Methodology - the core The Stock Market, Canadian Stock Exchange | TMX Group Computershare Investor Centre enables you to have fast, secure access to your holdings. Log in or register to manage your account online or research market data. Existing User Login now to view your portfolio, access statements online. Login New User Create your User ID and password now to access all your Computershare holdings. Create Login Investor Centre Features View the balance of your holding View your payment history View your transactions Research the latest market data

Market News Bulletin Board - Sydney Stock Exchange - SSX Sydney Stock Exchange wins Most Innovative Stock Exchange Company 2016 Award Sydney 26 October 2016: The Sydney Stock Exchange has been awarded the prestigious Most Innovative Stock Exchange Company Australia award 2016. This is an award by a UK based financial information, research and media group, Global Banking and Finance. Sydney Stock Exchange CEO Tony Sacre, said “Its pleasing to be recognized by this prestigious global media for the work we have been doing and our unique position and market offer in the Asian region. "One of Sydney Stock Exchange’s core philosophies is to grow interconnectivity between Asian and Australian markets. “This award and these innovations illustrates how the SSX are approaching the market differently, collaboratively working with industry, and developing viable solutions and services. APX Settlements CEO, Mr. About Sydney Stock Exchange Sydney Stock Exchange is a part of the Asia Pacific Exchange Group. About APX Settlement Media Contacts: Hugh Fraser

Talking Trading Börse Berlin Link Market Services: Share Registry and Financial Services Provider Link Market Services Link Market Services Link Market Services (Link) is a leading global share registry and financial services provider. Read more about our business. Global Network Global Network The Link Group global network continues to grow with offices throughout Australasia, Asia, Africa, Europe and North America. Client Services Client Services Link's premium service offering is end to end, incorporating registry management, capital raisings and other corporate actions, employee equity solutions, and various specialist services. Community Link Community Link Link's Corporate Social Responsibility policy encourages workplace giving, and facilitates staff involvement in community and environmental initiatives.

Market News Bulletin Board - Sydney Stock Exchange - SSX The Sydney Stock Exchange were pleased to host their inaugural “From Startup to IPO” event at their offices in Sydney. It was a very well attended event, with over 40 founders of startup companies attending this event. The principal discussion was around the theme of what it takes to be a listed company, how one goes about raising capital in the Australian market, and how companies can work with the SSX to understand their listing requirements. Mr. George Wang, Chairman of AIMS Capital, meeting with Mr. Glen Frost, founder of FinTech Sydney, introducing the speakers during the ‘From Startup to IPO event” Sydney Stock Exchange CEO, Mr. Sydney Stock Exchange CEO, Mr. Stephen Moss, Black Citrus CEO, presented the guests on the current circumstances of global venture capital investment, discussing the reasons why Australia risk falling behind when comparing to the other regions such as North America and Asia. Glen Frost, the founder of FinTech Sydney, and BlackCitrus CEO, Mr.

Futures The calculator was a major leap forward in trading strategy implementation, not just in terms of how it streamlined the work of professional traders, but in how it allowed non-pros to use advanced trading techniques. As we saw in our first installment in this series, the calculator soon was supplanted by the computer and purpose-built software that did the heavy lifting for you. Profit Taker was the first commercial trading platform that could backtest trading strategies, but it offered a single system for which the user only could change parameters. Soon, traders could not only test — and modify — trading systems on their own, but they were able to start from scratch, applying their own ideas to the markets. Walk-forward testing, portfolio-based analysis and real-time optimization followed. Today, this path has led us to fully automated backtesting and algorithmic trading, but this wasn’t necessarily a smooth progression, and it didn’t happen without a few detours and speed bumps.

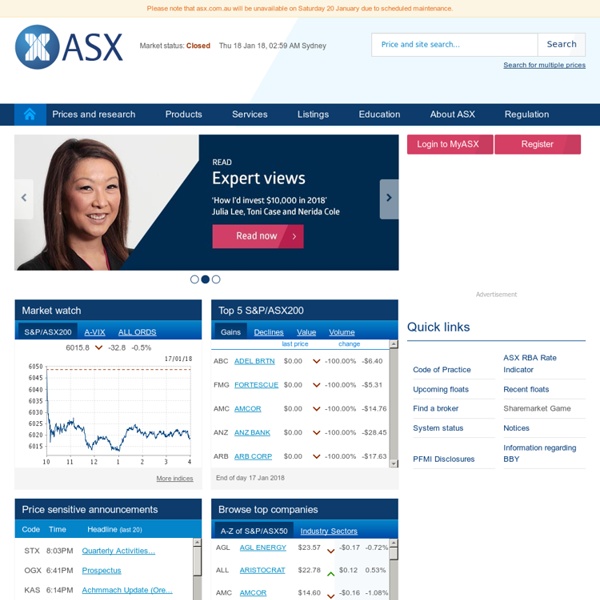

Tradegate Exchange Australian Securities Exchange Announces Decision to Implement Blockchain-Based Clearing and Settlement System Blockchain advocates have been awaiting the final decision by ASX Ltd, the Australian Securities Exchange, as to whether ASX will replace its existing and aged CHESS registry, settlement and clearing system with a blockchain-based system that ASX has been developing and testing for the last two years. Today, ASX announced that it will go ahead with its plan to move to the new blockchain system, as it believes that adopting it will result in significant savings of back-office costs for all involved parties. At the end of March 2018, ASX reportedly plans to release for market feedback details regarding the launch functionality of the system and the timetable for its implementation, with the final launch date to be determined. This decision is huge. It is a milestone in the adoption of blockchain generally, and it positions ASX at the forefront of blockchain deployment in the financial services industry.