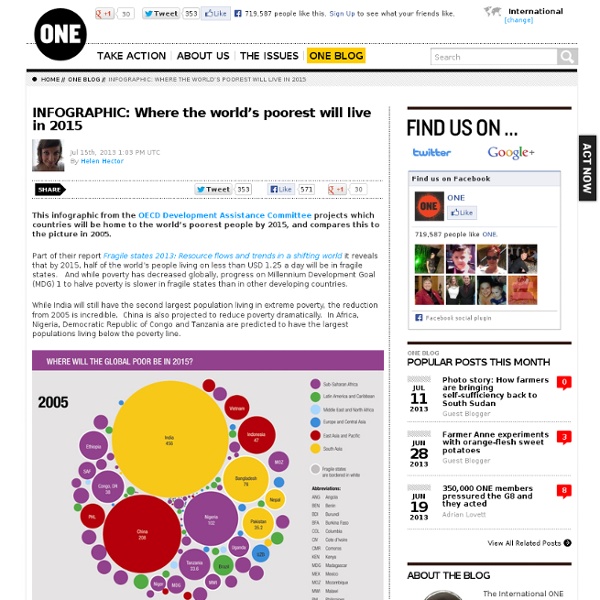

INFOGRAPHIC: Where the world’s poorest will live in 2015

This infographic from the OECD Development Assistance Committee projects which countries will be home to the world’s poorest people by 2015, and compares this to the picture in 2005. Part of their report Fragile states 2013: Resource flows and trends in a shifting world it reveals that by 2015, half of the world’s people living on less than USD 1.25 a day will be in fragile states. And while poverty has decreased globally, progress on Millennium Development Goal (MDG) 1 to halve poverty is slower in fragile states than in other developing countries. While India will still have the second largest population living in extreme poverty, the reduction from 2005 is incredible.

The Value of an Hour of Work (GDP)

More Infographics on Good

The Industrial Revolution and the Working Class | Guided History

The Industrial Revolution and the Working Class by: Hannah Goldman The world as we know it would not be the same if it were not for the Industrial Revolution. The Industrial Revolution has changed the world immeasurably. This guide focuses on the impact the Industrial Revolution had on the working class of England. Background The Industrial Revolution effected incalculably many aspects of life. Ashton, T. This source is offers a comprehensive overview of the Industrial Revolution concentrating on the economic factors surrounding England. “Modern World History: Interactive Textbook.” This online resource gives a nice overview of the Industrial Revolution. Coleman, D. Coleman’s book offers an opposing view of the much discussed Industrial Revolution. Jones, E. Jones develops his thoughts smoothly throughout this book. Living Conditions The living conditions of the working class change tremendously as the Industrial Revolution progressed. Checkland, S. Taylor, Philip A. Sturt, George.

The Glass-Floor Problem

WHEN it comes to the economic malaise facing America, the biggest problem is not the widening gap between rich and poor, but the stagnation of social mobility. When the income gap of one generation becomes an opportunity gap for the next, inequality hardens into social stratification. Eliminating the income gap is relatively straightforward (if politically fraught): raise taxes and expand government assistance for lower-income workers. Kick-starting social mobility, once it has slowed, is much more difficult. It is important to be clear what we are talking about. Relative mobility, in contrast, is a measure of which rung of the income ladder a person lands on, compared with his or her parents’ position. We can improve rates of upward absolute mobility by simply expanding the economy. But it is sticky at the top, too: the same odds apply to those born into the richest fifth. One potential danger zone for opportunity hoarding is access to higher education. This is delicate territory.

Does Capitalism Exploit Workers

Today, many define “exploitation” as taking unfair advantage of others’ vulnerability. Based on this definition, many suspect that capitalism exploits workers. Professor Matt Zwolinski examines whether this is accurate and finds two points against it: 1. 2. Markets may not be perfect, but what’s the alternative?

Related:

Related: