How To Make The Perfect Startup Pitch Deck Original Foursquare Investor Pitch Deck 2009 Foursquare is one of the biggest, buzziest startups in New York. Scratch that -- anywhere. The local check-in startup raised $50 million this past summer from Andreessen Horowitz and Spark Capital. It recently reached 15 million downloads and it has been rolling out tons of new features including Lists and Radar. Foursquare has come a long way in two years. What started as a self-proclaimed "part friend-finder, part social city-guide, part social-game" has become a $600 million company. We asked cofounder Dennis Crowley for a copy of his original pitch deck so other entrepreneurs could see what Foursquare looked like in its early days. "Decks don't have to be super formal," says Crowley.

Raising funding as a first-time founder I’ve been fortunate enough to meet with some outstanding first-time entrepreneurs on a few different days during this week. In almost every case I can really feel the passion and determination they have, and I know that if they will just continue there is every chance that eventually they will be very successful. One interesting topic which came up on a couple of different occasions was timing of raising funding as a first time founder. I’ve had entrepreneurs often talk to me with just an idea or a very early prototype with no traction and tell me that they want to raise funding. Times during a startup at which you can raise funding What I’ve learned from talking with some very experienced and highly respected successful serial entrepreneurs is that there are only really two good times to raise funding. Unfortunately for us first time founders, we don’t have the track record which we very much need in order to close funding without traction. A note on incubators How we did it with Buffer

effezfezfz How to Speak the Language of Venture Capital Skip Advertisement This ad will close in 15 seconds... Young Entrepreneurs Today's Most Read 9 Proven Ways to Get People to Take You Seriously 4 Intangibles That Drive CEOs What It Takes to Go From Dead Broke to 6 Figures in 6 Months The Mentality of a Successful Career 4 Big Challenges That Startups Face These Siblings Are Cooking Up America's First Meatless Butcher Shop Kim Lachance Shandrow 3 min read News and Articles About Young Entrepreneurs Failure 6 Stories of Super Successes Who Overcame Failure They're perfect examples of why failure should never stop you from following your vision. Jayson DeMers Podcasts Top 25 Business Podcasts for Entrepreneurs Podcasts are as easy to use as old-school radio but as specialized as blogs. Murray Newlands Entrepreneurship Programs Saxbys and Drexel Team Up to Promote Entrepreneurship Saxby's founder Nick Bayer talks about the one-of-a-kind program and why he wishes there was one for himself years ago. Carly Okyle Presented by Young Entrepreneurs Laura Entis Fear

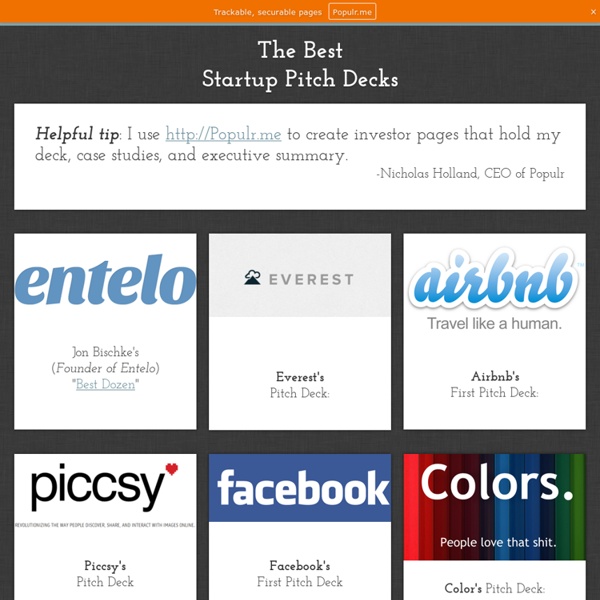

Startup Pitch Decks: Free Templates from VCs Today, NextView Ventures is excited to release a pillar project in our Growth Guides series: pitch deck templates for raising seed capital. These help address a common question which we frequently receive from entrepreneurs about how to create startup pitch decks for this crucial financial milestone. For context, last year, based on questions from our existing portfolio, we launched two board deck templates for seed-stage startups. These were well-received, so we next turned our attention to entrepreneurs outside the portfolio to ask what questions we could address in a similar fashion. The response was consistent and clear: “Thanks for those board decks — hope to use them someday — but I’m still raising a seed round right now. What makes a great pitch deck?” This answer was somewhat surprising — there seem to be several templates like this which already exist. So, we hope these two deck resources can address both issues. Read on for more context, or download your templates right here:

Consejos para hacer un 'elevator pitch' | Hay un gurú en mi sopa | Blogs Por definición, el 'elevator pitch' es la presentación de tu negocio o empresa a un potencial inversor en breves minutos . La idea surge a partir de un escenario hipotético: cómo vender tu proyecto a un posible inversor si te lo encuentras en un ascensor. Debes ser directo, concreto, trasmitir pasión y lograr hacerlo en menos de 3 minutos . Vivimos en una sociedad inmediata. Nunca sabes dónde y cuándo tendrás la oportunidad de presentar tu empresa , especialmente si estás buscando inversión, como ocurre estos días con cierta frecuencia a multitud de emprendedores. Los 'elevator pitch' no son solo importantes para poder captar inversión. Por ese motivo resulta extremadamente importante tener un discurso de 'elevator pitch' bien estructurado y aprendido para poder captar la atención de tu interlocutor en unos pocos minutos. Éstos son algunos consejos para poder estructurar un buen 'elevator pitch': ― Ensáyalo . ― El objetivo. ― Cifras. ― Sé muy breve. ― No ser un "brasas". ― Sé coherente.

The Pitch Deck We Used To Raise $500,000 For Our Startup One of the big no-no’s we’ve learnt about early on in Silicon Valley is to publicly share the pitchdeck you’ve used to raise money. At least, not before you’ve been acquired or failed or in any other way been removed from stage. That’s a real shame, we thought. Ratio thinking One of the most important elements, that we had to learn during our fundraising process was the concept of “Ratio thinking”. “If you do something often enough, you’ll get a ratio of results. It sounded simple enough as a concept to us, but man, this was one of the toughest things to learn. “The law of averages really comes into play with raising investment. I believe that this is in fact one of the most valuable things to know up front. How to read this deck: It builds up to one key slide – Traction If you go through the deck, you will quickly realize that the one key slide was the traction slide. Avoid confusion: Our second most important slide – competition The slidedeck Without any further explanation, here it is: