Mpare savings accounts & the best savings rates in the UK - Moneyfacts.co.uk. Before immersing yourself in our lovely selection of the best savings accounts & best savings rates, take a step back.

Do you know what you need from a savings account? Savings accounts can get pretty complicated, and are designed to meet different needs. There are many considerations to make when deciding which account to choose - it's far more than simply finding the best savings rate. So it’s good to get a handle on what it is you want, before jumping in… How much have you got to save? Some accounts are only available to you if you can commit at least a certain minimum level. Inflation.

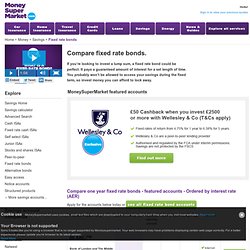

Find & Compare Fixed Rate Bonds. Fixed rate bonds are usually savings accounts that pay a set rate of interest, agreed at the outset, for a certain term.

The interest rates available are generally higher than those on easy-access accounts – especially if you opt for a fixed rate bond that lasts for two years or more. You will, however, pay a penalty if you need to make a withdrawal within the fixed term. Consequently, fixed rate bonds are only suitable for savers who are prepared to lock their cash away for a few years.

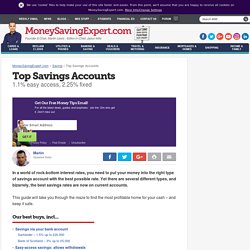

What types of fixed rate bonds are available? Most banks and building societies offer fixed rate bonds lasting for anything from six months to five years. You will need to invest a lump sum to benefit, as you cannot generally add to your initial deposit as you might with an easy access account. To qualify for some of the most competitive accounts, you may need a large amount. However, with more than 100 on the market most of the time, you should be able to find good deals that require as little as £1,000. Top Savings Accounts: 3.17% easy access or 3.11% consistent. Rate (paid on full balance): 1.5% AER variable up to £20k | Fee: £5/mth | Min deposit: £500/mth to get the interest (within a month of your statement date) | Max deposit: None, but interest only paid up to £20,000 | Access: Online, mobile, branch or phone | Interest paid: Monthly | Withdrawal restrictions: None How much cashback could I really earn?

You get 1% cashback on water, council tax bills and repayments of up to £1,000/mth on Santander mortgages, 2% on bills from major gas and electricity suppliers and on Santander home insurance, and 3% on mobile, home phone, broadband and TV packages. Santander has a list of qualifying suppliers (though it's worth checking with them about your suppliers, even if they're not listed). We crunched the numbers on how this stacks up for low, average and high bill payers. After the fee, we worked out low users would be up by £11 a year, average users £79 and high users £190, even before savings interest's taken into account. Fool.co.uk: Stock Investing Advice.