What is Mint

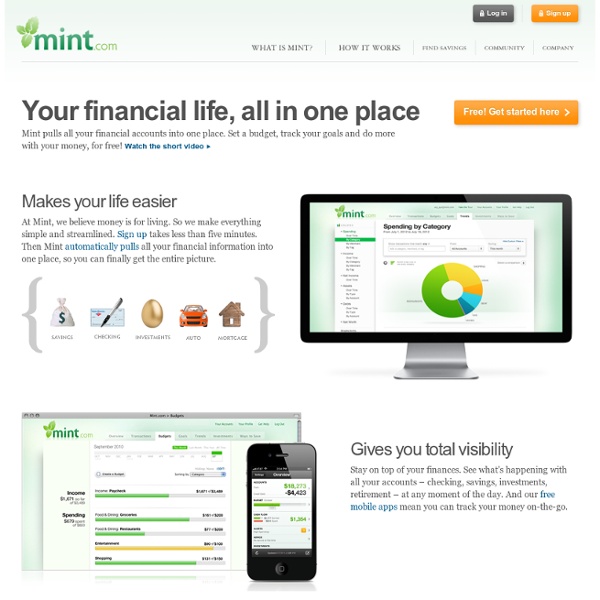

Free! Get started here Mint pulls all your financial accounts into one place. Set a budget, track your goals and do morewith your money, for free! Watch the short video Makes your life easier At Mint, we believe money is for living. Gives you total visibility Stay on top of your finances. Helps you reach your goals Set a budget and create a plan to reach your personal financial goals. Trusted, safe and secure Mint has more than 10 million users who know their information is always secure. Over 10 million users agree We've been a Money Top Pick and we've won awards from Kiplinger's, The Webby's, CNN Money and more.

Simmen Blog | für Führung, Personalentwicklung und Coaching

Online Budget Software for Web, Android, iPhone: Easy Envelope Budget Aid

Time Management - Start Here for Time Management Training from MindTools

Work Smarter. Improve Time Utilization. Spend your time wisely. © iStockphoto/v_rybakov This section discusses personal time management skills. People who use these techniques routinely are the highest achievers in all walks of life, from business to sport to public service. At the heart of time management is an important shift in focus: Concentrate on results, not on being busy. Many people spend their days in a frenzy of activity, but achieve very little because they are not concentrating on the right things. The 80:20 Rule This is neatly summed up in the Pareto Principle, or the '80:20 Rule'. By applying the time management tips and skills in this section you can optimize your effort to ensure that you concentrate as much of your time and energy as possible on the high payoff tasks. Time Management Tools By the end of this section, you should have a much clearer understanding of how to use time to its greatest effect.

How to Create a Working Budget (with Examples)

Steps Creating a Working Budget 1Calculate how much money you earn in a month after taxes. For this budget plan, use your net pay or take home pay. Include tips, supplementary income, side-jobs, investments etc. This is your income. 11Use that first section of the ledger book to record income and then show the budget being subtracted from it each period. Tips Don't try and begin a budget for the first month after an event in your life where money was significantly spent or saved, such as a vacation or a move, or coming into an inheritance or winning the lottery. Ad Warnings At times a budget can seem very restrictive.

Mind42.com - Collaborative mind mapping in your browser

Bugetul personal

De obicei, cand esti tanar, “patrimoniul” tau nu este foarte mare. Pe masura ce inaintezi in varsta, vei dobandi mai multe lucruri – o casa sau o masina, de exemplu – si vei incepe sa economisesti pentru pensie. Ideea este sa dobandesti lucruri care sa te ajute sa-ti stapanesti singur situatia financiara; altfel, aceasta va fi dictata de cei carora le datorezi baniOrice se foloseste ca mediu de schimb general acceptat, standard de valoare si mijloc de economisire sau de conservare a puterii de cumparare. . Calculul bugetului este o modalitate de a pune stapanire pe banii tai. Intrebarile de mai jos se refera la cheltuielile obisnuite ale unui tanar. Pentru fiecare intrebare, bifeaza toate raspunsurile care sunt valabile in cazul tau. 1. 2. 3. 4. 5. 6. 7. 8.

Related:

Related: