Does Class Warfare exist? Dr. Michael Parenti: The 1% Pathology And The Myth of Capitalism - 10/19/2012. Iron law of oligarchy. History[edit] In 1911 Robert Michels argued that paradoxically the socialist parties of Europe, despite their democratic ideology and provisions for mass participation, seemed to be dominated by their leaders, just like traditional conservative parties.

Michels' conclusion was that the problem lay in the very nature of organizations. The more liberal and democratic modern era allowed the formation of organizations with innovative and revolutionary goals, but as such organizations become more complex, they became less and less democratic and revolutionary. 5GWTF: Calculation and Control. Hakim Bey - Boycott Cop Culture. Download.php. Part 1 - The Television Advertising Renaissance. The Gervais Principle, Or The Office According to “The Office” Careerism breeds mediocrity. A common gripe of ambitious people is the oppressive culture of mediocrity that almost everyone experiences at work: boring tasks, low standards, risk aversion, no appetite for excellence, and little chance to advance.

The question is often asked: where does all this mediocrity come from? Obviously, there are organizational forces– risk-aversion, subordination, seniority– that give it an advantage, but what might be an individual-level root cause that brings it into existence in the first place? What makes people preternaturally tolerant of mediocrity, to such a degree that large organizations converge to it? Is it just that “most people are mediocre”? Death of the Yuppie Dream. The rise and fall of the professional-managerial class.

Should we mourn the fate of the Professional Managerial Class or rejoice that there is one less smug, self-styled, elite to stand in the way of a more egalitarian future? Reprinted and condensed with permission from Rosa Luxemburg Stiftung—New York Office. All Work and No Pay: The Great Speedup. When Do Humans <i>Want</i> to Share the Wealth? Jonathan Haidt reports an interesting experimental result:

The Society of the Spectacle. The One Percent. Hedrick Smith Timeline: Who Stole The American Dream. Economic Inequality Teach In - Causes and Consequences. Wealth Inequality In USA or Rich vs Poor In America. Poverty, Inequality, and Unethical Behavior of the Strong. A Town Without Poverty?: Canada's only experiment in guaranteed income finally gets reckoning. September 5, 2011 Canada's only experiment in guaranteed income finally gets reckoning by Vivian Belik The Dominion - Photo: Dave Ron "It would be a major contribution for the functioning of a free society to have independent news sources, free from corporate or state control, internally organized in ways that exemplify what a truly participatory and democratic society would be.

AP: Chavez Wasted His Money on Healthcare When He Could Have Built Gigantic Skyscrapers. Makes Chavez's schools and health clinics look pretty sad, doesn't it?

(Photo: Joi Ito) One of the more bizarre takes on Venezuelan President Hugo Chavez's death comes from Associated Press business reporter Pamela Sampson (3/5/13): Chavez invested Venezuela's oil wealth into social programs including state-run food markets, cash benefits for poor families, free health clinics and education programs. RSA Animate - Crises of Capitalism. The One Percent: Breaking Down US Wealth Distribution. How Rich Are You? - WEALTH INEQUALITY IN AMERICA - The Shocking Truth About Money. The $5 Trillion Stash: U.S. Corporations' Money Hoard Is Bigger Than the GDP of Germany - Jordan Weissmann. You can't blame corporations for wanting a security blanket during the past few years, what with the world economy always seeming one more pointless Congressional showdown or odd European election away from catastrophe.

But as Reuters' David Cay Johnston points out this week, American companies may be hoarding more cash than most of us had previously realized -- about $5 trillion worth, as of 2009. The Federal Reserve reported that, at the end of March, U.S. corporations held $1.7 trillion in cash reserves, which they keep in treasuries, other bonds, and bank accounts. But that only covers the money companies are keeping on hand domestically. Johnson came up with his eye-popping figure by looking at recently released IRS documents that track companies' worldwide holdings. Obviously, the precise amount of money sitting on the sidelines may have changed by now. Austerity Hawks Want a Return to 1920's Capitalism. Reinhart, Rogoff... and Herndon: The student who caught out the profs. This week, economists have been astonished to find that a famous academic paper often used to make the case for austerity cuts contains major errors.

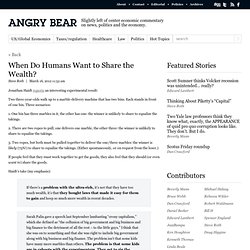

Another surprise is that the mistakes, by two eminent Harvard professors, were spotted by a student doing his homework. It's 4 January 2010, the Marriott Hotel in Atlanta. At the annual meeting of the American Economic Association, Professor Carmen Reinhart and the former chief economist of the International Monetary Fund, Ken Rogoff, are presenting a research paper called Growth in a Time of Debt. At a time of economic crisis, their finding resonates - economic growth slows dramatically when the size of a country's debt rises above 90% of Gross Domestic Product, the overall size of the economy. Word about this paper spread. And so did student Thomas Herndon. Thomas chose Growth in a Time of Debt. 2 More Grad Students Claim To Find Another Flaw In Reinhart-Rogoff Research. Like Scooby-Doo villains, Carmen Reinhart and Kenneth Rogoff keep getting done in by meddling kids.

First, University of Massachusetts-Amherst grad student Thomas Herndon shot holes in their influential research paper, "Growth In A Time Of Debt," by pointing out several mistakes and omissions the Harvard economists had made. Now, two PhD students at the University of Missouri-Kansas City have a new paper that they say finds another flaw in that same research. The students argue that Reinhart and Rogoff's paper leaned too heavily on data from one country, Japan, leading to all sorts of bad conclusions about the relationship between government debt and economic growth. "The argument that high ratios of government debt-to-GDP cause low growth remains plagued by misconceptions, at least for nations which issue their own currency," wrote the UMKC students, Matthew Berg and Brian Hartley.

A (brief) Critique of LacLau and Mouffe’s Discourse Analysis. Media as Discourse – Lacau and Mouffe’s social constructivism ‘message without a medium’ In a follow up to a previous post on Deleuze and Guattari’s third major group of strata – alloplastic strata – I will now critique LacLau and Mouffe’s social constructivism.