13 Million U.S. Homeowners Still Underwater in Q1, But More Than 9 Million More May Lack Enough Equity to Move - May 23, 2013. SEATTLE, May 23, 2013 /PRNewswire/ -- The national negative equity rate fell in the first quarter, to 25.4 percent of all homeowners with a mortgage, according to the first quarter Zillow® Negative Equity Report[i].

But another 18.2 percent of homeowners with mortgages, while not technically underwater, likely do not have enough equity to afford to move. Slightly more than 13 million homeowners with a mortgage were in negative equity, or underwater, at the end of the first quarter, owing more on their mortgage than their home is worth. But when including homeowners with less than 20 percent home equity, the "effective" negative equity rate at the end of the first quarter was 43.6 percent, or a total of 22.3 million homeowners. These homeowners likely cannot afford a down payment for a new home, tying them to their current homes and contributing to inventory shortages. The Subprime Boomerang: After the Writedowns Comes the Litigation. Securities Docket put on a great webinar on The Subprime Boomerang: After the Writedowns Comes the Litigation.

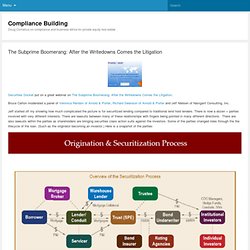

Bruce Carton moderated a panel of Veronica Rendon of Arnold & Porter, Richard Swanson of Arnold & Porter and Jeff Nielsen of Navigant Consulting, Inc. Jeff started off my showing how much complicated the picture is for securitized lending compared to traditional lend hold lenders. There is now a dozen + parties involved with very different interests. There are lawsuits between many of these relationships with fingers being pointed in many different directions. Consumer Access - About. National Mortgage Professional Magazine. Magazines & Periodicals - InsideBanking.