Iowa Electronic Markets

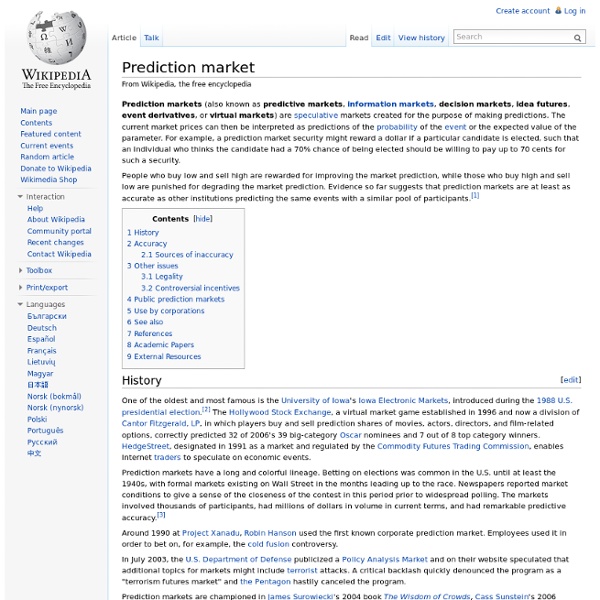

Iowa Electronic Market for 2008 Democratic National Primary. The Obama spike in February is a result of Super Tuesday. The Iowa Electronic Markets (IEM) are a group of real-money prediction markets/futures markets operated by the University of Iowa Tippie College of Business. The IEM allows traders to buy and sell contracts based on, among other things, political election results and economic indicators. The IEM has often been used to predict the results of political elections with a greater accuracy than traditional polls.[1][2][3][4] A precursor to the IEM was the Iowa Political Stock Market (IPSM), invented by George Neumann, and was developed by Robert E. How it works[edit] Here are examples of contracts that the IEM traded, beginning June 6, 2006, concerning the 2008 U.S. $1 if the Democratic Party nominee receives the majority of popular votes cast for the two major parties in the 2008 U.S. On the first trading day in January, 2007, the DEM08_WTA contract sold for 52.2 cents.

Harvard - Online Data Sources

Online Data Sources Political Governance Stability Corruption Freedom and human rights Social United Nations Population Health Ethnic groups Religion Quality of life Socio-economic Economic General Income Resources – natural, food, water, sanitation Economic freedom Development Global investment Security Armed conflict Military balance Conflict data Disaster security See also: Key to source classifications Political ( ^ ) Worldwide Governance Indicators – World Bank {ind} Indicators, reports, data, and comparisons over time and between countries available. Indicators available: Voice and Accountability Political Stability Government Effectiveness Regulatory Quality Rule of Law Control of Corruption Data format: Online search, table and charting interface 212 countries (includes all Muslim countries). Polity IV Datasets – Center for Systemic Peace {ind} Data format: Excel, SPSS

Knapsack problem

Example of a one-dimensional (constraint) knapsack problem: which boxes should be chosen to maximize the amount of money while still keeping the overall weight under or equal to 15 kg? A multiple constrained problem could consider both the weight and volume of the boxes. (Answer: if any number of each box is available, then three yellow boxes and three grey boxes; if only the shown boxes are available, then all but the green box.) The knapsack problem or rucksack problem is a problem in combinatorial optimization: Given a set of items, each with a mass and a value, determine the number of each item to include in a collection so that the total weight is less than or equal to a given limit and the total value is as large as possible. The problem often arises in resource allocation where there are financial constraints and is studied in fields such as combinatorics, computer science, complexity theory, cryptography and applied mathematics. Applications[edit] Definition[edit] Let there be to .

Public Data Explorer

Indicateurs de développement humain Rapport sur le développement humain 2013, Programme des Nations Unies pour le développement Les données utilisées pour calculer l'Indice de développement humain (IDH) et autres indices composites présentés dans le Rapport sur le développement humain ... Eurostat, Indicateurs démographiques Eurostat Indicateurs démographiques annuels. Chômage en Europe (données mensuelles) données sur le chômage harmonisé pour les pays européens. Salaire minimum en Europe Salaire mensuel brut minimum en euros ou parités de pouvoir d'achat, données semi-annuelles. Dette publique en Europe Statistiques sur les finances publiques des pays européens.

Optimization problem

Continuous optimization problem[edit] The standard form of a (continuous) optimization problem is[1] where is the objective function to be minimized over the variable , are called inequality constraints, and are called equality constraints. By convention, the standard form defines a minimization problem. Combinatorial optimization problem[edit] Formally, a combinatorial optimization problem is a quadruple , where is a set of instances;given an instance , is the set of feasible solutions;given an instance and a feasible solution of , denotes the measure of , which is usually a positive real. is the goal function, and is either or . The goal is then to find for some instance an optimal solution, that is, a feasible solution with For each combinatorial optimization problem, there is a corresponding decision problem that asks whether there is a feasible solution for some particular measure which contains vertices and , an optimization problem might be "find a path from to that uses the fewest edges".

Confidence Intervals

In statistical inference, one wishes to estimate population parameters using observed sample data. A confidence interval gives an estimated range of values which is likely to include an unknown population parameter, the estimated range being calculated from a given set of sample data. (Definition taken from Valerie J. Easton and John H. McColl's Statistics Glossary v1.1) The common notation for the parameter in question is . , which is estimated through the The level C of a confidence interval gives the probability that the interval produced by the method employed includes the true value of the parameter Example Suppose a student measuring the boiling temperature of a certain liquid observes the readings (in degrees Celsius) 102.5, 101.7, 103.1, 100.9, 100.5, and 102.2 on 6 different samples of the liquid. In other words, the student wishes to estimate the true mean boiling temperature of the liquid using the results of his measurements. ). For a population with unknown mean + z* . . + t*

Journal of Theoretical Biology : The promise of Mechanical Turk: How online labor markets can help theorists run behavioral experiments

Volume 299, 21 April 2012, Pages 172–179 Evolution of Cooperation Edited By Martin Nowak Abstract Combining evolutionary models with behavioral experiments can generate powerful insights into the evolution of human behavior. Keywords Evolutionary game theory; Experimental economics; Cooperation; Internet; Economic games Copyright © 2011 Elsevier Ltd.

MDG data