the main story EU rules say that countries using the euro are not allowed to have an annual deficit of more than 3% of GDP, but several countries have failed to keep to that rule in recent years. Note that Germany, Italy and France were all among the first countries to break the Maastricht rule during the last decade, while Spain and the Republic of Ireland ran surpluses before the 2008 crisis. Since 2008, peripheral economies such as Spain, Greece and Portugal have run big deficits, because their economies have slumped, generating less tax revenues and requiring more unemployment benefit payments. Ireland experienced an exceptionally enormous deficit of 31% of its GDP in 2010, largely due to the cost of rescuing its banks. Italy, however, has faired surprisingly well. Send us your feedback

A tale of two economies – Greece and Iceland

Last Friday (March 9, 2012), the Greek government effectively defaulted on its public debt after the required minimum of 75 per cent of private creditors agreed to the so-called “haircut” or debt swap. I find it amusing how the Euro leaders have attempted to massage the default as a debt swap or some other euphemism. The facts are obvious – close to 100 per cent of those who are holding Greek government debt will lose at a minimum 53.5 per cent of the value of their assets. All the political elites in Europe (or most of them) seemed to be raising their Chardonnay glasses to toast a success. On Saturday (March 10, 2012) the Sydney Morning Herald reported in the article – Greek problem solved, Sarkozy says – while Germany warns – which predictably had the French leader making political statements in the face of his upcoming election and the Germans – being, well, Germans. Sarkozy was quoted as saying: Today the problem is solved … A page in the financial crisis is turning. Conclusion

Germany: A False Model at Reports from the Economic Front

As growing numbers of countries face renewed austerity pressures, there is a tendency to explain the trend by searching for specific policy failures in each country rather than considering broader structural dynamics. Key to the credibility of those who argue for a focus on national decisions is the existence of countries that people believe are performing well. Thus, the argument goes, if only policy makers followed best practices their people wouldn’t find themselves in such a bad place. Here is a typical framing of the German experience: At a time when unemployment rates in France, Italy, the UK, and the US are stuck around 8%-9%, many are turning to the apparent miracle in the German labor market in search of lessons. In other words, Germany seems to be doing things right. This development was far from accidental. The New York Times described the German employment miracle as follows: As the chart below shows, German wages have been stagnating for over a decade.

Related:

Related: