What I learned from my first startup | Engage // Innovate's Blog I joined my first startup in the summer of 2000. Not a good year for tech, but nevertheless a highly ambitious and inspirational group called NST. NST, or Nordic Speech Technology, was developing next generation speech recognition software and human-machine interaction via speech. Today, most know this as Siri. At the time, this was truly groundbreaking stuff. I got hired – while still running through school – to “be a business analyst”. - Lead strategy analysis for emerging technologies in speech technologies Still today, a pretty cool job by itself. On the very first day of the job, this was early June 2000, I was shown my office. - “oh, cool”, one of the Industrial economics guys, cried out. My reply at the time, “I haven’t decided yet’’. The honest answer, however, was I had no idea. But, with unlimited confidence in my own ability, I figured, how hard can it be? So, I sat down, opened Google.com and typed “Strategy”. But the tools and the fundamental ideas behind the company were not.

Private Company Knowledge Bank | Private Equity & Venture Capital Private equity represents a class of investors, their funds, and their subsequent investments, which are made in private companies or in public companies with the goal of taking them private. Private equity investments are primarily made by private equity firms, venture capital firms, or angel investors, each with its own set of goals, preferences, and investment strategies, yet each providing working capital to the target firm to nurture expansion, new product development, or restructuring of the firms operations, management, or ownership. Aside from the outline of the private company life cycle below, this chapter will focus primarily on private equity firms, which represent the majority of the money in the private equity industry and characteristically invest in the buy-outs of mature companies and venture capital firms, which typically make high risk equity investments in seed, early, and growth stage private companies. The Private Company Life-Cycle The Father of Venture Capitalism

Why You Should Take the Blame - Peter Bregman I was at a party in Greenwich Village in New York City. It was crowded, with about twice as many people as the space comfortably fit. There was a dog in the mix too. I was at the sink washing dishes when I heard the dog yelp behind me. “Watch out!” Really? Actually, a lot of us do. We start blaming others at an early age, usually to escape parental anger and punishment, but also to preserve our own self-esteem and self-image. Sometimes it’s at a departmental level: A struggling sales group blames a poor product, while the product people blame an ineffectual sales team or maybe lax manufacturing. A few years ago I sat at a table with the leaders of a major stock exchange. I asked them what was getting in the way. “Seriously?” “No,” the head of something answered with the others nodding, “The CEO isn’t here.” I retorted: “You’re blaming the CEO? An awkward silence followed. Blaming others is a poor strategy. Recently, a CEO I work with fired Bill*, one of his portfolio managers.

NRW.INVEST - Your experts on North Rhine-Westphalia Great Leaders Know When to Forgive - Rosabeth Moss Kanter by Rosabeth Moss Kanter | 8:00 AM February 26, 2013 Leaders must be firm and foster accountability, but they also must know when to forgive past wrongs in the service of building a brighter future. One of the most courageous acts of leadership is to forgo the temptation to take revenge on those on the other side of an issue or those who opposed the leader’s rise to power. Instead of settling scores, great leaders make gestures of reconciliation that heal wounds and get on with business. This is essential for turnarounds or to prevent mergers from turning into rebellions against acquirers who act like conquering armies. Nelson Mandela famously forgave his oppressors. Forgiveness can be costly, like the massive amounts of debt forgiveness toward countries like Greece to help create a stable foundation for restoring growth to Europe. If revenge is not justice, it is not strategy either. Anger and blame are unproductive emotions that tie up energy in destroying rather than creating.

EVCA :: Home :: A More Productive Way to Think About Opponents - David L. Shields by David L. Shields | 12:00 PM February 22, 2013 When scandals rock the business world, we all go scurrying to find big causes. Human greed. Structural economic pressures. Lax regulations. Contesting theory, which my colleagues and I pioneered helps explain the cognitive roots of poor decision-making in competitive situations. Metaphorical interpretation is an unconscious process, but it can have profound implications. For some, “contests” are mentally processed through a contest-is-partnership metaphor. Through intense competition, the whole of society benefits. Still, contesting in sports can lead to recruitment scandals and aggression, and contesting in the marketplace can lead to insider trading, deceptive advertising, skirted regulations, and a host of other problems. Since “striving with” is replaced by “striving against,” we call it decompetition. So what does this mean practically? Cognitive reframing is the second step.

Welcome to the Knowledge Economy Network! - Knowledge Economy Network Giving Feedback Across Cultures - Andy Molinsky by Andy Molinsky | 8:00 AM February 15, 2013 Although many of us don’t like to do it, we know that critiquing others’ work — ideally in a constructive, polite, empowering manner — is an essential part of our jobs. But does critical feedback work similarly across cultures? Do people in Shanghai provide critical feedback in the same way as people in Stuttgart, Strasbourg, and Stockholm? Nicht, non, and nej. Instead, they confront situations where they do have to adjust their feedback style, and sometimes that’s easier said than done. It turns out that what worked in Germany in terms of tough, critical, to-the-point negative feedback was actually demotivating to Jens’s new Chinese employees, who were used to a far gentler feedback style. It took quite some time and effort on Jens’s part to recognize this difference and to be willing to adapt his behavior to accommodate the difference, because to Jens such a motivational style felt awkward and unnatural. Tip #1: Learn the new cultural rules.

Open Innovation Community Why the World Needs Tri-Sector Leaders - Nick Lovegrove and Matthew Thomas by Nick Lovegrove and Matthew Thomas | 1:00 PM February 13, 2013 The critical challenges society faces — such as water scarcity, access to education, and the rising cost of healthcare — increasingly require the business, government and nonprofit sectors to work together to create lasting solutions. But this is only possible if the senior executives of our leading institutions are what Dominic Barton, Worldwide Managing Director of McKinsey & Company, refers to as “tri-sector athletes” — leaders able to engage and collaborate across all three sectors. Our research at The InterSector Project shows that these leaders often have prior experiences in each sector and a unique ability to navigate different cultures, align incentives and draw on the particular strengths of a wide range of actors to solve large-scale problems. Take water scarcity. Coca-Cola understands the tri-sector approach better than many. Jeff Seabright is a model tri-sector athlete but they come in many forms.

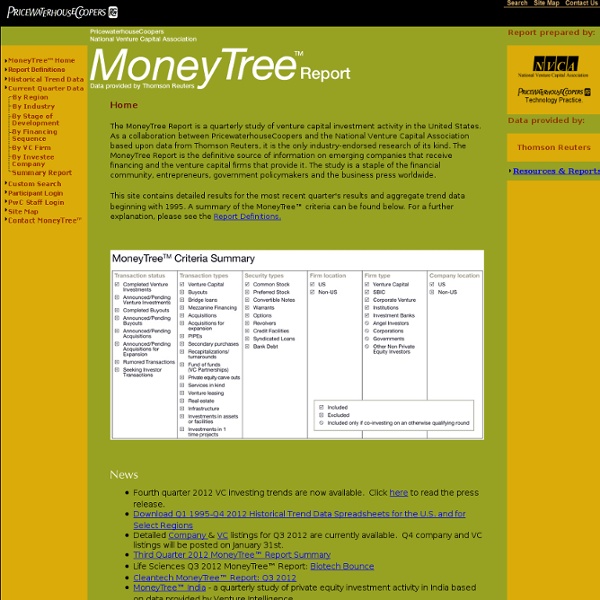

A good source of overall market figures but a bit cumbersome to get individual deal or VC level data. by wallen Mar 12