Two Wheeler Insurance | Bike Insurance Renewal | Bharti AXA GI Let go of all concerns of liability, theft and accident and enjoy an untroubled worry free ride with Bharti AXA GI’s Two Wheeler Insurance. Our product gives you access to a vast pan India cashless network constituting over 2,000 garages. Enjoy benefits of 24x7 claims assistance and the convenience of hassle free claim settlement process. Get a No Claims Bonus (NCB) of up to 50% on your two wheeler insurance renewal even if it’s from another insurance provider. Basic Insurance Cover Provides comprehensive two wheeler insurance( covers you when your bike sustains damage due to an accident, fire or is stolen,) Third Party Liability (Kicks in case of a claim against you for injury or damage to third party person(s), vehicle or property) Get additional discounts on your online two wheeler insurance premium with Voluntary Deductible. Basic Insurance Cover + Personal Accident Cover Advantages of buying a Long Term Two Wheeler Package Policy (for 2 years or 3 years)

Health Insurance Plans | Medical Insurance Policy | Bharti AXA GI With Bharti AXA GI’s Comprehensive Health Insurance plans you can enjoy product benefits that address not just your health insurance needs but the requirements of your entire family. Pick from any of our three affordable plans that provide you with the flexibility to suit your needs and budget. Bharti AXA GI offers 3 innovative plans – Rs 2 lakhs, Rs 3 lakhs and Rs 5 Lakhs Plans on Rs.3 lakhs and Rs.5 lakhs provide double the sum insured in case of a critical illness. What’s more is that this amount could be received in form of lump sum compensation that can help not just with hospitalization costs but daily expenses too. (As shown in TV commercial) Refer table below. Compare our Health plans to see the benefits Help me to choose my plan Health insurance needs to vary in accordance with your age group, family size and type. Refer policy wordings (PDF, 383 KB) to view the complete list of critical illnesses covered.

Travel Insurance Online | Family Travel Insurance Plans | Bharti AXA GI Fear of trip cancellation, loss of passport and medical emergencies on your mind? Overseas Travel Insurance covers medical emergencies along with the travel related benefits like loss of checked in baggage, trip delay, trip cancellation, missed connection, assistance during emergencies, compassionate visit to make your travel worry free, etc. Key benefits Instant policy, no health check-up up to 70 years Wider and affordable overage 24x7 worldwide AXA assistance Recognized by Schengen* Embassies Covers all travel related emergencies What is Schengen Area comprising of 26 European countries. We have 3 products as per your needs 1. This is for the people travelling to major countries like US, UK, Canada, Japan, Australia etc. Find Out More 2. If you are travelling to Schengen countries, travel Insurance is compulsory. Find Out More 3. We recommend Annual Multi Trip plan in case you travel abroad more than once in a year. Find Out More

Retirement Pension Plans |Best Retirement Plan-Exide Life Who should buy? This plan is suitable for you if you have a child (with up to 15 years of age). Key Features Min / Max Entry Age For Parent: 20 – 55 years For child: 0 – 15 years Premium Paying Term (PPT) 10-20 years The child has to be minimum 18 years on the date of maturity Policy Term PPT + 5 years Minimum Guaranteed Maturity Benefit Rs 4 Lacs Maximum Guaranteed Maturity Benefit No limit (subject to Underwriting) Guaranteed Death Benefit (In addition to the Guaranteed Maturity Benefit) Before the Policy Maturity Date For Parent:- 50% of GMB For Child:- 2.5% of the GMB + Surrender Value (if any) After the Policy Maturity Date For Parent:- Not applicable For Child:-50% of GMB What is ING Accidental Death Disability and Dismemberment Rider? It is add-on that can be attached to a Traditional ING Life Insurance Policy and provides enhanced coverage in case of accidental death, disability or dismemberment. How does the Plan Work? Premium shown is exclusive of service tax Product brochure Benefit Illustration

ULIP Investment | ULIP Plans from Exide Life Insurance What is Exide Life Wealth Maxima? Your goals and responsibilities increase with every growing stage of life. No wonder, there is a need to invest to not only maximize your wealth but also ensure a strong financial foundation to realize your goals. Presenting Exide Life Wealth Maxima, a Unit Linked Insurance Plan that not only helps make the most out of your wealth but also adapts to offer higher life cover at every new phase of life. Funds available under this product 4 Reasons to buy this plan Exide Life Wealth Maxima UIN: 114L079V01. ULIP Investment | ULIP Plans from Exide Life Insurance What is Exide Life Wealth Maxima? Your goals and responsibilities increase with every growing stage of life. No wonder, there is a need to invest to not only maximize your wealth but also ensure a strong financial foundation to realize your goals. Presenting Exide Life Wealth Maxima, a Unit Linked Insurance Plan that not only helps make the most out of your wealth but also adapts to offer higher life cover at every new phase of life. Funds available under this product 4 Reasons to buy this plan Exide Life Wealth Maxima UIN: 114L079V01.

Exide Life My Term Insurance What is Exide Life My Term Insurance Plan? A pure term insurance plan allows you to build strong family's financial foundation at a nominal price. Life cover starting 25 lakhs to 25 crore Limited premium payment options Key Features Minimum / Maximum Age at Entry 18 years / 65 years as on last birthday Maximum Maturity Age 75 years as on last birthday Policy Term* 10 - 35 years Premium Paying Term (PPT) Regular Pay:Equal to policy term Limited Pay: 5 or 7 or 10 years Minimum Life Cover ( 25 lakhs Maximum Life Cover ( 25 crores Premium Mode Annual and Monthly *For PPT 7, minimum policy term is 15 years, For PPT 10, minimum policy term is 20 years Insurance is the subject matter of the solicitation. Exide Life Insurance Company Limited (Formerly known as ING Vysya Life Insurance Company Limited), IRDA Registration Number: 114, CIN: U66010KA2000PLC028273.

Health Insurance for the young and healthy - That Girl's Life Stories A sultry Mumbai morning, I started walking from home towards my office as usual. Yes, the temperature were a bit too high at 35 degrees Celsius, but it was just a 6 minute walk – what could go wrong? I reached my office, took the lift and reached my desk at the 23rd floor. The doctor checked my blood pressure and it was 97/67. Blood Pressure problem, in my mind, always resonated with the likes of old people. 1) Much needed peace of mind If you know me well, peace of mind is utmost important to me. 2) An ounce of prevention is worth a pound of cure We all feel that this can never happen to us. 3) Affordability at this age One needs to be covered under health insurance sooner or later, but why not do it now, when it will definitely work out cheaper? 4) Tax Benefit Nothing can get better than this for salaried people like us. Given these benefits, I have decided to enrol to a Health Insurance Policy as soon as possible. Have you taken Health Insurance Policy?

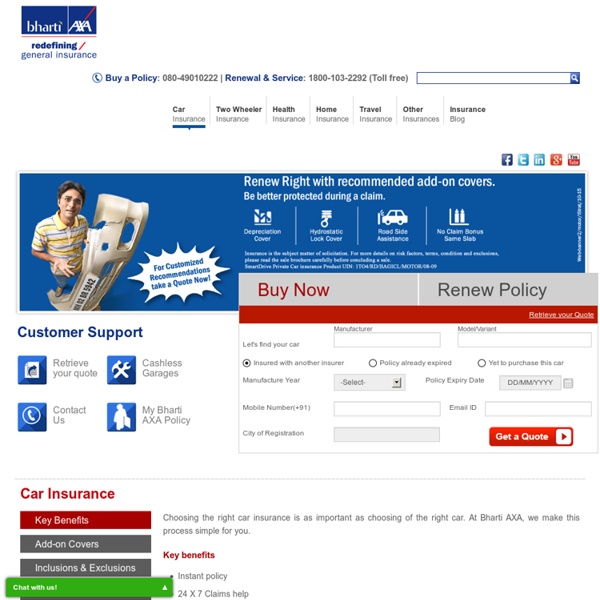

Monsoons are here | Bharti AXA GI Monsoons are here: Get maximum protection for your car with these motor insurance add-on covers While monsoons for you mean lush green foliage and curling up with a good paperback and a steaming cup of coffee, for your car it’s four months of constant wading through floods, engine issues, and mouldy closed-car smell. Whether it is breakdown due to being stranded in flood or rusting of exposed metallic car parts, monsoons can wreak havoc on your car and the worst part is that your motor insurance might not even cover these damages. A basic car insurance policy may not be sufficient: Your general car insurance does cover accident damages but a lot of monsoon-specific car damages like the ones brought on by conditions like hydrostatic lock, etc. aren't a part of it. Damages caused by monsoon are seen as consequential or indirect damages as these aren't actively caused by the rains but the owner's negligence. Hydrostatic Lock Cover The first rule of driving a car in floodwater?