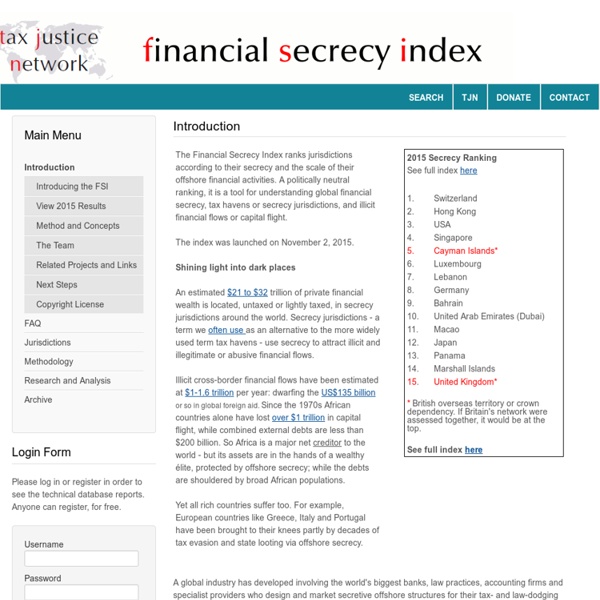

Tax Justice Network: And the losers are . . . The results of the 2009 Financial Secrecy Index Finally, the time has come to reveal the names of the secrecy jurisdictions that we have ranked according to both their lack of transparency and their scale of cross-border financial activity. For the first time ever, and based on far stronger criteria than those used by the OECD, we can now announce the world’s leading secrecy jurisdictions. Nothing like this has ever been done before. Our new index assesses each jurisdiction on an opacity rating – how secretive the jurisdiction is – combined with a weighting according to size. And here we go . . .Counting down from number 5, we have, at number 5, the City of London in the United Kingdom, the world's largest financial centre, and the state within a state that sits like a spider at the centre of a web that includes exactly one half of all 60 secrecy jurisdictions ranked on the Index. Few will be surprised to see Switzerland coming in at third position. The also rans . . . #12 Austria

Political change and democracy in China - La vie des idées Wang Shaoguang is a chair professor and chairperson in the Department of Government and Public Administration, a Changjiang [1] Professor in the School of Public Policy and Management at Tsinghua University in Beijing, a non-official member of the Commission on Strategic Development of the Hong Kong Special Administrative Region, and the chief editor of The China Review, an interdisciplinary journal on greater China. He belongs to the first promotion of students to enter University after the Cultural Revolution in 1977. He first studied in the Law department at Beijing University. He later obtained his PhD in Political Science at Cornell University (Ithaca, New York) in 1990. He then taught politics at Yale University (New Haven, Connecticut) from 1990 to 2000 before settling in Hong Kong. Wang belongs to an informal intellectual grouping labelled the New Left (xin zuopai). Wang is also currently working on the publication of a series of books on “State democratic re-building”. Text Video

Mesure non conventionnelles de politique monétaire Supply chains and financial shocks | vox - Research-based policy How do firm linkages transmit shocks? This column discusses the real and financial transmission mechanisms in the supply chain and financial system that can create troublesome cascades. It applies its logic to the Asia Pacific production chain. The most recent phase of globalisation was characterised by the geographical fragmentation of the production processes within networks of firms. The disruptive potential of a failure in the international supply chain became larger with time; trade in manufactures represented a quarter of the world industrial output in 2000, this proportion doubled after only five years. The role of supply chains in amplifying the impact of the business cycle on trade is not only caused by a mechanical "multiplier effect", when firms adapt production plans to the anticipated demand. The second building block of the model is the creation and destruction of endogenous money through the monetary circuit. Table 1.

De la bulle à la dépression : l'analyse de Vernon Smith, Prix No Ces caractéristiques essentielles des marchés du logement – les opérations sur le momentum, la liquidité, le compartimentage de la cote, et les achats à fort endettement – se combinent pour offrir une description assez complète et assez simple du dégonflement de la bulle du logement, et comment celui-ci a saisi le système financier et l'ensemble de l’économie. Rien qu’au cours des 40 dernières années, il s’est produit deux autres bulles immobilières, avec des maximums en 1979 et 1989, mais la plus grande de l'histoire américaine a commencé en 1997, probablement déclenchée par la hausse du revenu des ménages qui a débuté en 1992, en plus de l'élimination en 1997 de l’impôt sur les plus-values sur le logement personnel à concurrence de 500,000 dollars. La hausse des valeurs sur un marché d’actifs attire l'attention des investisseurs ; les premières phases de la bulle immobilière ont présenté cette caractéristique amplificatrice habituelle. C’est en 2006 que la baisse des prix a commencé. M.

Steven Gjerstad and Vernon Smith Explain Why the Housing Crash R Fallait-il vraiment assouplir les règles comptables ? | Telos - Lors de sa réunion du 2 avril dernier, le Financial Accounting Standards Board (FASB, organisme qui établit les normes comptables aux Etats-Unis) a une fois encore assoupli les règles de la valorisation des actifs sur la base de leur valeur de marché (mark-to-market). Cette décision a suivi une réunion de la Commission parlementaire, le Financial Services Committee du Congrès américain (HFSC), dont on peut se demander si ce n’est pas une filiale à 100% de l’American Bankers Association : le 12 mars, le HFSC demandait au FASB de réviser sa doctrine sur la juste valeur dans les marchés inactifs, l'avertissant que s’il ne se montrait pas suffisamment accommodant, le Congrès légiférerait et accorderait aux banques zombies ce qu’elles demandent. Tout cela va-t-il dans le bon sens ? Résolument, non. Explications. Le FASB s’est couché, et ce n’est pas la première fois. Cet argument n’a pas de sens. Et ce n’est pas tout. © Telos.

Financial turbulence and early crisis detection | vox - Research The international community has called for the IMF to deepen its work on systemic risks and early warning signals. While there are currently many different research strands, this short column empirically examines the role that global market conditions play in detecting systemic risk. We adopt regime-switching models using variables that proxy for global market conditions – Chicago Board Options Exchange Volatility Index (VIX), TED spread (the difference between LIBOR and Treasuries), and US dollar-euro foreign exchange swap rate. For instance, the Lehman Brothers collapse on 15 September 2008 was a watershed event that rapidly spilled over to emerging market countries, sharply increasing uncertainty across asset markets, a scramble for US dollars with the breakdown of the carry trade, and the need for financial institutions to refinance their US dollar positions. The flight to quality was also accompanied by a flight to liquidity.

ANALYSE : Pourquoi l'émirat de Dubaï affole la planète finance, Conjoncture : La folie des grandeurs d'un émirat bât Le rêve était trop beau pour durer. Après dix ans de boom économique, Dubaï s'enfonce dans les sables mouvants de la crise. Déjà secoué, en fin d'année dernière, par la récession mondiale, le petit émirat semblait se remettre, peu à peu, du choc. Mais c'était sans compter sur le second, cette fois-ci plus fatal : celui de l'annonce, mercredi 25 novembre, du rééchelonnement de la dette de deux de ses principaux groupes, le géant Dubai World et sa filiale immobilière Nakheel. Coïncidence ou volonté d'éviter la panique ? Spéculation à tout va Autant de projets à l'image des ambitions d'un homme visionnaire, Cheikh Zayed, ex-président de la fédération des Émirats arabes unis (décédé en 2004), qui misa, dès les années 1970, sur trois piliers : le tourisme, le commerce international et l'immobilier. Au cours de ces derniers mois, des dizaines de gros projets ont été reportés sine die. La famille régnante tremble en cachette.

La crise de Dubaï a affolé les marchés LE MONDE | • Mis à jour le | Par Claire Gatinois Ça allait mieux. Ça va moins bien. Cette fois, l'étincelle n'est pas venue du petit marché des subprimes, ces crédits hypothécaires à risque souscrits par les ménages de Floride ou de Californie, mais d'un petit émirat pauvre en pétrole, Dubaï. L'annonce d'un risque de défaut de paiement du pays adepte des projets immobiliers pharaoniques (c'est à Dubaï qu'ont été construites une île en forme de palmier et une station de ski en plein désert), a provoqué une onde de choc sur les marchés mondiaux. Il y avait de quoi. De fait, Dubaï n'est pas Lehman Brothers. Pour autant, les turbulences venues de Dubaï ont de quoi stresser les investisseurs. Mais ce sont surtout les banques qui sont dans le viseur des marchés. Mais le problème n'est pas tant celui du niveau d'exposition au risque émirati que le fait de se rendre compte que les banques ont, encore, des créances potentiellement "pourries".

Mondialisation - Wikipédia - Mozilla Firefox Un article de Wikipédia, l'encyclopédie libre. Carte du monde Origines du terme[modifier | modifier le code] En français le mot apparaît pour la première fois en 1916 dans un ouvrage de Paul Otlet[3]. Après la Seconde Guerre mondiale, le mot est employé de façon croissante[6]. Globalisation et mondialisation[modifier | modifier le code] La distinction entre ces deux termes est propre à la langue française. En anglais américain, l'usage premier revient au terme « globalisation », repris d'ailleurs par la plupart des autres langues. En français, malgré la proximité de « globalisation » avec l'anglais, la particularité de « mondialisation » repose sur une divergence sémantique. Définitions[modifier | modifier le code] Le terme s'enrichit au cours du temps au point de s'identifier, d'après Robert Boyer, à une nouvelle phase de l'économie mondiale[8]. En 1983, Théodore Levitt désigne sous ce terme « la convergence des marchés qui s'opère dans le monde entier ».