Tools to Help You Track Your Cash I often think of my mom and her frugal ways. She was a budget goddess. In the days before the pc, lap top, tablet and smart phone phenomenon, she implemented a budget system that anyone could manage – anyone who was committed that is. It was the envelope system. Technology has eclipsed the old envelope system of budgeting for most people. In the past I’ve written about online budget tools and personal finance software. So take a look at these 5 online money management tools to help you track your spending. The Birdy If your goal is to just track cash purchases, this is as simple as it gets. I signed up to see how user friendly it was. Mvelopes Mvelopes takes the traditional envelop budgeting method and combines it with innovative financial software to help folks manage their money. You Need A Budget YouNeedABudget is budgeting software that’s all about controlling cash flow. Step 1 helps you understand how to assign each dollar a job (category). Adaptu HelloWallet

I Hope I Don’t Get DeGonzoed « Marketing Tea Party I’ve said this before, will say it again: My two most-prized possessions are the collection of Grateful Dead concerts on my iPod and the two Gonzo Banker coffee mugs I own. The rest of the shit I own is replaceable. And so you can imagine that it’s not very often that I find something to disagree with Steve Williams from Cornerstone Advisors (the alter egos of Gonzo Banker) about. But Steve recently wrote in BAI Strategies, in an article titled Making Financial Responsibility Fashionable: “The financial services industry should take a tip from the diet-and-fitness industry by promoting the idea of financial responsibility. Gotta disagree with Steve on this one. First, the level of interest that banks and credit unions — of all sizes — have in providing PFM is a clear sign to me that they “get it” and are looking for ways to help their customers and members better manage their financial lives. I can’t imagine that’s what Steve is really looking for banks to replicate. Like this:

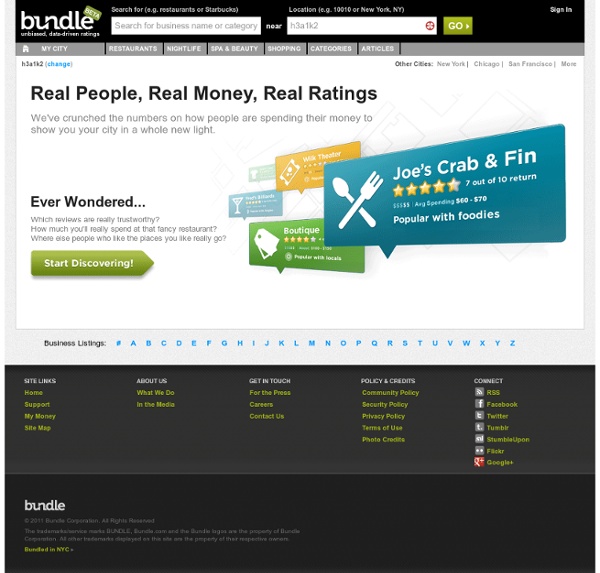

Bundle.com exploite les données bancaires pour évaluer les restaurants Lancé au début de l'année en partenariat avec Microsoft et Citi, le site de PFM (Personal Finance Management ou gestion de finances personnelles) Bundle.com a progressivement enrichi sa plate-forme, ajoutant successivement à la gestion de budget et au suivi de dépenses, la comparaison des dépenses de l'utilisateur avec le reste de la population, puis une composante sociale de partage et d'échanges entre utilisateurs. Des fonctions sommes toutes classiques, qui mettent cependant la solution au niveau des meilleures du genre et la rendent crédible sur un marché disputé. Mais Bundle.com ne souhaite pas en rester là et la prochaine évolution, annoncée en version pilote à New York pour le mois prochain, va réellement rompre avec les classiques du PFM. Il s'agit en effet d'exploiter les données bancaires fournies par Citi pour évaluer les restaurants, sur la base du taux de retour (fidélité) des consommateur dans chaque établissement et de l'importance de l'addition à chaque visite.

Google knows you but Yodlee knows your online banking habits. - Nov. 16, 2010 By Blake Ellis, staff reporterNovember 16, 2010: 3:51 PM ET NEW YORK (CNNMoney) -- Think Google knows everything about you? Wait until you meet Yodlee. The company knows where you invest your money and how much you owe on your mortgage. It knows your credit card numbers, the amount of your weekly paycheck, and how much you really spend on shoes. If you've banked online, you've probably used Yodlee without even knowing it. Yodlee is the proverbial man behind the curtain. When you log into your bank and transfer money between your savings and checking accounts, that's Yodlee providing to the technology to make the transaction happen. Then there are its fancier financial-management tools. For example, on Bank of America's website, customers can see all of their bank accounts in one place. It's also the only gorilla in the room. In fact, some competitors -- like Strands -- are actually turning to Yodlee for their data aggregation services. Share this

Citi mulls investing in rival to Mint.com-sources Blippy, le futur Twitter pour cartes bancaires - Marketing - Ban Le web est devenu social. Toutes les nouvelles applications phares du web, Facebook, Twitter, Flick'r nous font partager beaucoup d'informations personnelles avec notre communauté. Nous présentons à nos proches le meilleur côté de notre personnalité : photos, films, musique écoutée, évènements... Blippy (en beta privée pour le moment) est un nouveau site qui va plus loin dans ce partage d'infos puisqu'il permet de diffuser vos transactions par carte bancaire à votre communauté ! Considérant que vous avez plusieurs cartes dans votre portefeuille, vous en réservez une pour les achats que vous voulez rendre publics. On imagine aisément le potentiel social de Blippy et aussi son potentiel polémique ! Sur le côté social, la consommation définit une part importante de votre personnalité : vous êtes ce que vous consommez. En ce qui concerne la polémique, elle concernera bien entendu la confidentialité des données. Blippy illustre aussi la tendance au "passive sharing" qui se développe.

Private Banking Business Models blippy / What are your friends buying?