Mini Beet Protocol ~ Robert Von Mini Beet Protocol (MBP) The MBP is pretty simple... I used this in Mexico for all the endlessly fluoridated people and all their sicknesses, and it made it so that the conditions associated with endless amount of fluoride they were consuming via bathing was reversing and QUICKLY. This happened to the extent that mold and fungus in and under toenails and fingernails disappeared within weeks, if mold etc had been there less than 10 years, but it took about 2 to 4 months if they had mold under toenails more than 40 years. Bathing forces the poisons of chlorine, bromine and fluoride (all water contaminants esp when in excess) into your body 10 to 30 times more than if you drank 8 cups of the tap water per day (and they drink NO tap water in Mexico it's all Reverse Osmosis water for drinking!) At the same time these super powered elements of beets were manifesting in their faces. 3 steps are necessary and must be done in order... Notes and extra information section: Mini Beet Alternative:

Cramer on Buffett: 'His luck's about to change' Jim Cramer is coming to Warren Buffett's defense. This headline in The New York Times caught Cramer's eye: "The Oracle of Omaha, lately looking a bit ordinary." The story cited a new statistical study by Salil Mehta that compared Berkshire Hathaway's performance to the benchmark S&P 500 stock index. While Buffett's company has beaten the market in 38 of the past 48 years, it has underperformed the S&P in four of the past five years. Mehta calculates there's only a 3% chance Buffett is suffering through a period of bad luck. On Tuesday night's "Mad Money," Cramer shot back. Cramer believes that "just when it starts to seem like Buffett may have lost his touch, that's when his bets really start to pay off." In addition, Cramer said the tide is turning on Wall Street. Here's his take on Berkshire's top 10 publicly disclosed U.S. stock holdings: Wells Fargo: The bank has a "truly fortress balance sheet." American Express: "Who among us doesn't wish that we own this juggernaut."

Startup Engineer: Which number is right for you? | Femgineer Having been an engineer at a startup I empathize with people who are being recruited into startups especially if it’s their first startup. The key deciding factor for me was that I wanted to learn everything about engineering a consumer product. Sure making bank is a nice motivation, but I quit my Masters at Stanford because I knew I’d learn a ton more working on the ground floor of a startup than I would sitting in a classroom. I still wholeheartedly believe that the only way I learn is by doing, which is why I’m starting a company instead of getting an MBA. It’s my MO but that doesn’t mean it works for other people. The point of this post isn’t how to negotiate or what to ask for because it really depends on your needs (maybe I’ll cover that later). Being a ground floor engineer means you work everyday… 365 days at the very least for the first year. 5-10 stuff is built… but you’re still adding a ton of value to the product and defining the engineering team.

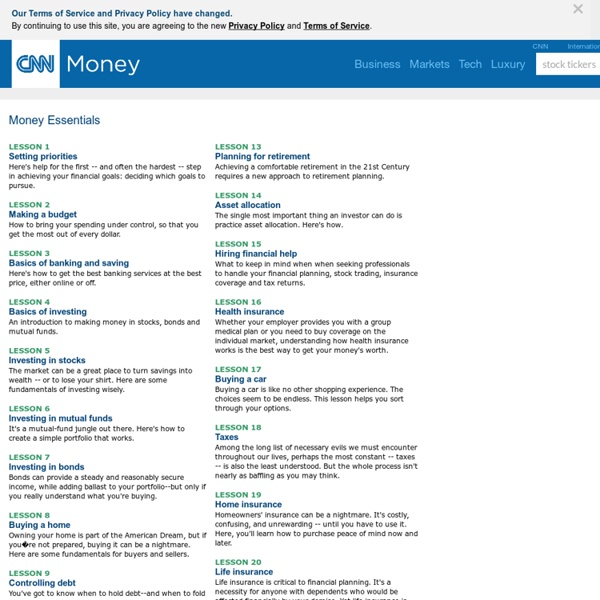

Improve Your Money Skills with These Free Resources I feel like I understand my budgeting flaws and how to do it better. My issue is "What do you do with your budget when you and your wife are both working full time jobs and you still can't make your bills each month?" It isn't like I can just step into a better job, regardless of ambition. I have skills and references, they just aren't doing anything for me. I've made 20 dollars an hour, now I'm pulling just under 10 dollars an hour. Fuck this awful economy and layoffs. Erg. I appreciate the reply, and I look forward to the post. Thanks!

How to Organize Evernote for Maximum Efficiency Please note: The way I organize Evernote today is completely different than what I wrote here. You can find my updated methodology here. I have been using Evernote for months. Photo courtesy of ©iStockphoto.com/STEVECOLEccs However, thanks to Brett Kelly’s very helpful e-book, Evernote Essentials, the Evernote user forum, and a little experimentation, I have begun to see the incredible power of this digital repository. It all begins by establishing a solid organizational structure. If you are just getting started with Evernote, I suggest that you buy Brett Kelly’s remarkably practical e-book, Evernote Essentials, 4.0. First, let’s define some terms: Notebooks: These are collections of individual notes. I tend to think of stacks and notebooks as a vertical (or hierarchical) way of organizing, and tags as a horizontal (or lateral) way of organizing. For example, you might “tag” a piece of paper within a folder by printing invoices on yellow paper. Here are my current tags:

A better way to pay off debt | Just Explain It If you’re one of the millions of Americans carrying an average $15,000 in debt, you know just how frustrating and daunting it can be to pay off. It’s easy to fall into the red, whether it’s from credit card bills, student loans or unforeseen medical expenses. And it seems every expert has the perfect 5, 7 or even 13-step plan to get you out of debt fast. Also see: 3 Harmful Money Lies We Tell Ourselves Most debt-reduction programs advise tackiling the highest interest rate account first. The "debt snowball" method focuses on paying the smallest debt first, then the next and the next, until it snowballs until, eventually, your debt is gone. Also see: Signs You Suffer from a Financial Disorder Researchers at Northwestern University’s Kellogg School of Management found that people who attack their debt in this way are more likely to pay off everything—even if it takes years—than those who prioritize debt based on interest rates. Also see: 3 Things Keeping You in Debt

Advice for University of Chicago Professor Todd Henderson Learn to Invest: Learn how to buy stocks and how to invest